Sales of new cars increased by 129 thousand in October compared to last year

In the first ten months of the year, the growth reached 16.8% yoy

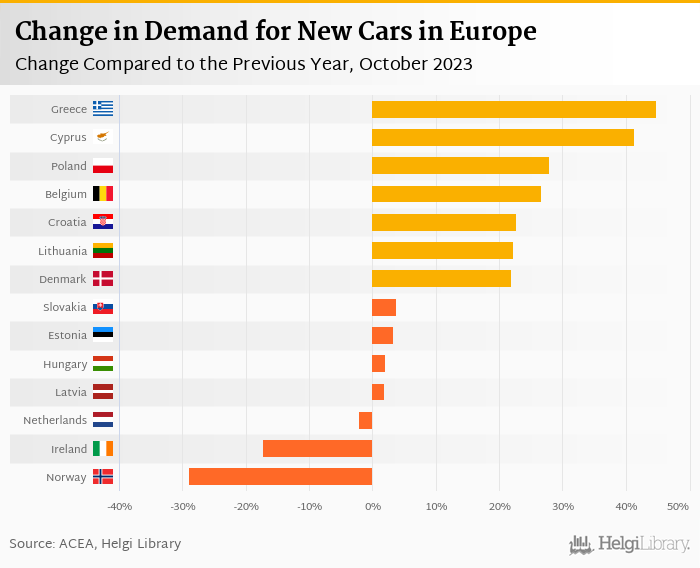

Greece performed relatively the best (up 44.8% yoy) while sales in Norway showed the weakest change compared to the last year (down 28.9% yoy)

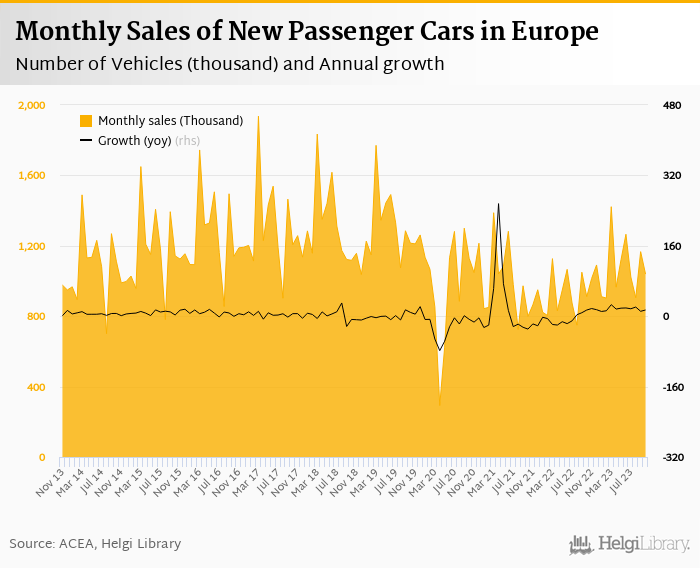

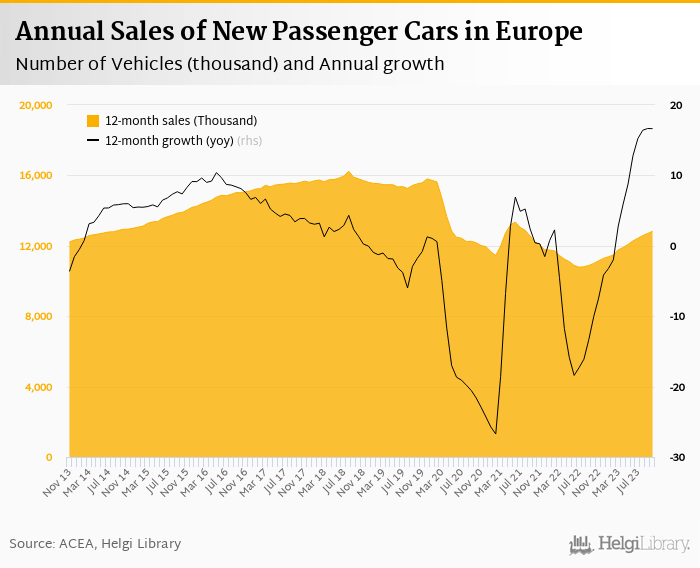

Sales of new passenger cars reached 1,039 thousand in October 2023 in the enlarged Europe (EU plus Iceland, Norway and Switzerland), according to ACEA. This is 14.1%, or 129 thousand more than in the previous year. In the first ten months of 2023, some 10,721 thousand cars were sold in Europe, up 16.8% yoy.

In October 2023, the EU car market expanded significantly with sales surging by 14.6%. This marked the fifteenth consecutive month of growth. Ten months into 2023, new car registrations were up by 16.7%, totalling almost nine mil units. Sale of battery-electric cars represented 14.2% of total in October, up from 12% last year. Sale of hybrid-electric cars represented 29% of total while petrol cars maintained their lead, albeit decreasing to 33.4% in October.

Historically, between 1990 and 2023, sales of passenger cars in Europe reached a high of 1,937 thousand in March 2017 and a low of 292 thousand in April 2020.

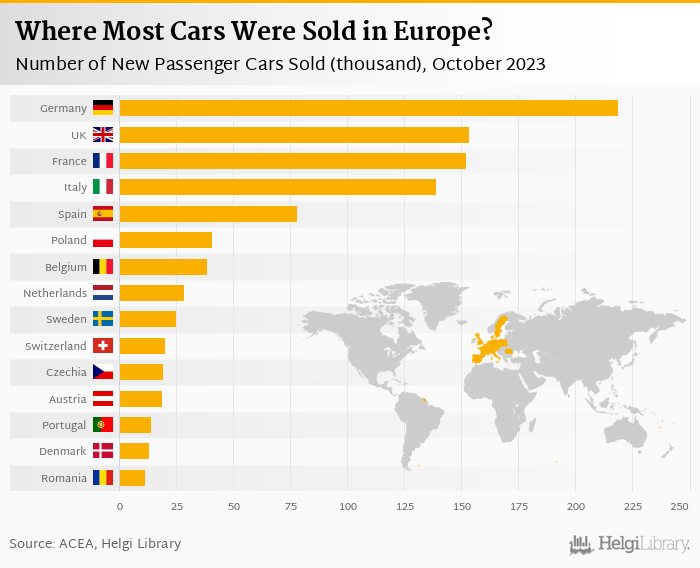

In October, most vehicles (219 thousand) were sold in Germany (up 4.94% yoy), followed by the United Kingdom (154 thousand, up 14.3%), France with 152 thousand cars (up 21.9%), 139 thousand new vehicles were registered in Italy (up 20.0%) and 77.9 thousand in Spain (up 18.1%). The five largest countries accounted for 63.9% of total new vehicles registered in October 2023.

In absolute terms, the best performance in sales of new cars has been seen in France (up 27.4 thousand cars) and Italy (up 23.2 thousand cars). At the other end of the scale, Norway and Netherlands showed the weakest change in registration of new cars in October when compared to last year (down 3.63 thousand and down 0.630 thousand cars, respectively).

In relative terms, sales in Greece (+44.8%) and Cyprus (+41.4%) performed the best compared to a year ago, whereas registration in Norway and Ireland the worst (-28.9% and -17.2% yoy), in October 2023, according to ACEA:

In the first ten months of the year, some 10,721 thousand cars were sold in Europe, up 16.8% yoy. The table below shows details of the sales for each of the European country:

| Country | October 2023 | October 2022 | YOY Change % | 1-10/2023 | 1-10/2022 | YOY Change % |

|---|---|---|---|---|---|---|

| Austria | 18.9 | 16.1 | 17.5 | 202 | 179 | 12.5 |

| Belgium | 38.6 | 30.5 | 26.6 | 413 | 312 | 32.5 |

| Bulgaria | 2.78 | 2.38 | 16.7 | 29.1 | 24.4 | 19.4 |

| Croatia | 3.71 | 3.02 | 22.7 | 49.5 | 37.6 | 31.5 |

| Cyprus | 1.17 | 0.824 | 41.4 | 12.8 | 9.90 | 29.1 |

| Czechia | 19.3 | 16.3 | 18.7 | 187 | 160 | 16.7 |

| Denmark | 13.2 | 10.9 | 21.9 | 137 | 120 | 14.4 |

| Estonia | 1.73 | 1.67 | 3.23 | 19.2 | 17.9 | 7.43 |

| Finland | 6.45 | 6.20 | 4.15 | 75.0 | 69.1 | 8.57 |

| France | 152 | 125 | 21.9 | 1,441 | 1,237 | 16.5 |

| Germany | 219 | 209 | 4.94 | 2,357 | 2,077 | 13.5 |

| Greece | 11.3 | 7.79 | 44.8 | 116 | 90.8 | 27.6 |

| Hungary | 8.43 | 8.26 | 2.05 | 91.3 | 94.0 | -2.90 |

| Iceland | 0.960 | 0.811 | 18.4 | 14.8 | 13.9 | 6.62 |

| Ireland | 2.17 | 2.62 | -17.2 | 121 | 104 | 15.7 |

| Italy | 139 | 116 | 20.0 | 1,315 | 1,092 | 20.5 |

| Latvia | 1.43 | 1.41 | 1.85 | 16.0 | 14.0 | 14.2 |

| Lithuania | 2.09 | 1.71 | 22.2 | 23.5 | 22.3 | 5.54 |

| Luxembourg | 4.17 | 3.47 | 20.3 | 42.2 | 35.5 | 18.6 |

| Malta | 0.583 | 5.64 | 0 | |||

| Netherlands | 28.4 | 29.0 | -2.17 | 317 | 255 | 24.5 |

| Norway | 8.93 | 12.6 | -28.9 | 104 | 115 | -9.45 |

| Poland | 40.9 | 32.0 | 27.8 | 391 | 349 | 12.2 |

| Portugal | 13.9 | 12.6 | 10.4 | 167 | 126 | 32.4 |

| Romania | 11.4 | 10.5 | 8.08 | 122 | 106 | 15.4 |

| Slovakia | 7.81 | 7.53 | 3.71 | 75.6 | 65.6 | 15.2 |

| Slovenia | 3.88 | 3.43 | 13.0 | 42.3 | 40.2 | 5.23 |

| Spain | 77.9 | 66.0 | 18.1 | 789 | 666 | 18.5 |

| Sweden | 25.0 | 22.4 | 11.8 | 235 | 227 | 3.51 |

| Switzerland | 20.4 | 17.2 | 18.4 | 203 | 180 | 13.1 |

| United Kingdom | 154 | 134 | 14.3 | 1,605 | 1,343 | 19.6 |

| EU + EFTA | 1,039 | 911 | 14.1 | 10,721 | 9,183 | 16.8 |

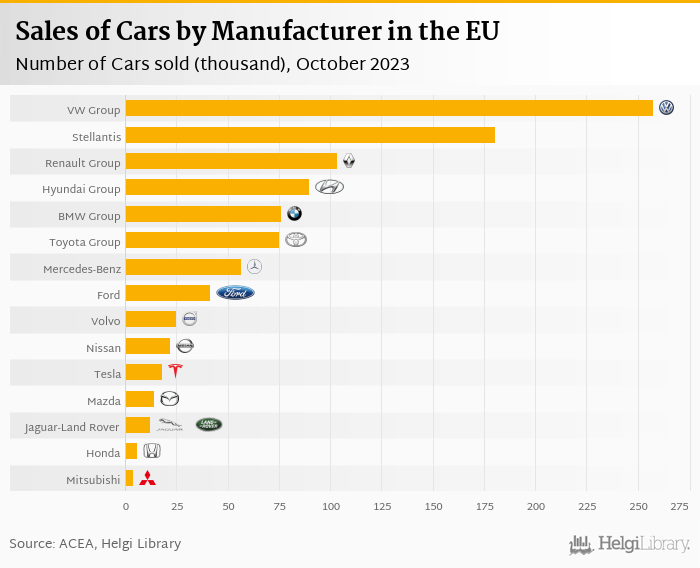

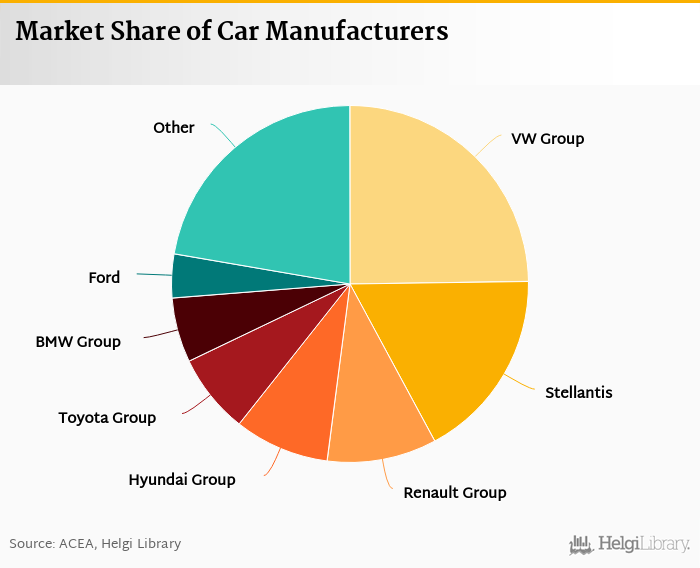

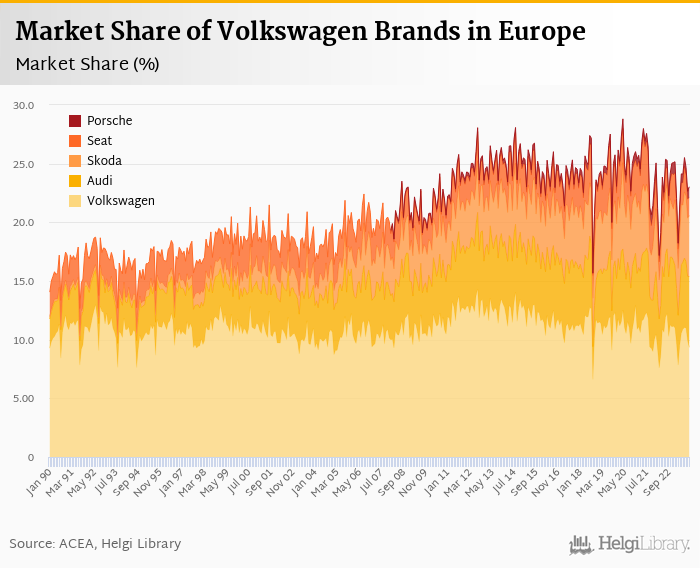

Volkswagen Group sold the most cars in October 2023 in Europe, some 258 thousand vehicles representing 24.8% of the European market. Sales of Renault Group amounted to 103 thousand vehicles (or 9.90% of the market) while Hyundai Group and BMW Group held 8.60% and 7.30% of the European market in October. Overall, the five largest manufacturers sold 57.8% of all new cars in October:

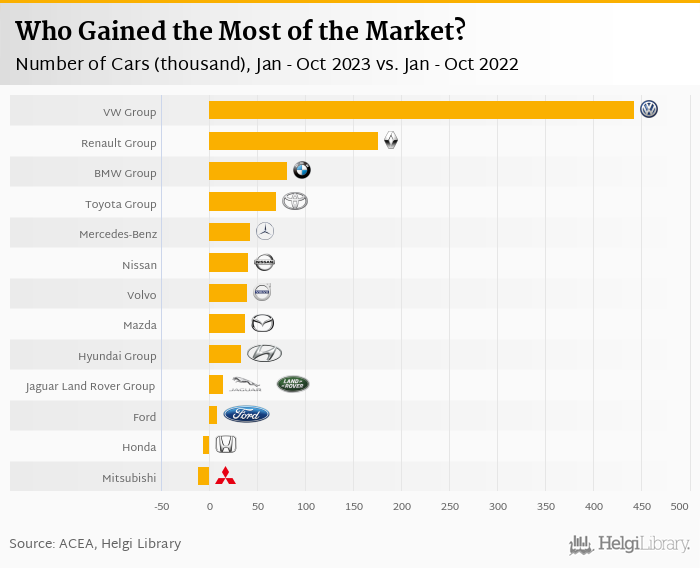

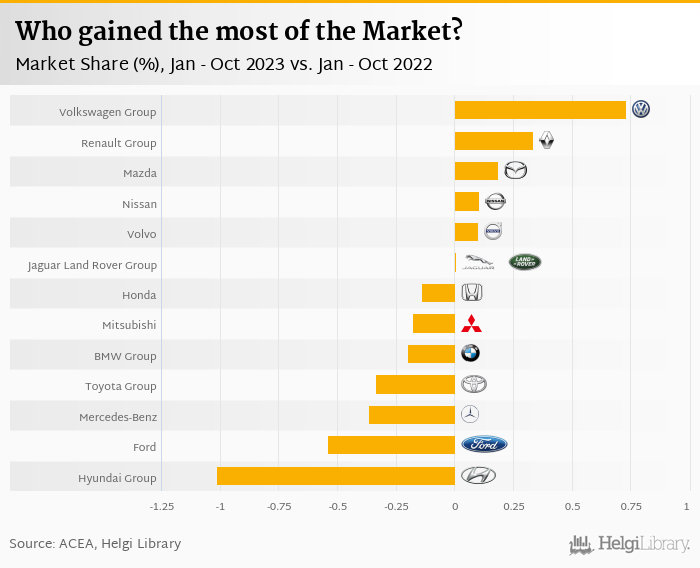

When compared to last year, Volkswagen Group has gained the most in terms of market share rising its market position by 0.731 bp, followed by Renault (up 0.337 bp) and Mazda Motor Corporation (up 0.188 bp). Hyundai Motor Company were on the other end of the market spectrum dropping 1.01 bp on the market alongside with Ford Motor Company (down 0.539 bp) and Daimler Group (-0.365 bp):

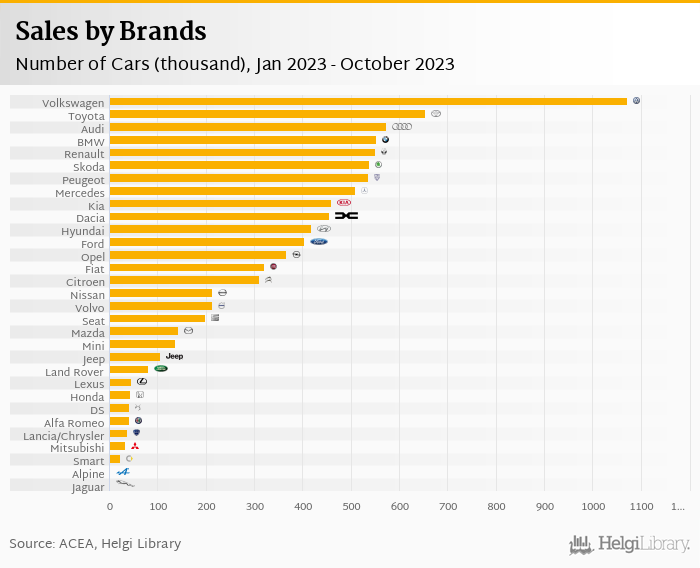

In terms of particular brands, Volkswagen stands out as the most favorite brand accounting for 1,071 thousand sold vehicles, or 9.99% of all new passenger cars sold on the European market from the beginning of the year.

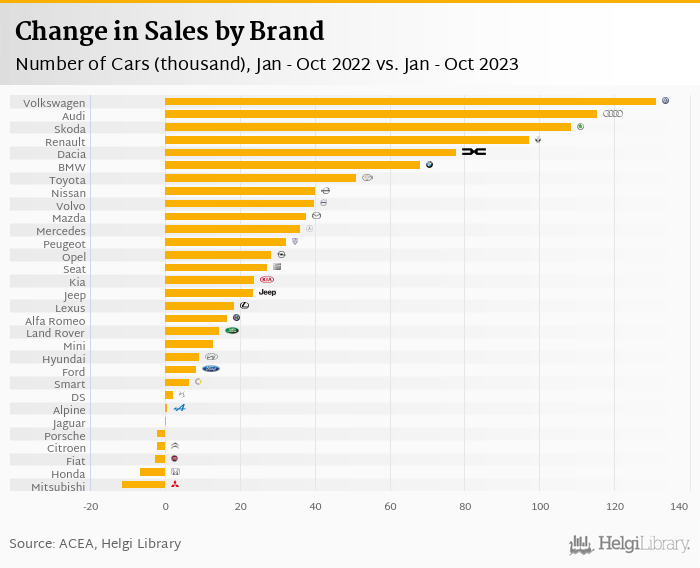

In terms of momentum, Audi gained the most in terms of market share when compared to last year (up 0.360 bp) followed by Skoda and Mazda. Hyundai and Ford were on the other end of the market spectrum losing -0.557 bp and -0.539 bp respectively:

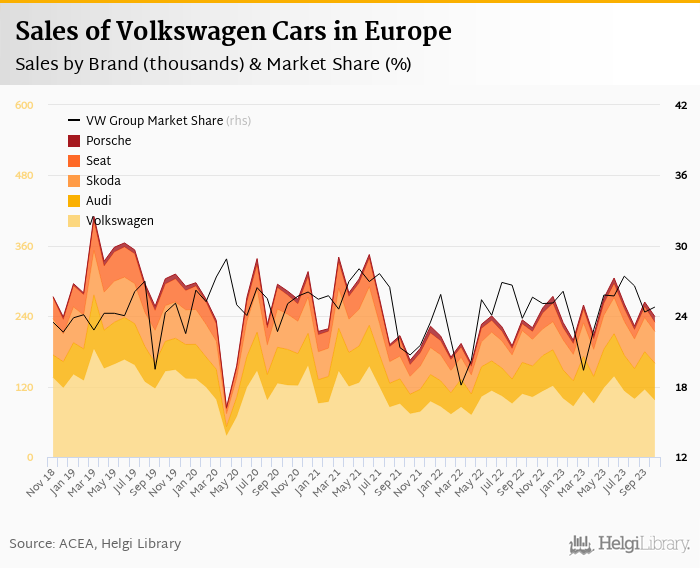

Volkswagen Group sold 258 thousand new passenger cars representing a 24.8% share of all new passenger cars sold in Europe in October 2023. This is 10.4% more vehicles and a 0.841 pp decrease in market share when compared to last year. Looking back three years, VW's market share was 25.1%.

The Group sold 97.1 thousand of Volkswagen brand cars in October, followed by 62.8 thousand of Audis and 53.9 thousand of Skodas. Cupra sold 17.6 thousand vehicles, Seat sold 16.0 thousand and Porsche some 9.62 thousand cars in October 2023:

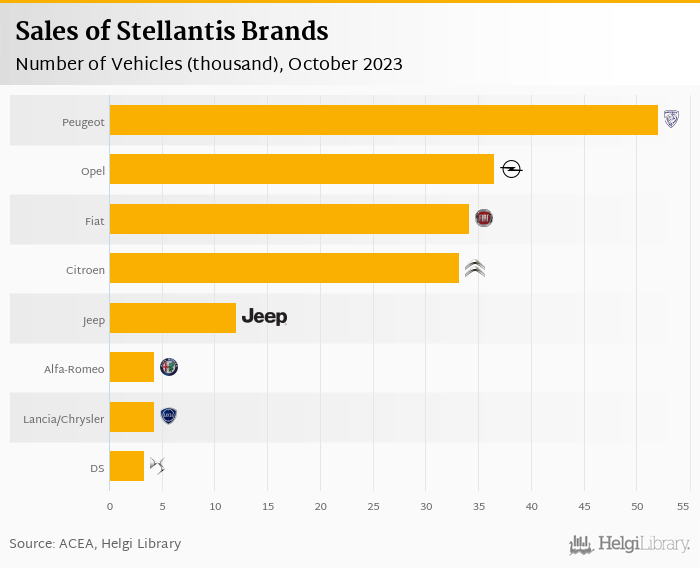

Stellantis sold 180 thousand new passenger cars representing a 17.4% share of all new passenger cars sold in Europe in October 2023. This is 10.8% more vehicles and a 0.525 pp decrease in market share when compared to last year.

The Group sold 52.0 thousand of Peugeot brand cars in October, followed by 36.5 thousand of Opels and 34.1 thousand of Fiats. Citroen sold 33.2 thousand vehicles, Jeep sold 12.1 thousand, Alfa-romeo sold 4.23 thousand, Lancia-chrysler sold 4.23, and Ds some 3.31 cars in October 2023:

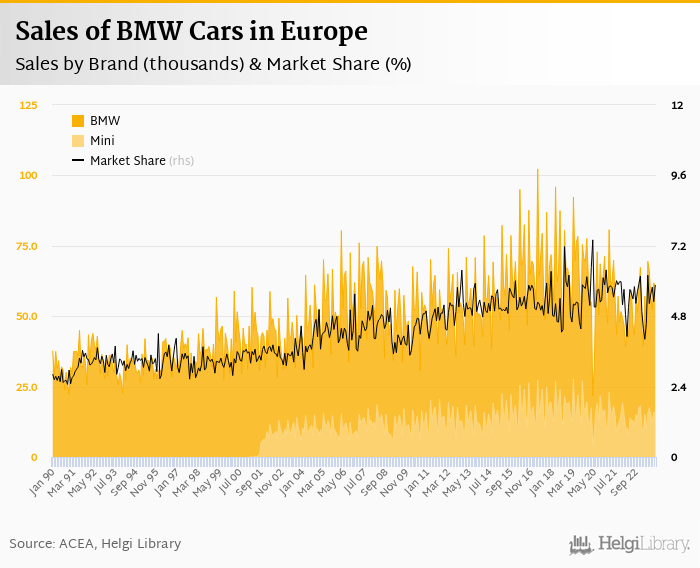

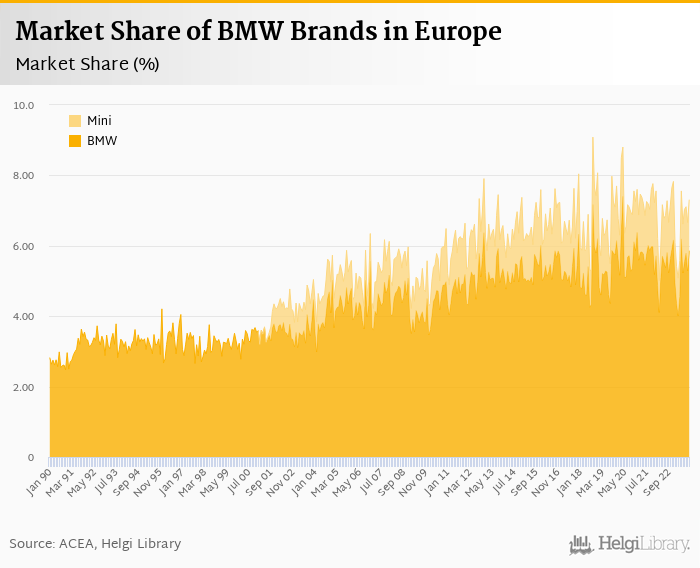

BMW Group sold 76.0 thousand new passenger cars representing a 7.31% share of all new passenger cars sold in Europe in October 2023. This is 17.0% more vehicles and a 0.182 pp increase in market share when compared to last year. Compared to three years ago, BMW Group's market share is now 0.429 pp higher.

The group sold 60.9 thousand of BMW brand cars, followed by 15.1 thousand of Minis in October 2023:

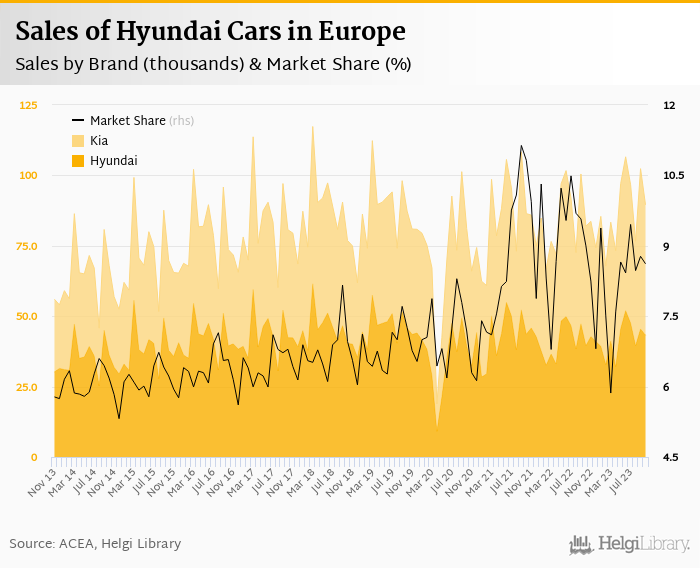

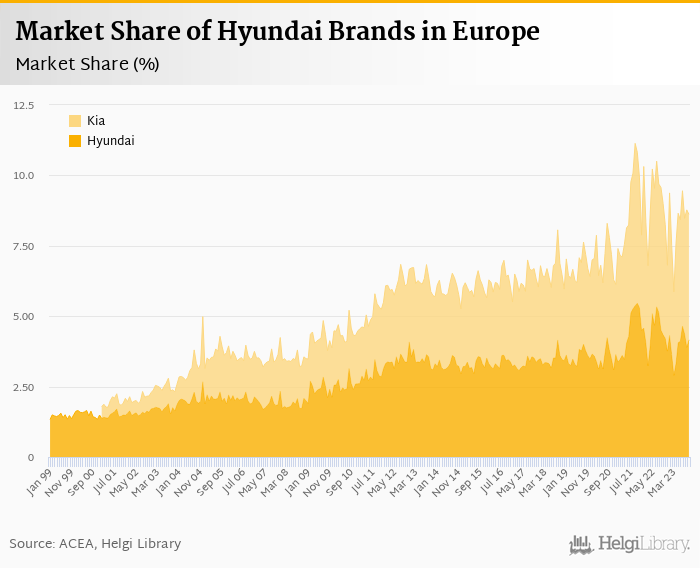

Hyundai Group sold 89.6 thousand new passenger cars representing a 8.62% share of all new passenger cars sold in Europe in October 2023. This is 9.27% more vehicles and a 0.382 pp decrease in market share when compared to last year. Compared to three years ago, Hyundai Group's market share is now 1.43 pp higher.

The group sold 46.3 thousand of Kia brand cars, followed by 43.2 thousand of Hyundais in October 2023:

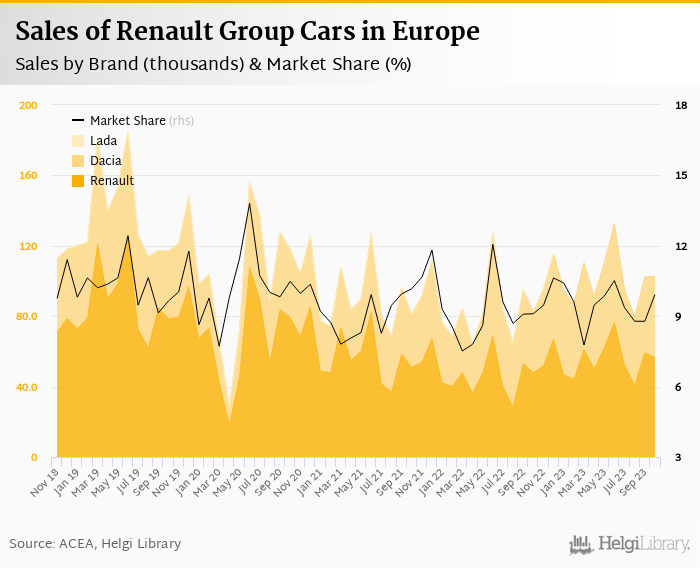

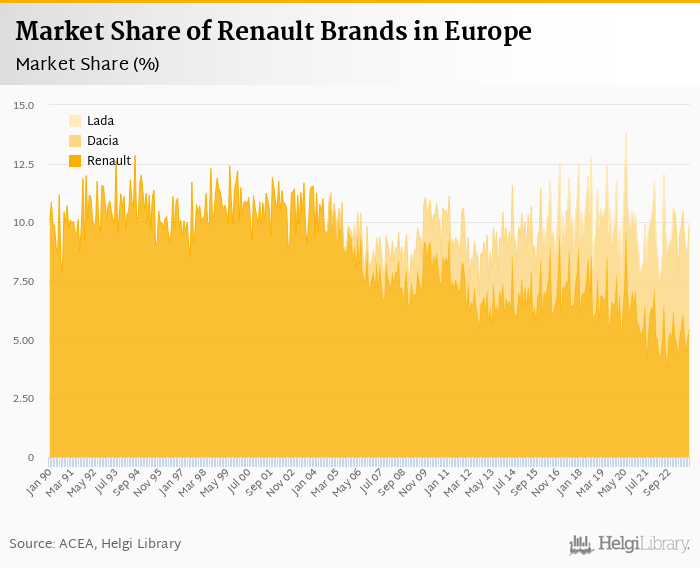

Renault Group sold 103 thousand new passenger cars representing a 9.93% share of all new passenger cars sold in Europe in October 2023. This is 24.4% more vehicles and a 0.819 pp increase in market share when compared to last year. By comparison, three years ago, Renault Group's market share was 10.5%.

The group sold 56.6 thousand of Renault brand cars in October, followed by 46.2 thousand of Dacias and of s:

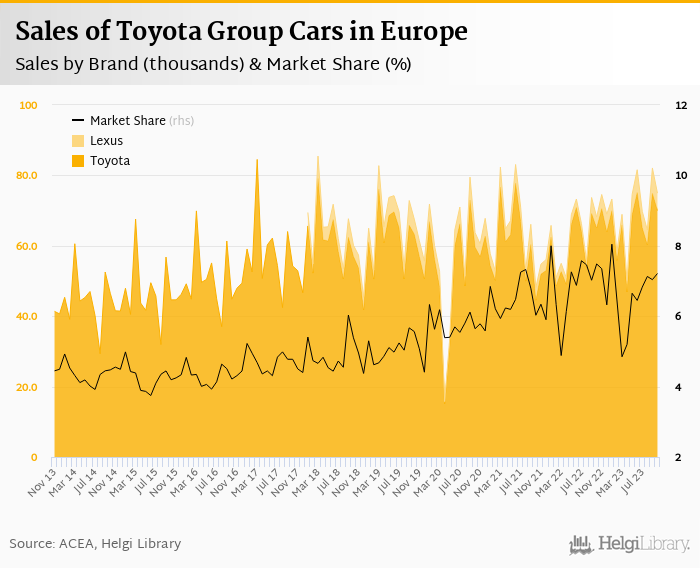

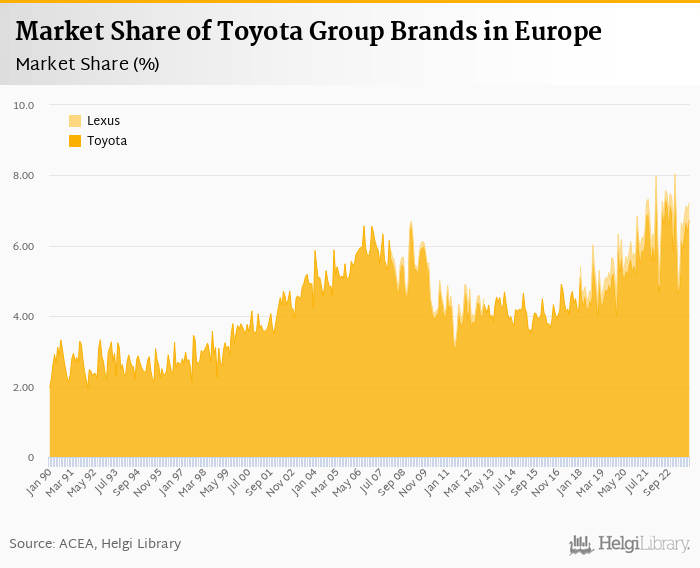

Toyota Group sold 75.0 thousand new passenger cars representing a 7.21% share of all new passenger cars sold in Europe in October 2023. This is 9.97% more vehicles and a 0.271 pp decrease in market share when compared to last year. Toyota Group's market share three years ago, by comparison, stood at 5.64%.

The group sold 70.0 thousand of Toyota brand cars in October, with Lexus following at 4.94 thousand cars:

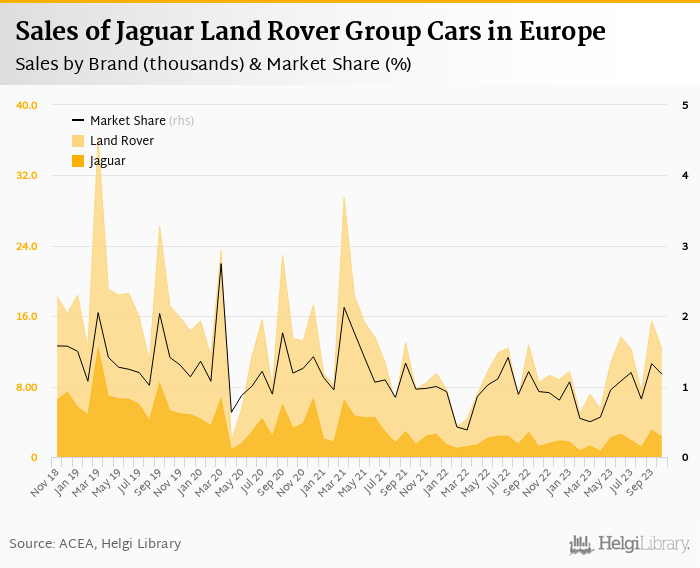

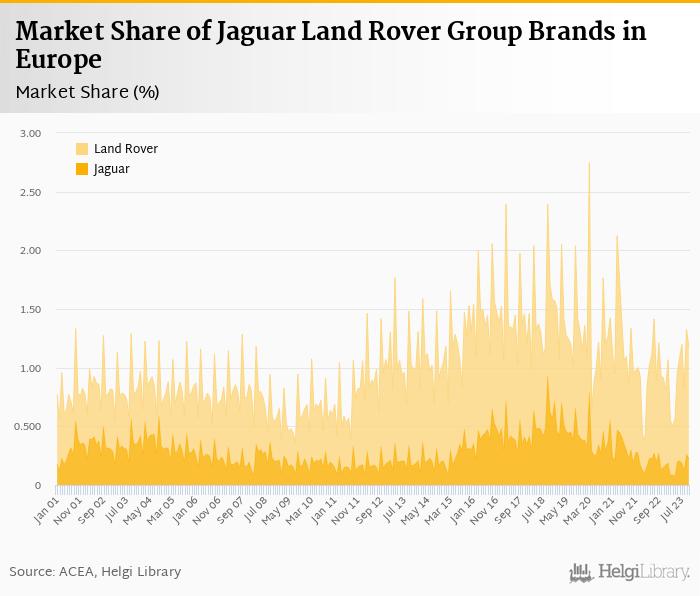

Jaguar Land Rover Group sold 12.3 thousand new passenger cars representing a 1.18% share of all new passenger cars sold in Europe in October 2023. This is 44.7% more vehicles and a 0.250 pp increase in market share when compared to last year. Three years ago however, the market share of Jaguar Land Rover Group was 1.19%.

The group sold 9.93 thousand of Land Rovers in October, followed by 2.32 thousand of Jaguars:

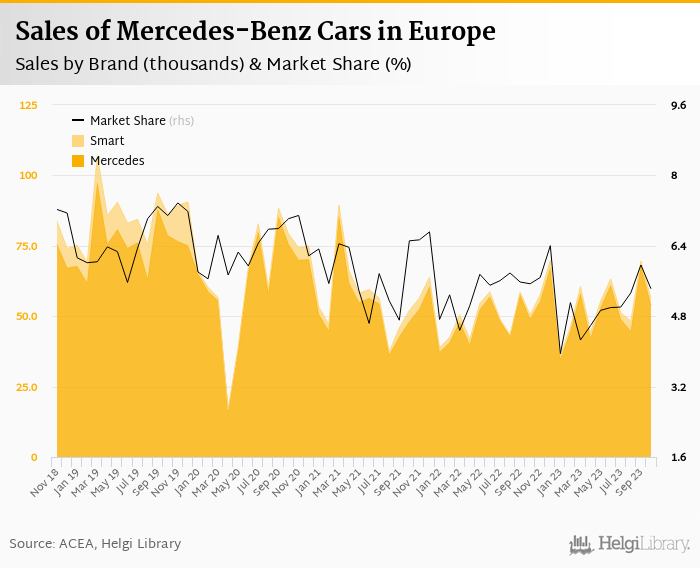

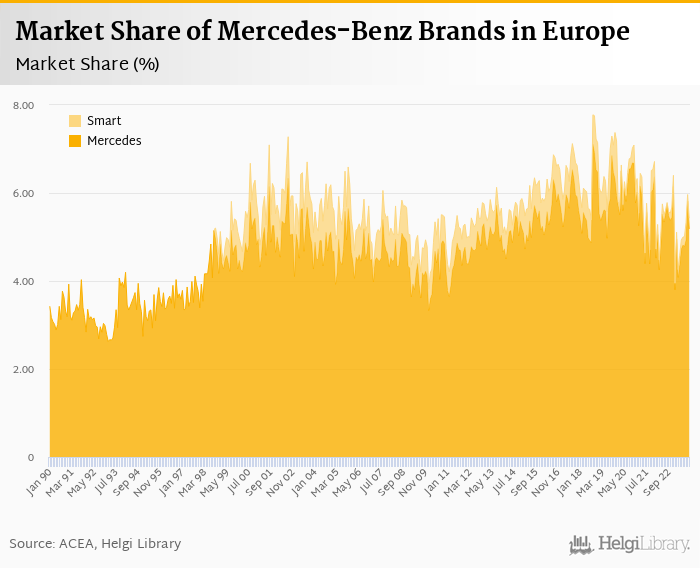

Mercedes-Benz sold 56.4 thousand new passenger cars representing a 5.42% share of all new passenger cars sold in Europe in October 2023. This is 11.8% more vehicles and a 0.112 pp decrease in market share when compared to last year. By comparison, three years ago, Mercedes-Benz's market share was 7.02%.

The group sold 53.9 thousand of Mercedes in October, followed by 2.51 thousand of Smart cars:

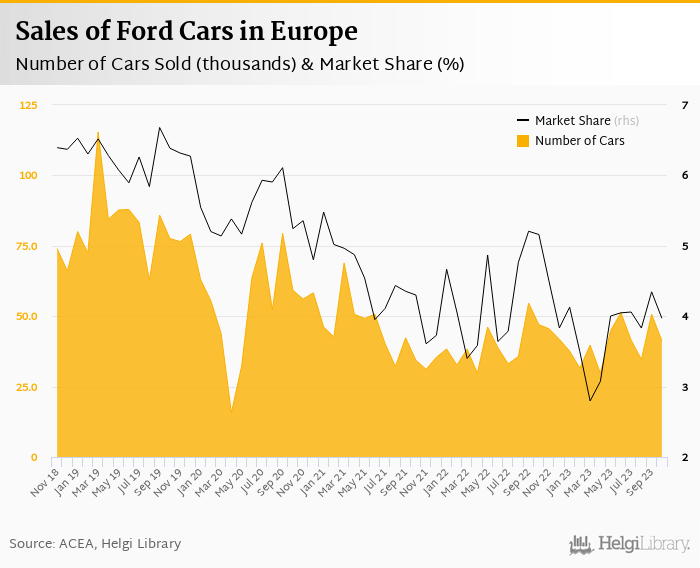

Ford sold 41.3 thousand new passenger cars representing a 3.97% share of all new passenger cars sold in Europe in October 2023. This is 12.2% fewer vehicles and a 1.19 pp decrease in market share when compared to last year. Compared to three years ago, Ford's market share is now 1.27 pp lower.

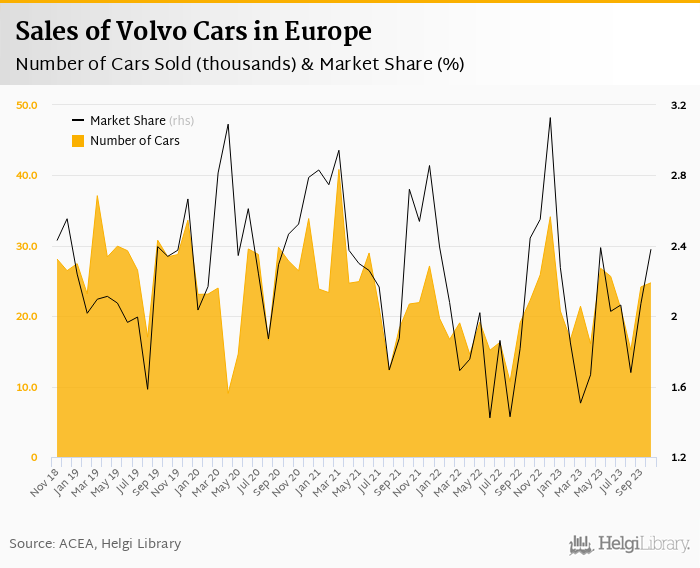

Volvo sold 24.7 thousand new passenger cars representing a 2.38% share of all new passenger cars sold in Europe in October 2023. This is 11.2% more vehicles and a 0.063 pp decrease in market share when compared to last year. Compared to three years ago, Volvo's market share is now 0.085 pp lower.

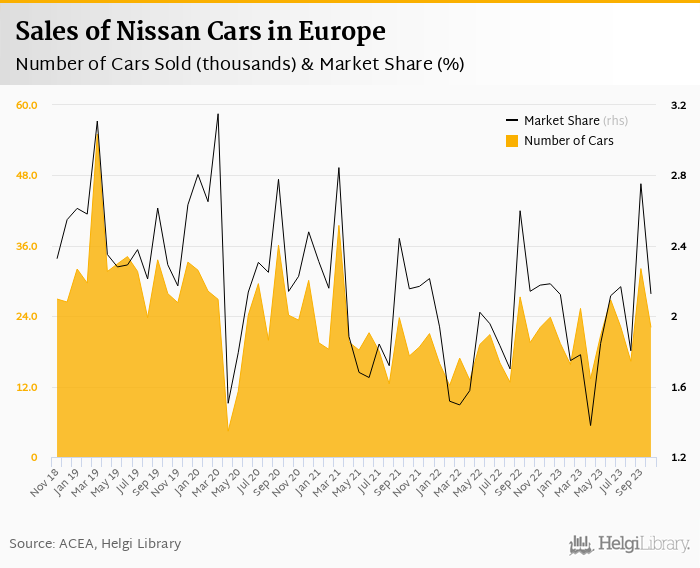

Nissan sold 22.1 thousand new passenger cars representing a 2.13% share of all new passenger cars sold in Europe in October 2023. This is 13.3% more vehicles and a 0.015 pp decrease in market share when compared to last year. Compared to three years ago, Nissan's market share is now 0.014 pp lower.

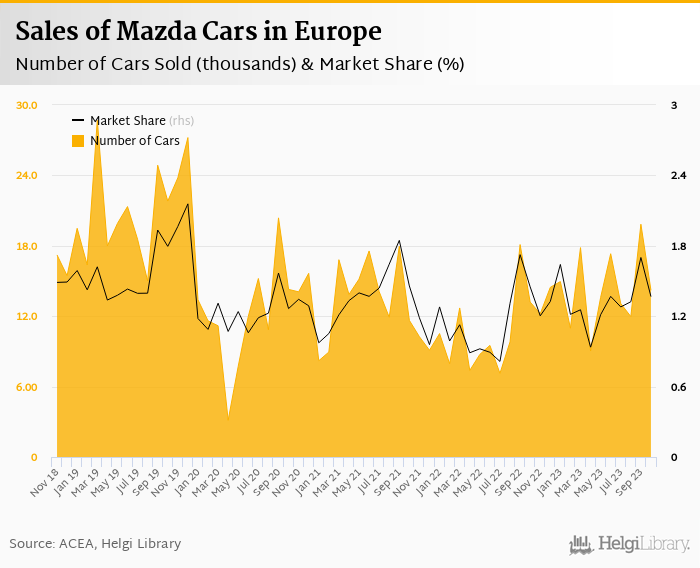

Mazda sold 14.2 thousand new passenger cars representing a 1.37% share of all new passenger cars sold in Europe in October 2023. This is 7.57% more vehicles and a 0.083 pp decrease in market share when compared to last year. Compared to three years ago, Mazda's market share is now 0.102 pp higher.

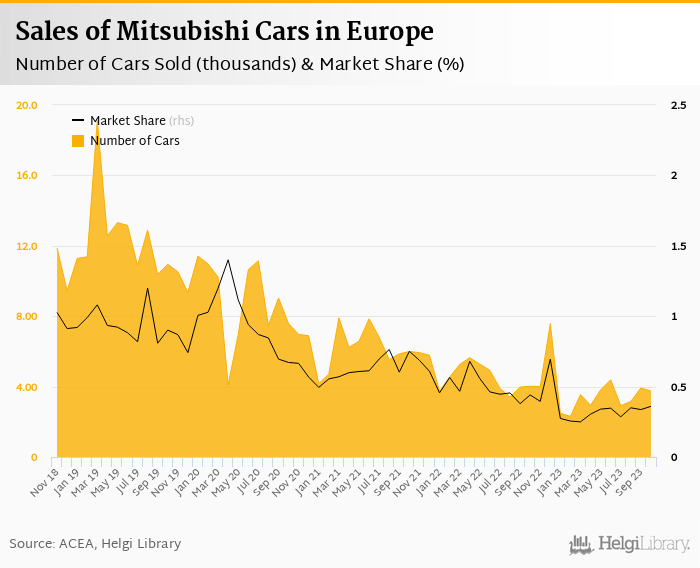

Mitsubishi sold 3.74 thousand new passenger cars representing a 0.360% share of all new passenger cars sold in Europe in October 2023. This is 6.90% fewer vehicles and a 0.081 pp decrease in market share when compared to last year. Compared to three years ago, Mitsubishi's market share is now 0.312 pp lower.

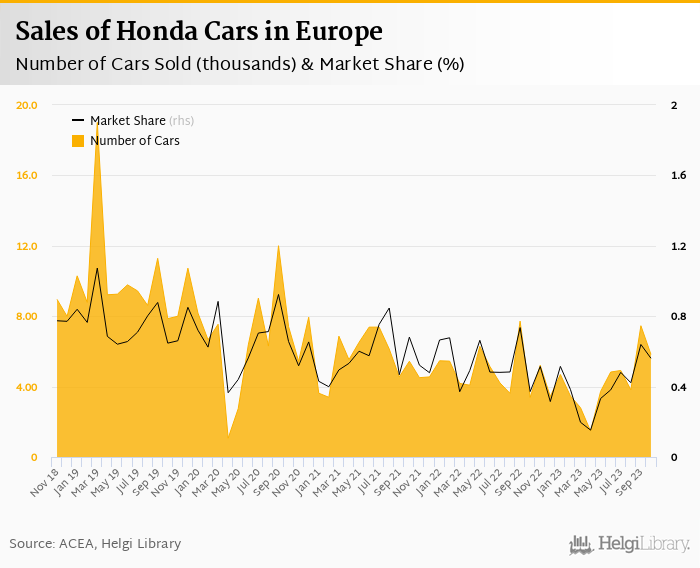

Honda sold 5.83 thousand new passenger cars representing a 0.561% share of all new passenger cars sold in Europe in October 2023. This is 72.2% more vehicles and a 0.189 pp increase in market share when compared to last year. Compared to three years ago, Honda's market share is now 0.095 pp lower.

Tesla sold 18.0 thousand new passenger cars representing a 1.73% share of all new passenger cars sold in Europe in October 2023. This is 210% more vehicles and a 1.10 pp increase in market share when compared to last year.

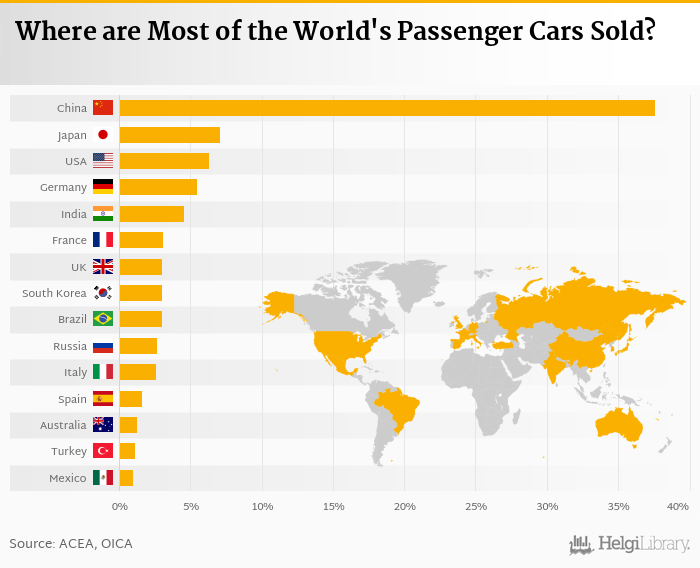

Based on a comparison of 64 countries, China ranked the highest with 20,178 thousand passenger cars sold in 2020 followed by Japan and the USA. Total sales of passenger cars reached 53,599 thousand in 2020 in the world, according to ACEA. This is 15.9% less than in the previous year and 3.98% less than 10 years ago. Historically, total sales of passenger cars reached an all time high of 70,695 thousand in 2017 and an all time low of 11,000 thousand in 1961. The average annual growth stands at 2.39% since 1960.

The top ranked country, China, accounted for 37.6% of all passenger cars sold in the world. The top 3 countries held a 51.1% share while the ten largest countries some 75.9% in 2020.

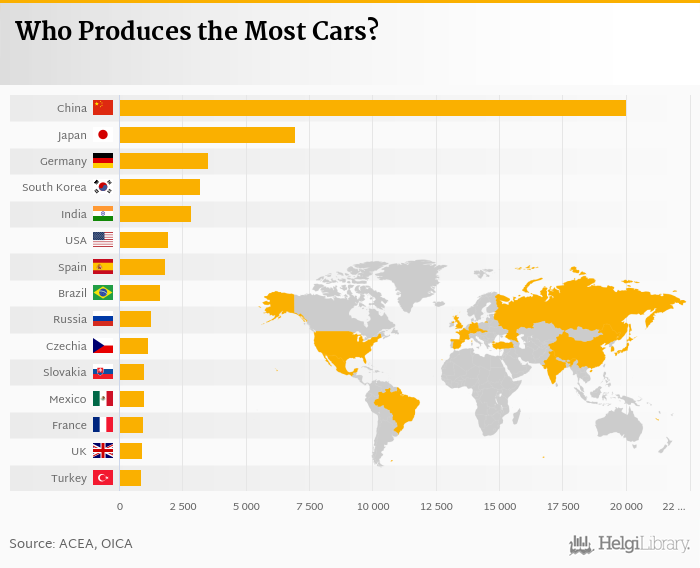

China was the largest car producer in 2020 with 19,994 thousand followed by Japan and Germany. Total production of passenger cars reached 55,834 thousand in 2020 in the world, according to ACEA. China accounted for 35.8% of the world's production, while the top 3 countries held a 54.6% share and the ten largest countries some 79.3% in 2020:

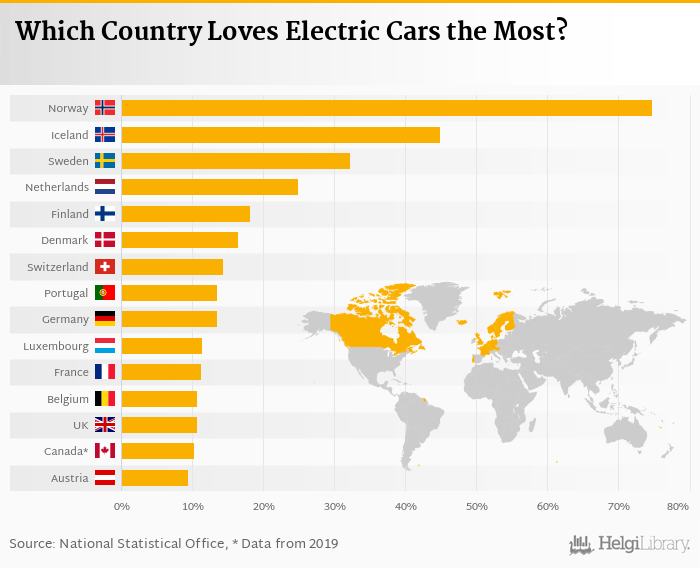

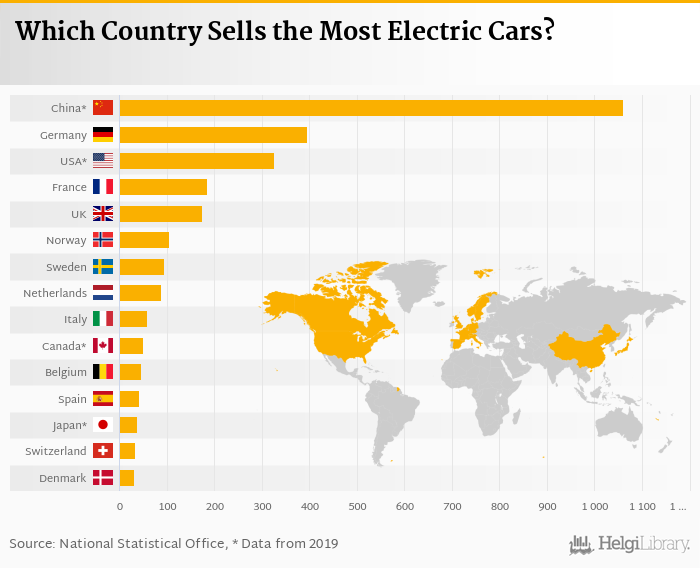

Based on a comparison of 29 countries, Germany ranked the highest in sales of electric cars with 395 thousand followed by France and United Kingdom in 2020. When looking at the ratio of electric to total new cars sold, Norway ranked the highest with 74.8% followed by Iceland and Sweden:

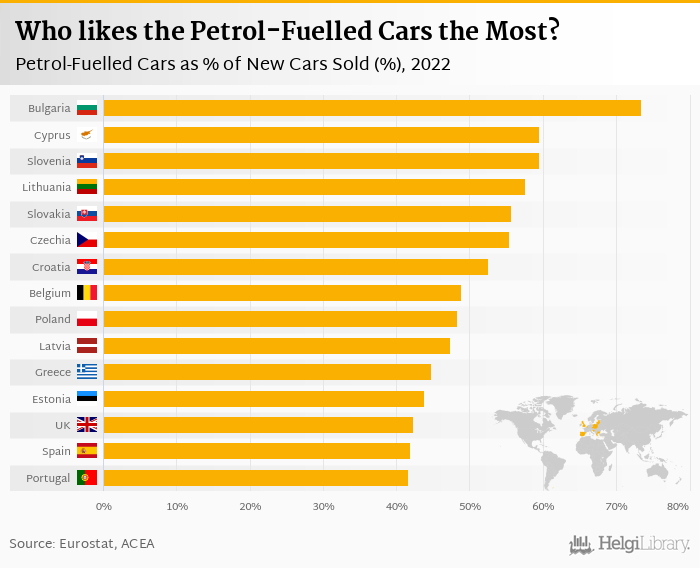

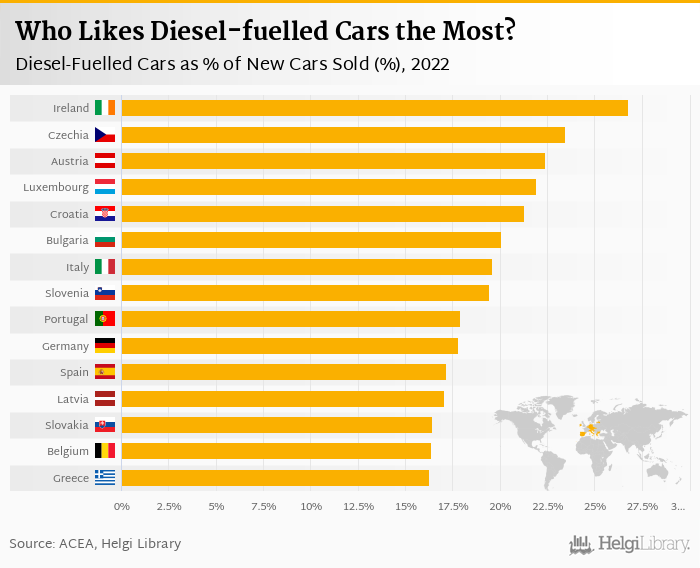

By contrast, Bulgaria ranked the highest in the number of petrol-fuelled as a proportion of new cars sold with 73.4%, followed by Cyprus and Slovenia. In terms of diesel-fuelled vehicles, Ireland ranked the highest with 26.8% followed by Czechia and Austria:

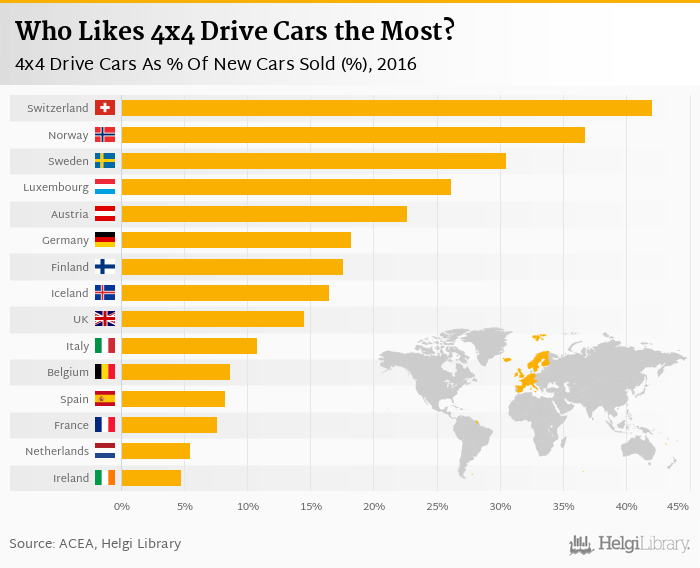

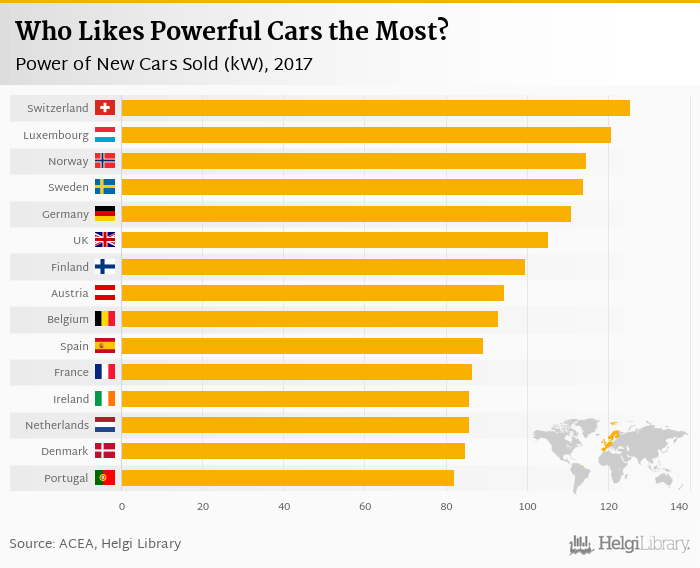

In 2016, Switzerland ranked the highest in 4x4 drive cars as a share of new cars sold with 42.1% followed by Norway and Sweden. Switzerland ranked the highest in the average power of new cars sold with 122 kW followed by Luxembourg and Sweden:

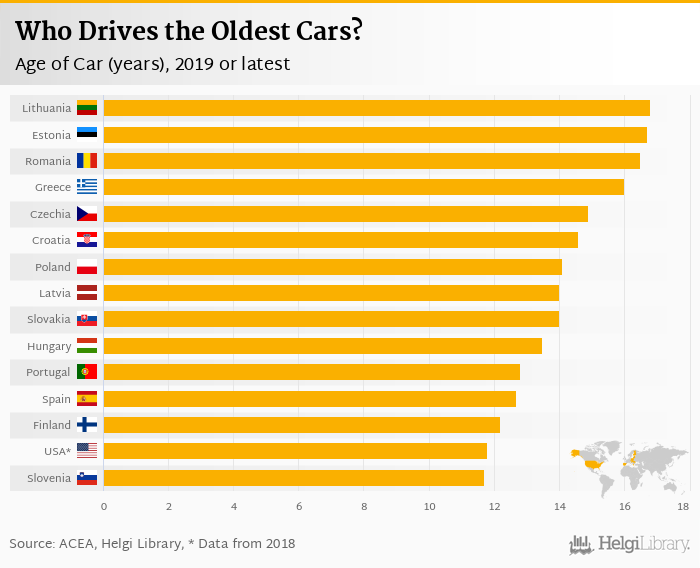

Based on the latest available data, Lithuania, Estonia and Romania were the countries with the oldest average age of passenger cars. The average age was an ancient 16.8 years in Lithuania, 16.7 years years for Estonia and 16.5 years years in Romania. On the other end of the scale was Austria with 8.30 years years, the United Kingdom with 8.00 years years and Luxembourg with 6.50 years years.

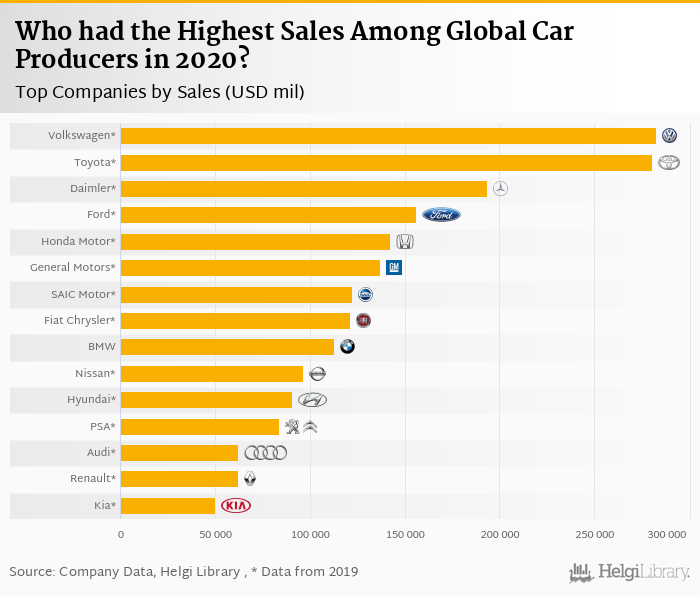

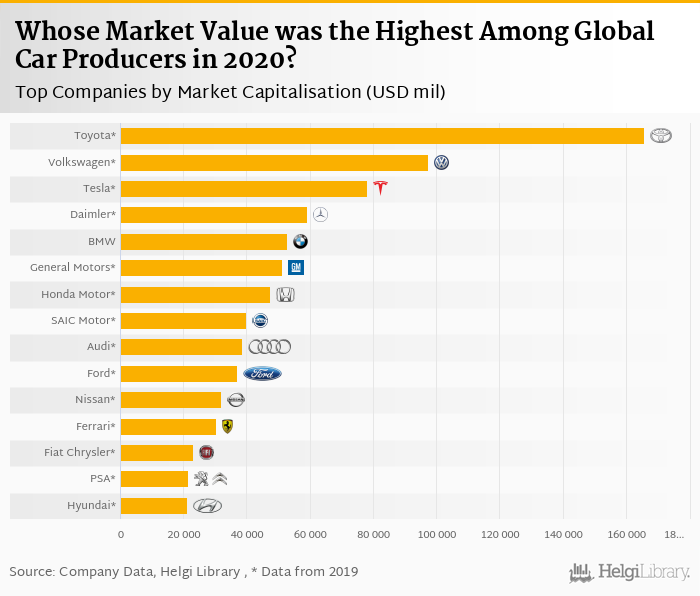

Based on a comparison of 27 firms among Global Car Producers, Volkswagen Group generated the highest sales in 2019 followed by Toyota Motor Corporation and Daimler Group. At the same time, Toyota Motor Corporation had the highest market value followed by Volkswagen Group and Tesla Inc.:

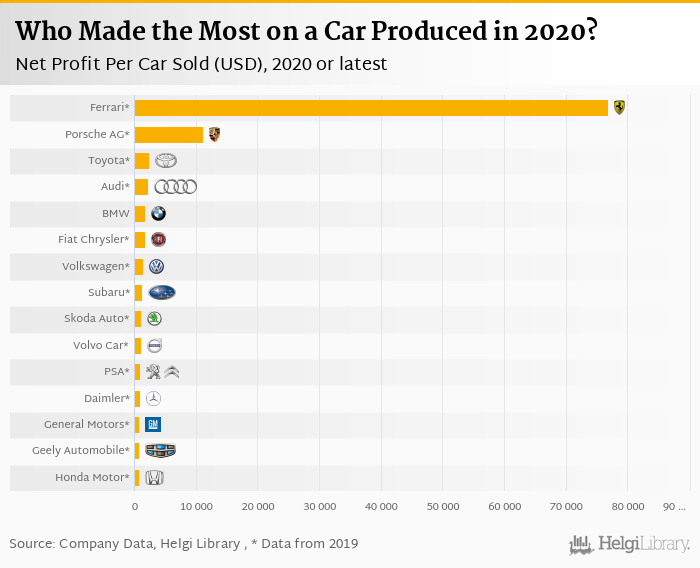

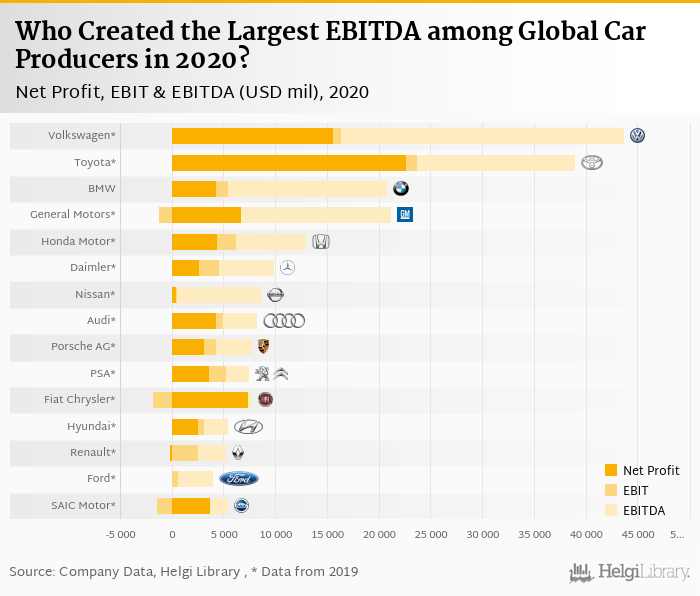

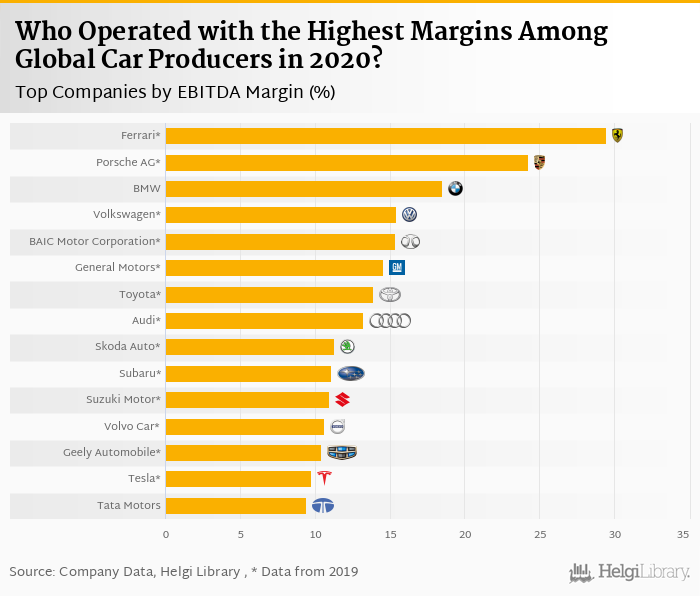

Volkswagen Group generated the highest earnings before interest costs, taxes and depreciation (so called EBITDA) in 2019 followed by Toyota Motor Corporation and General Motors. At the same time, Ferrari generated the highest EBITDA Margin followed by Porsche AG and BMW Group.

Ferrari produced the highest net profit per car sold in 2019 followed by Porsche AG and Toyota Motor Corporation. Ferrari made a net profit of USD 77,831 for each car sold, down 21.7% compared to the previous year.