Ceska Sporitelna rose its net profit 33.2% to CZK 5.34 bil in 3Q2023 and generated ROE of 15.8%.

Absence of losses from bond portfolio and buildings from last year and provision write-backs for Sberbank's portfolio drove the bottom line last quarter.

On the operating level, profit fell 10% yoy due mainly to higher cost of funding and weak trading income, though cost cutting seems to be accelerating.

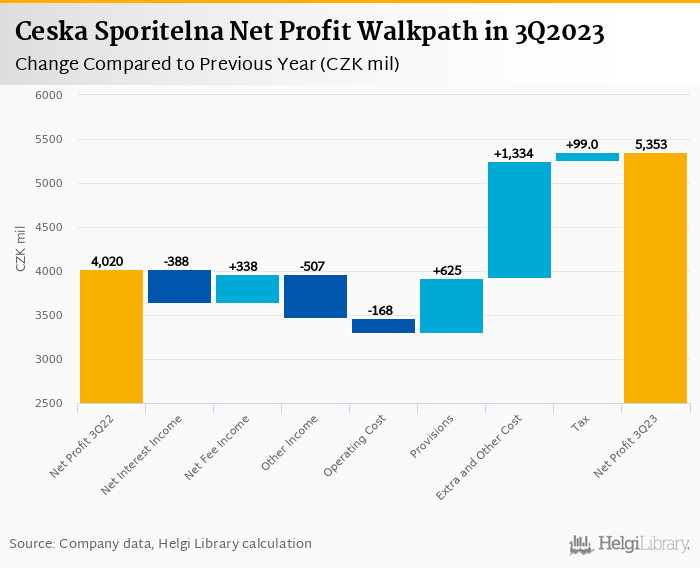

Ceska Sporitelna made a net profit of CZK 5.37 bil in the third quarter of 2023, up 33.2% yoy, or increase of CZK 1.33 bil in absolute terms. When compared to last year, the whole improvement came from an absence of losses on bond portfolio and impairments of buildings supported further by lower provisions (release of provisions for Sberbank's portfolio). Gross operating profit was 10% lower as revenues lost CZK 557 mil while cost increased CZK 168 mil:

Revenues decreased 4.5% yoy to CZK 11.83 bil in the third quarter of 2023. Net interest income fell 4.2% yoy as pressure from cost of funding remained high. On the non-interest income front, fee income grew strong 14.9% yoy to a quarterly record of CZK 2.61 bil, on the other hand, relatively weak trading and other income "helped" revenue growth into the red last quarter:

Average asset yield increased furher 34 bp to 5.50% in the third quarter of 2023 (up from 4.78% a year ago), but so did cost of funding (by 33 bp to 3.94% in 3Q2023), so net interest margin improved only slightly to 1.85% in 3Q2023 and was 14 bp lower compared to last year. Interest rate spreads seemed to have stabilized so far this year at around 1.56-1.58% of assets confirming the general trend:

Costs increased by relatively low 3.2% yoy (and fell 2.2% qoq when adjusted for the contribution the the Guarantee Fund) and the bank operated with average cost to income of 46.1% in the last quarter. It seems the Bank has been harvesting some of the first fruits of its cost cutting efforts as further 67 persons left the Bank and 20 branches and 26 ATMs have been closed last quarter:

Ceska Sporitelna's customer loans grew 1.94% qoq and 8.1% yoy in the third quarter of 2023 while customer deposit fell 2.62% qoq and grew 2.31% yoy. That’s compared to average of 7.6% and 6.7% average annual growth seen in the last three years.

At the end of third quarter of 2023, Ceska Sporitelna's loans accounted for 69.8% of total deposits and 51.7% of total assets.

Retail loans grew 1.05% qoq and were 8.7% up yoy. They accounted for 65.4% of the loan book at the end of the third quarter of 2023 while corporate loans increased 3.45% qoq and 6.43% yoy, respectively. Mortgages represented 43.2% of the Ceska Sporitelna's loan book, consumer loans added a further 8.63% and corporate loans formed 37.8% of total loans:

Ceska Sporitelna seem to continue gaining market share in all key areas on the lending side (based on the internal numbers until August 2023) , on the other hand, there seem to be marginal/gradual losses on the funding side:

Ceska Sporitelna's non-performing loans reached 1.80% of total loans, down from 1.90% when compared to the previous year. Provisions covered some 116% of NPLs at the end of the third quarter of 2023, up from 116% for the previous year.

The asset quality remains very good with improving quality of retail portfolio and some provision releases for SME and large corporates. Also, some of the provisons initially created for Sberbank's loan portfolio have been released supporting bank's bottom line in 2023:

Ceska Sporitelna's capital adequacy ratio reached 19.2% in the third quarter of 2023, down from 19.9% for the previous year. The Tier 1 ratio amounted to 17.9% at the end of the third quarter of 2023 while bank equity accounted for 14.3% of loans:

Overall, Ceska Sporitelna made a net profit of CZK 5.37 bil in the third quarter of 2023, up 33.2% yoy. This means an annualized return on equity of 15.8% in the last quarter or 14.3% when the last four quarters are taken into account:

Solid set of results on the bottom line heavily supported by i) an absence of losses on bond portfolio and impairments on buildings seen last year and ii) provision write-backs initially created when buying Sberbank's loan portfolio last year. On the operating level, the Bank still suffers from higher cost of funding, though stabilisation of interest rate spread has been confirmed again this quarter. Impressive fee income growth and cost cutting are something to watch for in the next quarters.