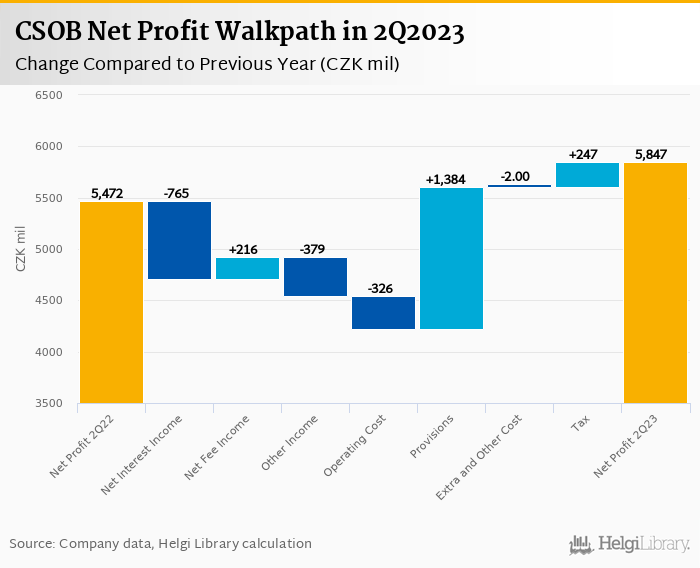

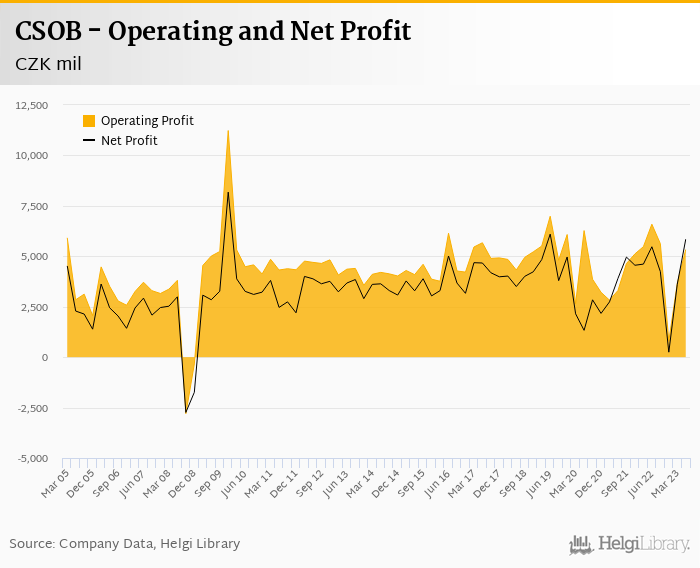

CSOB rose its net profit 6.9% to CZK 5,847 mil in 2Q2023 and generated impressive ROE of 22.1%. The strong profits have been achieved heavily by provision write-backs and lower effective tax rate, however.

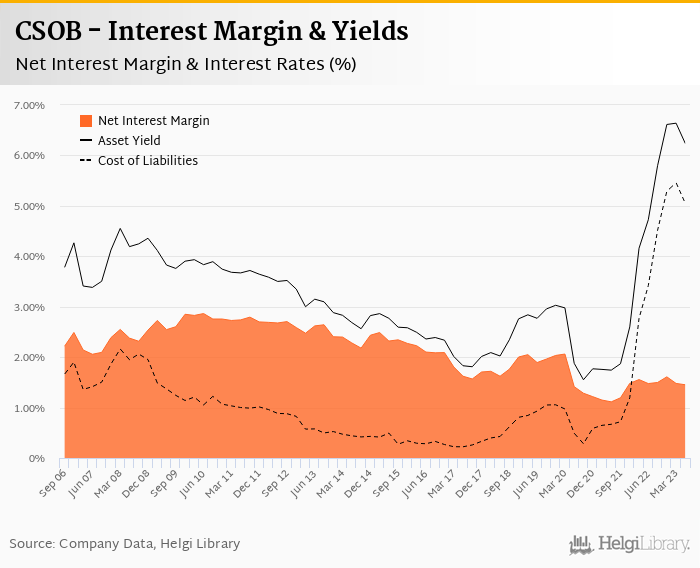

Operating profit fell 19% yoy due mainly to lower interest margin, though strong fee income and good cost control are worth mentioning helping the bank to keep costs below 50% of income.

CZK 1.26 bil provision write-back for corporate and SME customers saved the day and Bank's bottom line. Share of bad loans fell to 1.52% of total loans.

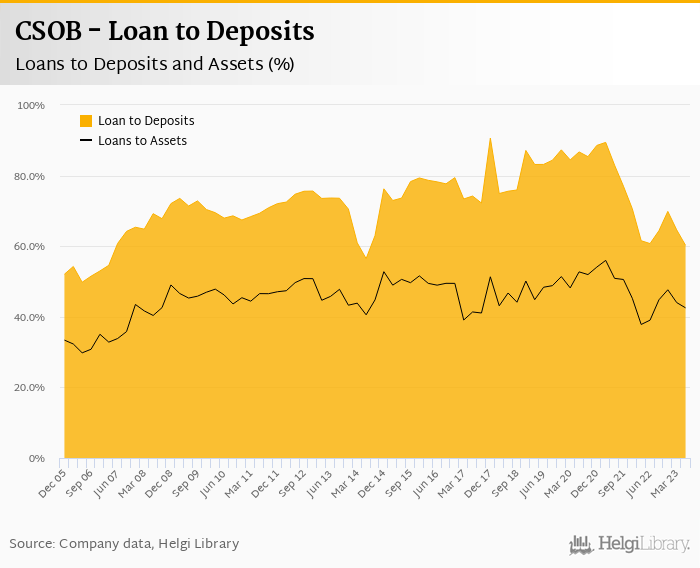

Weak loan demand and on-going market share losses are worth watching in the near future.

As seen below, strong fee income, hefty provision write-backs and lower effective tax rate were helping profits up when compared to last year. On the other hand, lower interest margin, weaker trading income and inflationary pressure on the cost side were playing against the Bank last quarter:

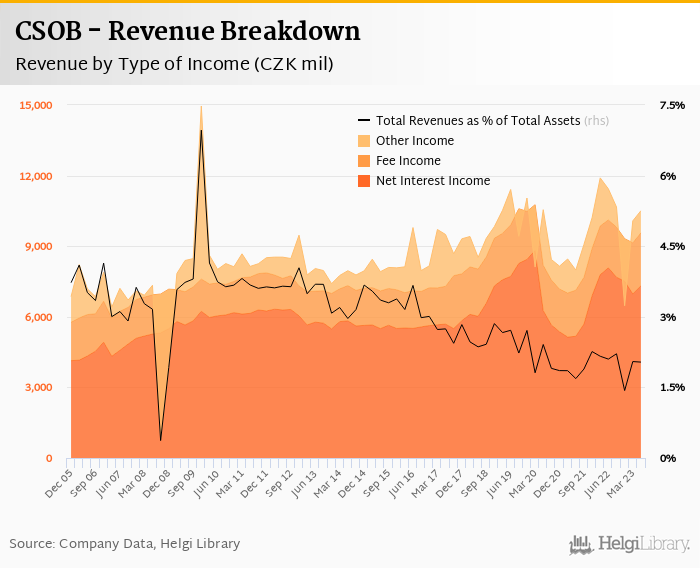

Revenues decreased 8.1% yoy to CZK 10,509 mil in the second quarter. Net interest income fell 9.5% yoy as net interest margin decreased further 3 bp to 1.45% of total assets. Fee income grew strong 10.6% yoy thanks to acquisition of Ukrainian customers, FX transactions and fees from asset management:

Average asset yield was 6.23% in the second quarter of 2023 (up from 4.72% a year ago) while cost of funding amounted to 5.05% in 2Q2023 (up from 3.42%). More importantly, net interest income grew 4.9% qoq and cost of funding dropped 40 bp last quarter, so the pressure seems to be gradually abating:

Costs appeared to be under good control given the general wage and inflationary pressures. They increased by 6.7% yoy and the bank operated with average cost to income of 49.2% in the last quarter. Staff cost rose 7.1% as the bank employed 8,053 persons and paid CZK 106,420 per person per month including social and health care insurance cost:

Demand for lending remains weak and CSOB's customer loans grew 1.3% qoq and 3.2% yoy in the second quarter of 2023 and customer deposits continue to grow faster (8.7% qoq and 4.1% yoy). At the end of second quarter of 2023, CSOB's loans accounted for 60.2% of total deposits and 42.5% of total assets.

Assets under management grow even faster than deposits, up 19% to CZK 340 bil, or 23% of bank's deposits at the end of June 2023:

Retail loans grew 0.61% qoq and were only 2.7% up compared to last year accounting for 63% of the loan book. Corporate loans increased 2.4% qoq and 1.6% yoy, respectively. Mortgages represented 58.4% of the CSOB's loan book, consumer loans added a further 4.38% and corporate loans formed 38.7% of total loans:

We estimate that CSOB has lost 0.616 pp market share in the last twelve months in terms of loans (holding 20.9% of the market at the end of 2Q2023). The Bank seems to be losing share in most of the loan categories, something to watch for in the future. On the funding side, the bank seems to have lost 0.750 pp and held 21.3% of the deposit market:

The Bank wrote back CZK 1.26 bil in the second quarter due to recoveries in the corporate and SME segments. On the other hand, provisions were created towards retail. As a result, CSOB's non-performing loans reached 1.52% of total loans, down from 1.90% when compared to the previous year. Provisions covered some 45.8% of NPLs at the end of the second quarter of 2023, down from 46.7% for the previous year:

CSOB's capital adequacy ratio reached 20.3% in the second quarter of 2023, up from 18.2% for the previous year. The Tier 1 ratio amounted to 20.1% at the end of the second quarter of 2023 while bank equity accounted for 12.1% of loans:

Overall, CSOB made a net profit of CZK 5,847 mil in the second quarter of 2023, up 6.85% yoy. This means an annualized return on equity of 22.1%, or 21.7% when equity "adjusted" to 15% of risk-weighted assets:

Strong profitability on the back of provision write-backs and lower effective tax rate, though stabilisation of interest margin, strong fee income and good cost control are worth watching in the coming quarters.