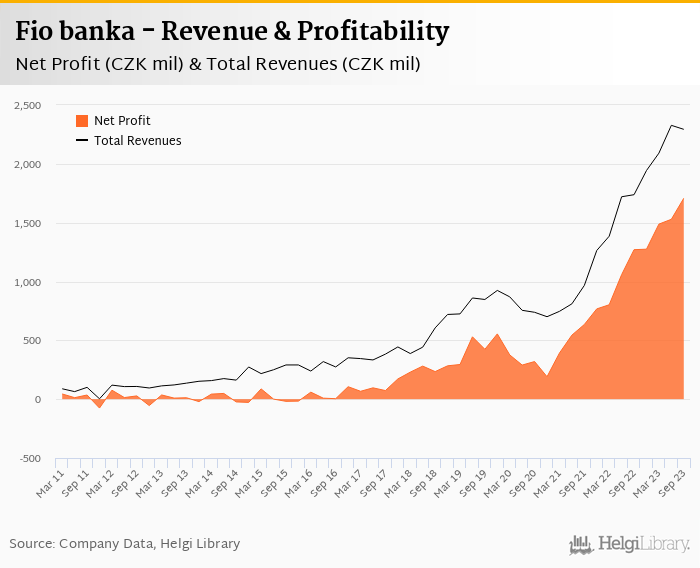

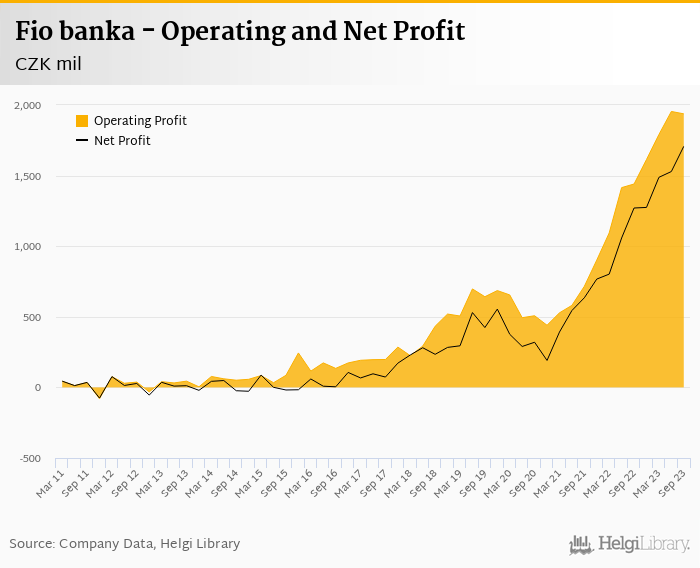

Fio banka rose its net profit 34.4% to CZK 1.71 bil in 3Q2023 and generated ROE of 42.1%.

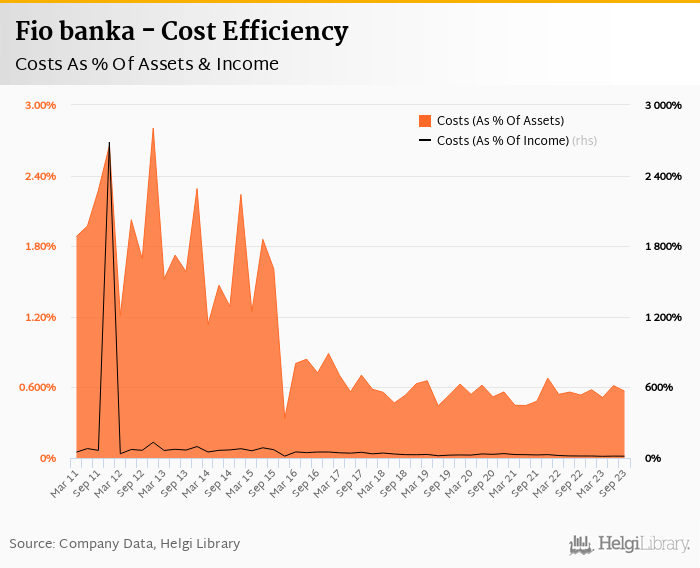

Revenues increased 32% yoy driven by higher interest margin and cost rose 19.7% due mainly to personnel. Cost to income decreased to impressive 15.5%

Provision write-back of CZK 73 mil further supported Bank's bottom lines, so we assume asset quality further improved last quarter

Another record quarterly results announced in the 3Q2023, both in absolute as well as relative terms. With the lowest cost of funding on the market, Fio banka is one of the winners from the higher interest rate environment.

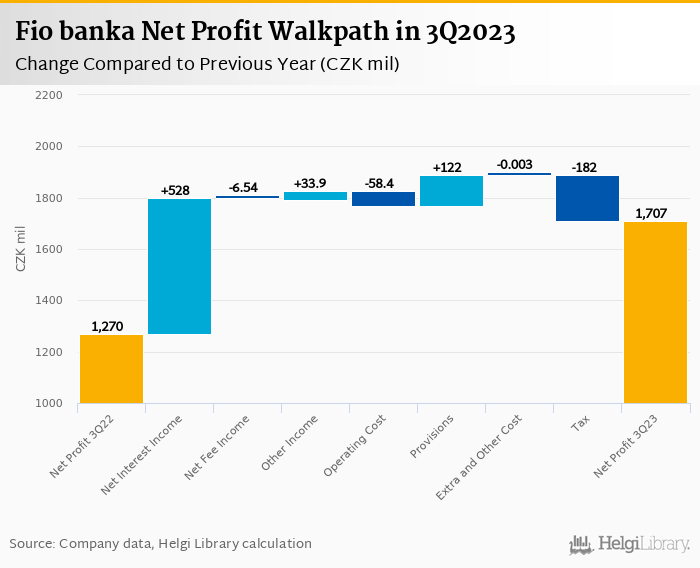

Fio banka made another record quarterly net profit of CZK 1.71 bil in the third quarter of 2023, up 34.4% yoy, or increase of CZK 437 mil in absolute terms. Most of the improvement came again from higher net interest income (more than 80%) further supported by CZK 73 mil provision write-back:

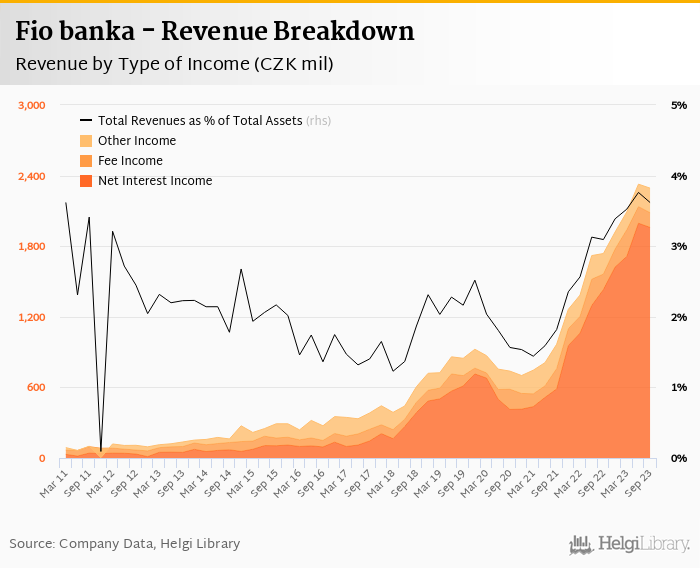

Revenues increased 32% yoy to CZK 2.29 bil in the third quarter of 2023 with net interest income rising 37% yoy and generating most of the revenue growth as well as total revenues absolutely (over 80%). This is heavily a result of higher interest rates when compared to last year and Fio banka's business model benefiting from one of the lowest cost of funding on the market:

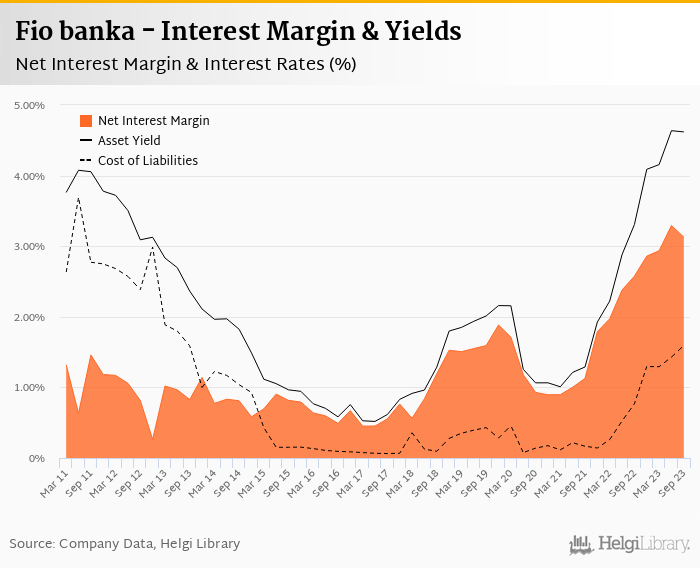

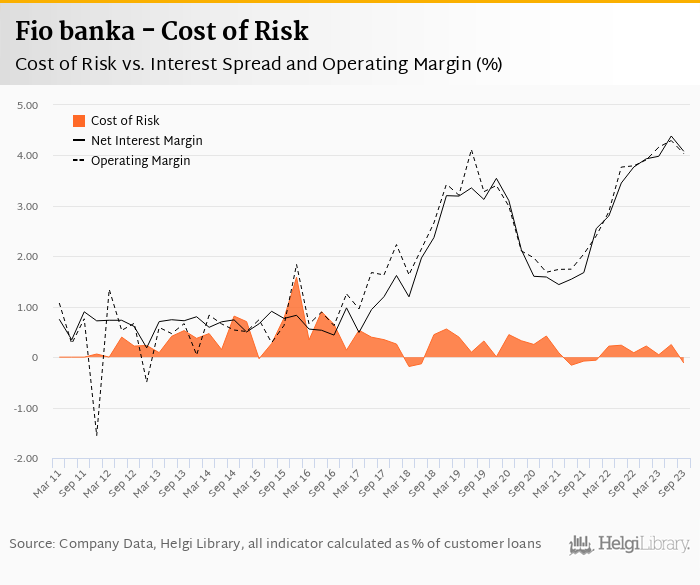

Net interest margin increased 55 bp to 3.13% when compared to last year with average asset yield accounting for 4.62% (up from 3.31% a year ago) and cost of funding 1.59% in 3Q2023 (up from 0.767%). With more 85% of revenues coming from interest income, details of net interest margin stabilisation/decline will be crucial to watch in the coming quarters affecting Fio banka's profitability, in our view:

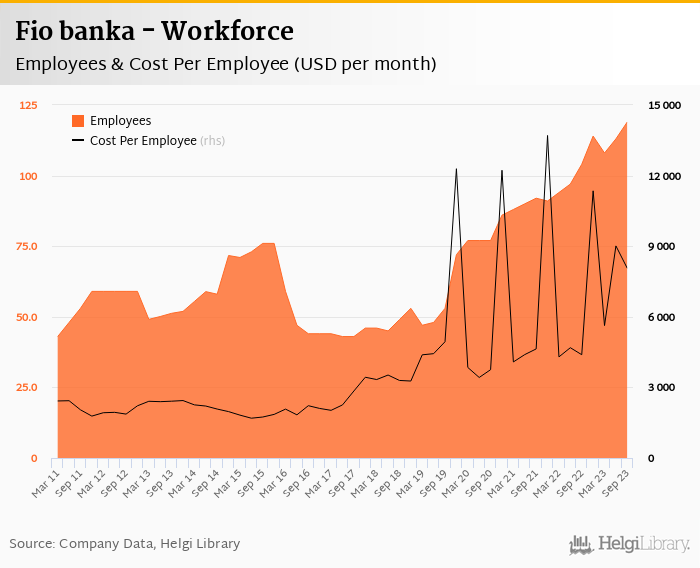

Costs increased by hefty 19.7% yoy driven by personnel (up 92% yoy amid 14.4% increase in number of workforce). We assume this might be performance-related given Bank's impressive profitability development. In spite of that, cost to income fell to impressive 15.5% in the last quarter with 15.7% ratio seen in the last 12 months:

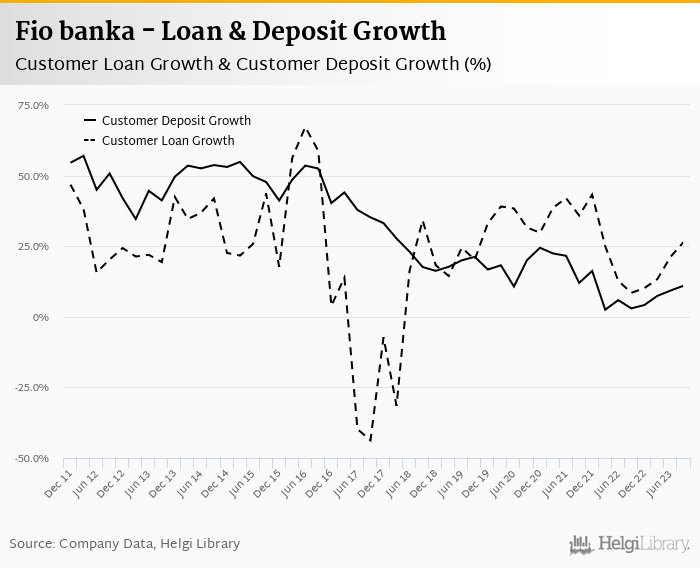

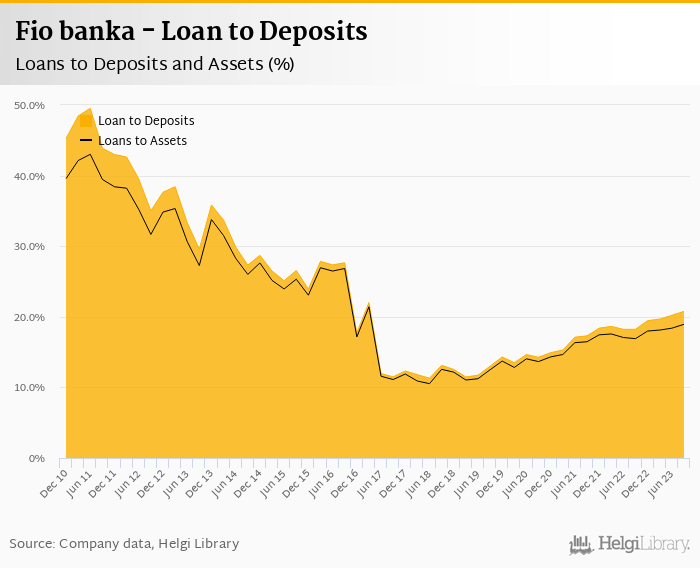

With few details regarding customer loans and deposits, we assume Fio banka's customer loans grew at around 4-5.0% qoq and increased some 25% yoy in the third quarter of 2023 while customer deposit growth slowed down to 2-3.0% qoq and 10-11.0% yoy.

If so, Fio banka's loans would have accounted for approximately a fifth of total deposits and around 19% of total assets.

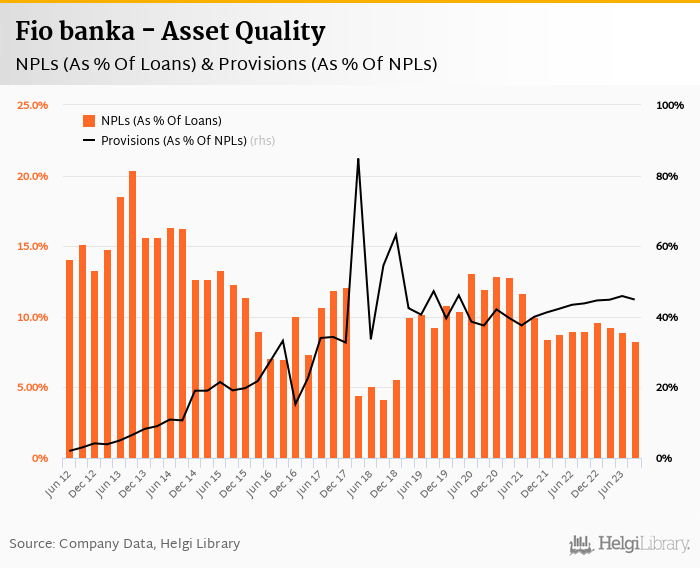

Fio banka wrote back CZK 73.2 mil in provisions in the last quarter, so we assume asset quality further improved. We therefore "guesstimate" that share of non-performing loans fell to around 8.0% of total loans while provision coverage amounted to 40-50% of NPLs at the end of September 2023:

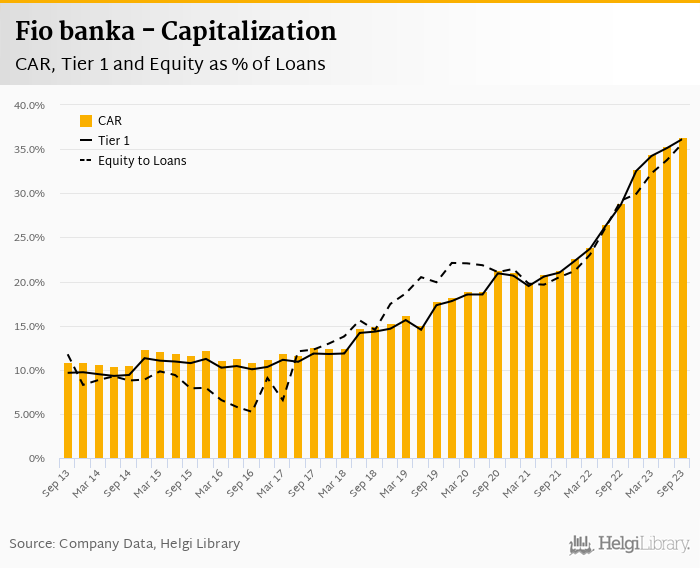

Based on the assumed loan growth and reported profitabily, we estimate Fio banka's capital adequacy ratio reached around 35% in the third quarter of 202 while bank equity accounted for 35.6% of loans:

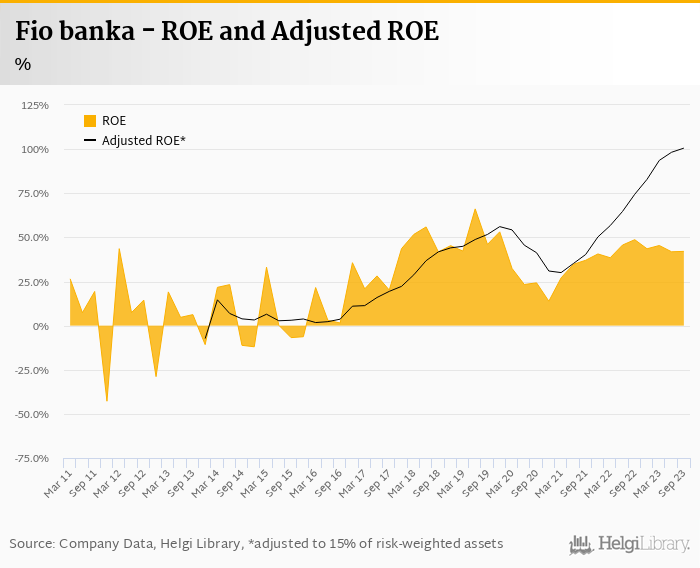

Overall, Fio banka made a net profit of CZK 1.71 bil in the third quarter of 2023, up 34.4% yoy. This means an annualized return on equity of 42.1% in the last quarter or 40.9% when the last four quarters are taken into account:

Another record quarterly results announced by Fio banka in the 3Q2023, both in absolute as well as relative terms. With one of the lowest cost of funding on the market, Fio banka is one of the winners of the current high interest rate environment.

We will be waiting for full-year results to see details on loan and deposits as well as asset quality and capitalization to see how traditional banking business has been developing at the Bank.

With more than 85% of revenues coming from interest income, development in net interest margin (and cost of funding in particular) remains the single biggest line to watch for in the coming quarters.