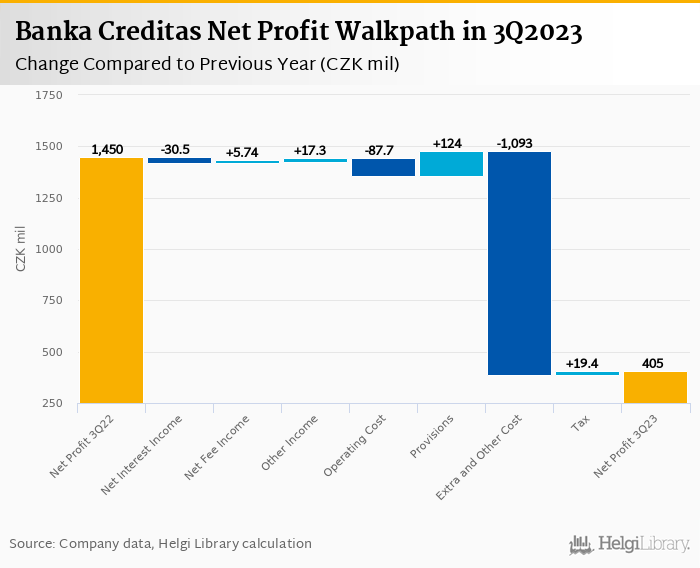

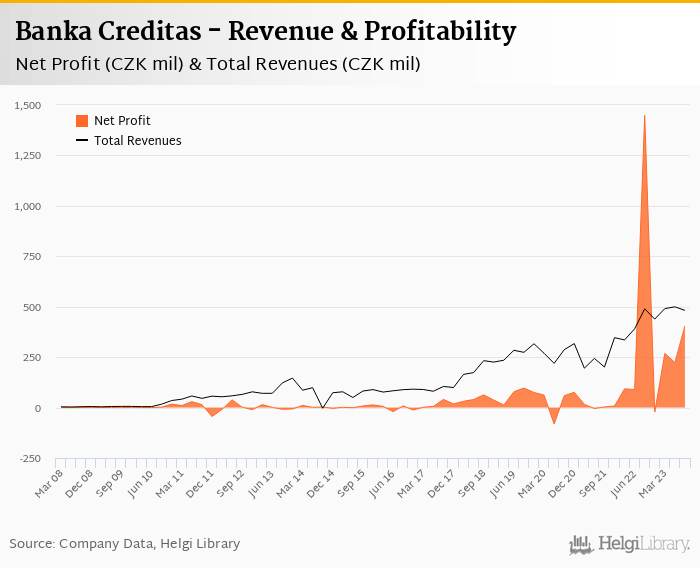

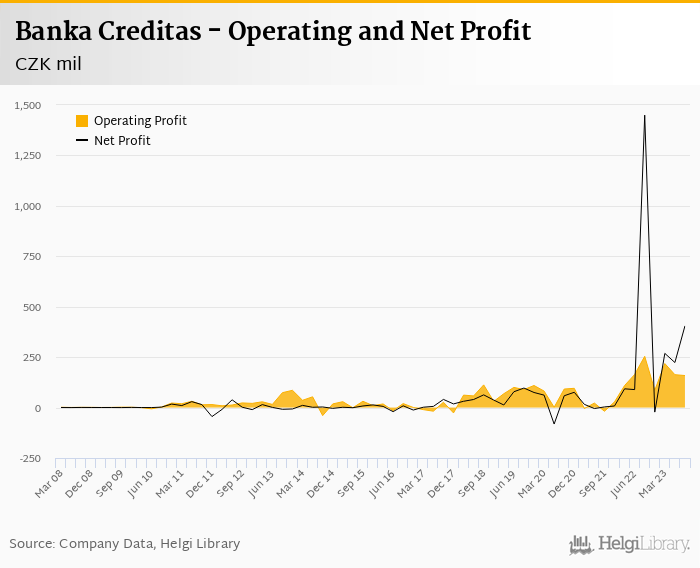

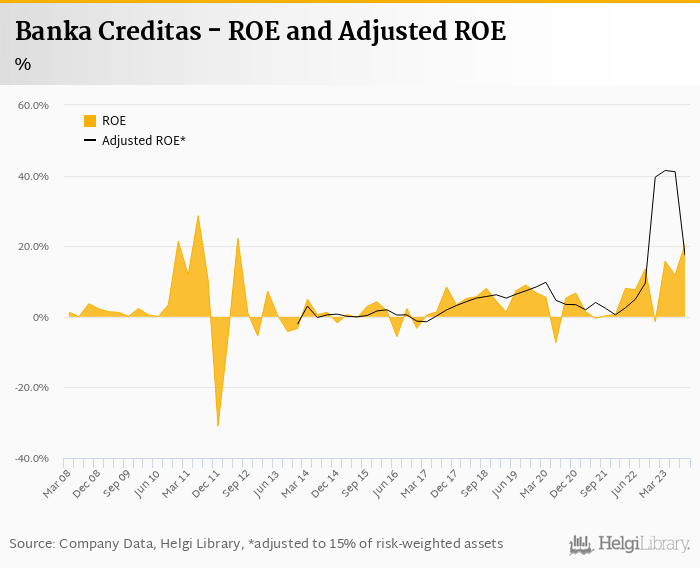

Banka Creditas decreased its net profit 72.1% to CZK 405 mil in 3Q2023 and generated ROE of 20.6%.

Revenues decreased 1.5% yoy as interest margin peaked while costs rose 37% due partly to fast expansion, so cost to income increased to 67%

Operating profit fell 37.5%, so Bank'sbottom line has been supported by CZK 95 mil provision write-back and contribution from subsidiaries

The 3Q23 numbers suggest peaking interest margin amid further slowdown in loan and deposit growth, cost pressure and a good asset quality, though we have to wait for full-year results to see the details.

Banka Creditas made a net profit of CZK 405 mil in the third quarter of 2023, down 72.1% yoy, or decrease of more than CZK 1.0 bil in absolute terms. The fall is heavily a result of CZK 1.26 bil one-off gain booked last year from a purchase of Max Banka (we assume), though operating profit fell 37.5% as revenues fell slightly and cost side remained under pressure. Provision write-back of CZK 95 mil and solid contribution from subsidiaries partly offset the weaker operating results:

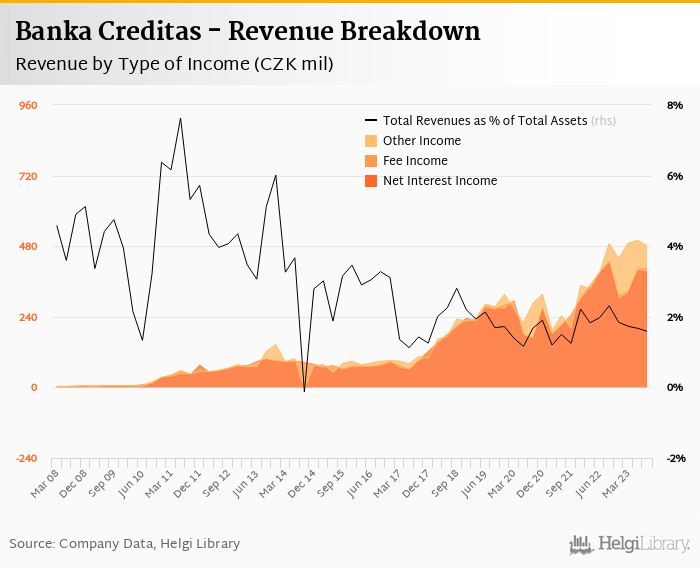

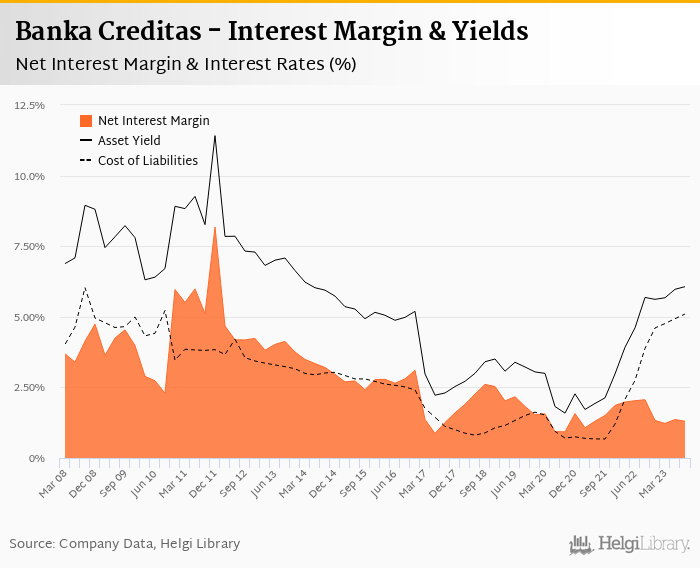

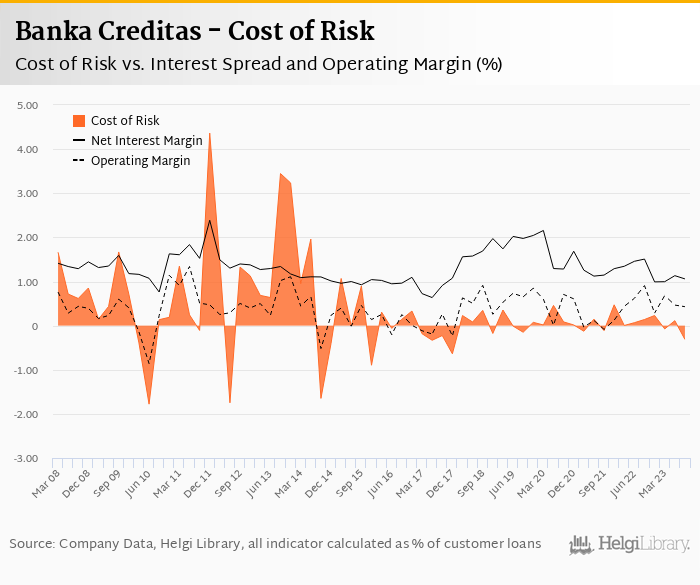

Revenues decreased 1.53% yoy to CZK 482 mil in the third quarter of 2023. This yoy comparison is partly distored by strong interest income seen last year and net interest margin stabilized at around 1.30%. Fees and other income rose nicely (80% and 29% yoy, respectively), though deposit growth and interest margin remain main drivers of the bank's bottom line as interest income still forms more than 80% of total revenues:

Net interest margin reached 1.30% last quarter. This is down significantly from record 2.06% seen last year, but was stable for a fourth consecutive quarter, so things clearly stabilized here. Having said that, cost of funding continued rising to 5.10% in 3Q2023 from 3.88% last year and 4.93% seen in the previous quarter, so we need to watch the development here closely in the coming quarters:

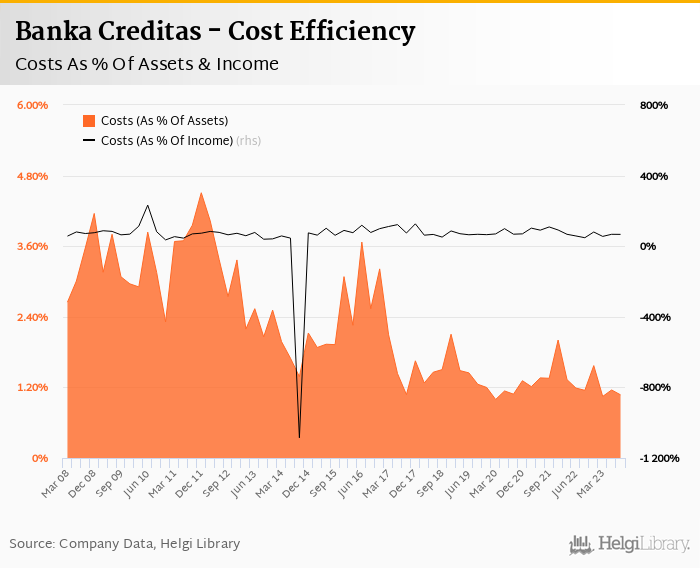

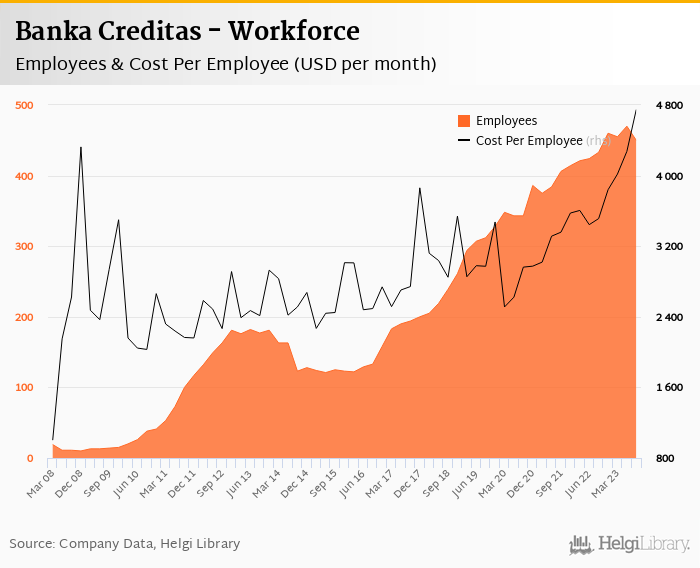

Costs increased by hefty 37.3% yoy and the bank operated with average cost to income of 67% in the last quarter. Staff cost rose 28.4% as the bank employed 450 persons (up 3.9% yoy) while non-personnel grew even more at 37.3% yoy.

Following the acquisition of Expobank last year or cooperative Ney this year, we believe expansion some of the cost growth should be attributed to the hefty expansion. On the positive side, core expenses (staff and non-personnel adjusted for contribution to the Bank Guarantee Fund) fell 3.0% qoq suggesting the "worst" could be over on that front:

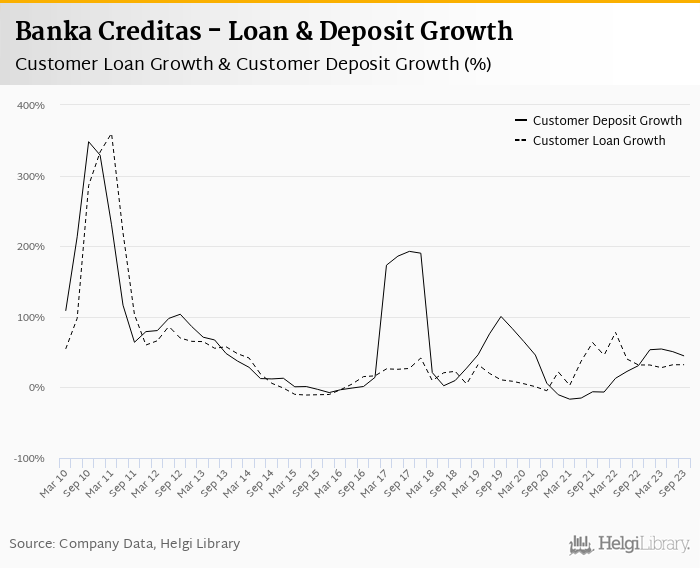

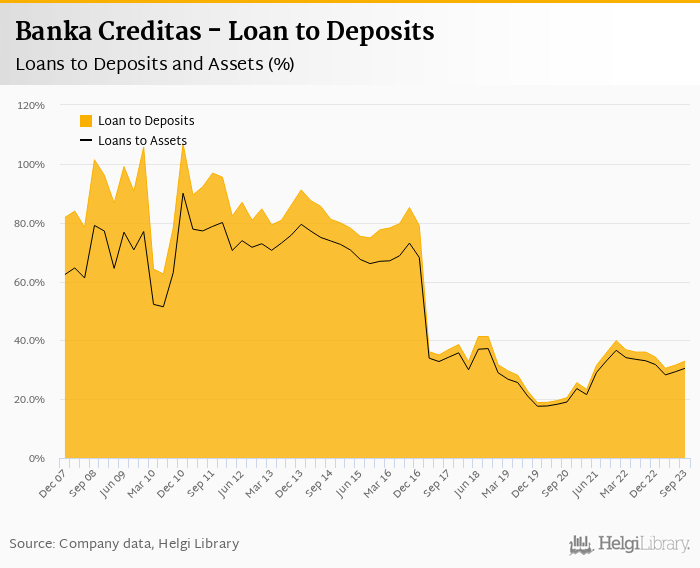

With few details on loans and deposits, we assume Banka Creditas's customer loan and deposit growth slowed further down in the third quarter. We assume loans grew at around 5.0% qoq and were by a third higher when compared to last year. Customer deposits might have slowed down to 1-2.0% qoq implying a 45% yoy growth, in our view.

As such, Banka Creditas's loans would have accounted for approximately 33% of total deposits and 30% of total assets at the end of September 2023 suggesting a plenty of room for futher loan growth:

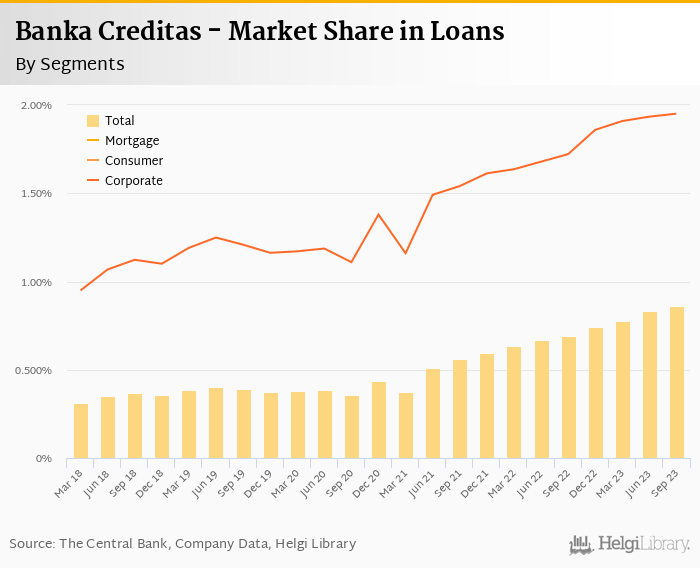

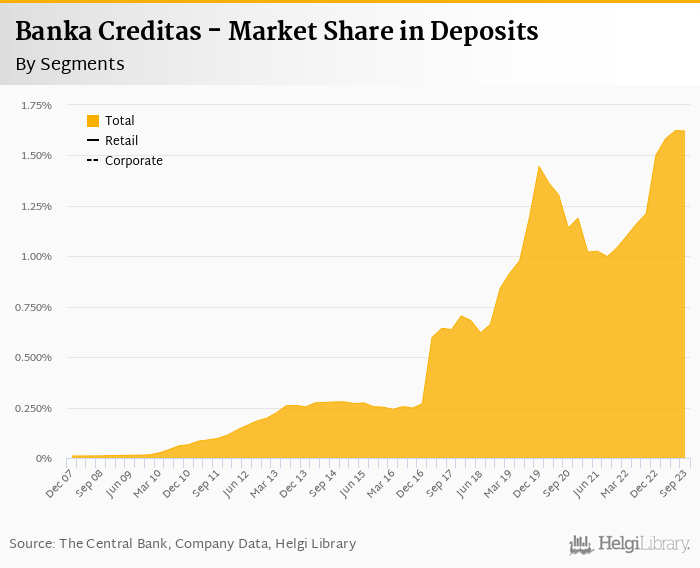

We estimate that Banka Creditas has gained 0.17 pp market share in the last twelve months in terms of loans (holding 0.86% of the market at the end of 3Q2023). On the funding side, the bank seems to have gained 0.41 pp and held 1.6% of the deposit market:

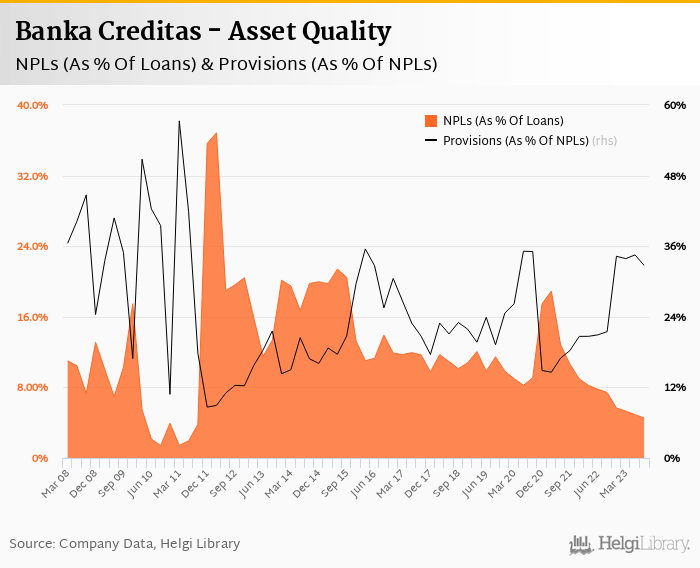

Banka Creditas wrote back some CZK 95 mil in provisions last quarter implying no concerns about its asset quality (assuming these are loan-related write-backs). We therefore assume non-performing loans fell further to 4-5.0% of total loans while provisions coverage increased to around a third of NPLs:

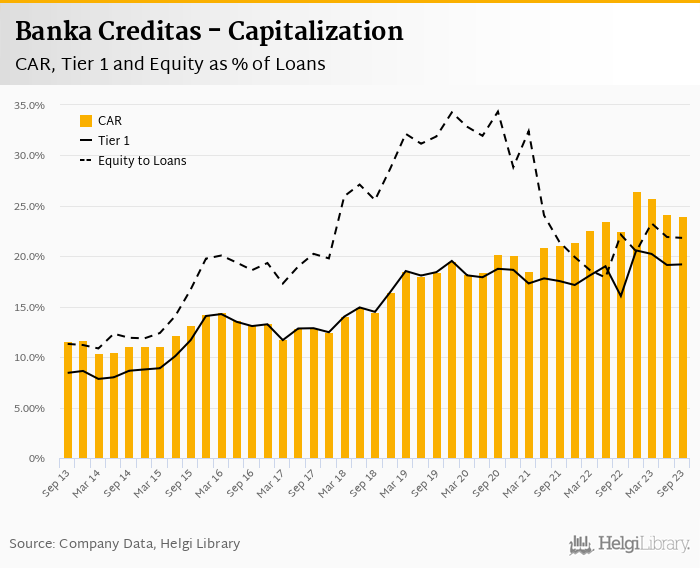

Based on the profitability and assumed loan growth, we guesstimate Banka Creditas's capital adequacy ratio reached approximately 24.0% in the third quarter of 2023 while bank equity accounted for 21.8% of loans:

Overall, Banka Creditas made a net profit of CZK 405 mil in the third quarter of 2023, down 72.1% yoy. This means an annualized return on equity of 20.6% in the last quarter or 11.9% when the last four quarters are taken into account:

Peaking interest margin, expansion-related cost pressure, slowdown in loan and deposit growth and high comparison base from last year, these all have resulted in a pressure on Bank's profitability and a fall when compared to last year's numbers. We need to wait for detailed full-year results to see details regarding loan and deposit breakdown and asset quality.