PPF Banka rose its net profit 37.1% to CZK 1.02 bil in 3Q2023 and generated ROE of 21.4%.

The results were driven by an absence of revaluation losses and provision write-backs when compared to last year

Revenues increased 24.1% yoy and cost rose 4.46%, so cost to income decreased to impressive 21.6%

Provision write-back of CZK 43.8 mil further boosted bottom line, so we assume asset quality remains good with NPLs at aroud 1.1-1.2%

A quarter heavily affected by one-offs, though stabilisation of interest margin, solid fee growth and good cost control are positives to point out

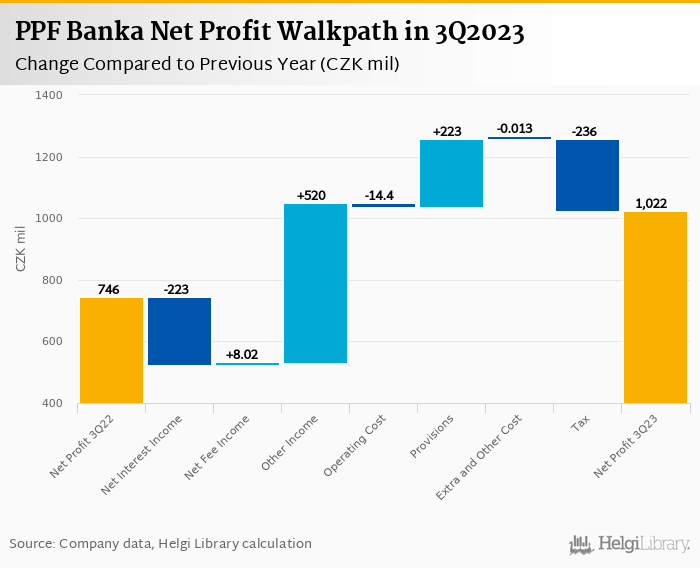

PPF Banka made a net profit of CZK 1.02 bil in the third quarter of 2023, up 37.1% yoy, or increase of CZK 276 mil in absolute terms. With core revenues (interest and fee income) falling 11.9% yoy and operating costs up 4.5%, CZK 520 mil intra-year improvement in other non-interest income (due to absence of last year's losses) and CZK 223 mil lower provisions were the main drivers of the headline profit improvement when compared to last year:

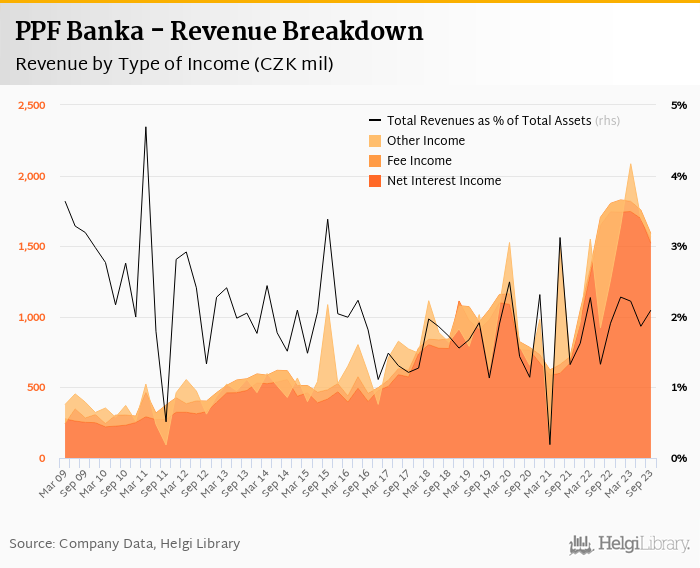

Revenues increased 24.1% yoy to CZK 1.57 bil in the third quarter of 2023 with net interest income being down 12.8% and fees rising 13.5% yoy. A loss of CZK 22.3 mil from other/trading income booked in the third quarter might look disappointing, though represents a CZK 520 mil improvement when compared to last year. Given its size and volatility, we assume this comes from a revaluation of bank's position in financials assets:

Net interest margin stabilised at 1.84% last quarter (down from record 2.57% seen in 3Q2022), though net interest income was still 10.4% lower when compared to the previous quarter. This is a difference compared to other banks, which reported results for 3Q2023 so far. With cost of funding rising further 15 bp last quarter to 3.81%, the pressure on the margin seems to persist, something to watch for in the coming quarters:

Costs increased by mild 4.46% yoy and the bank operated with impressive cost to income of 21.6% in the last quarter. The increase was driven by staff cost (up 16.3% yoy), so we assume 12-13% wage adjustments has been made within the last 12 months. On the other hand, non-personnel cost fell 1.8% yoy and depreciation charge by 7.4% yoy:

With few details regarding PPF Banka's loan and deposit porfolio, we assume growth was subdued, similar to the trends seen already at other banks. We therefore assume loans grew at around 1.0% qoq and were up some 3.0% yoy while customer deposit growth was flatish qoq and deposits were up 30% yoy.

If so, PPF Banka's loans accounted for 22.1% of total deposits and 15.6% of total assets.

With CZK 43.8 mil provision write-back recorded last quarter, we assume PPF Banka's asset quality remains good with non-performing loans at around 1.1-1.2% and provision coverage well exceeding 100% of NPLs:

Based on the profit generated last quarter (and loan growth), we estimate PPF Banka's capital adequacy ratio reached approximately 28% in the third quarter of 2023 while bank equity accounted for 42.1% of loans:

Overall, PPF Banka made a net profit of CZK 1,022 mil in the third quarter of 2023, up 37.1% yoy. This means an annualized return on equity of 21.4% in the last quarter or 21.0% when the last four quarters are taken into account:

PPF Banka announced another high profits in 3Q2023, though heavily driven by one-offs due primarrily to an absence last year's revaluation losses and provision write-backs.

Stabilisation of interest margin, solid fee growth and good cost control are the main positives seen this quarter, on the other hand, lack of details on loans and deposits makes difficult to assess the whole picture.

We are therefore waiting for full year results to see details on loan portfolio, capitalisation and confirmation that pressures from cost of funding have been fading away.