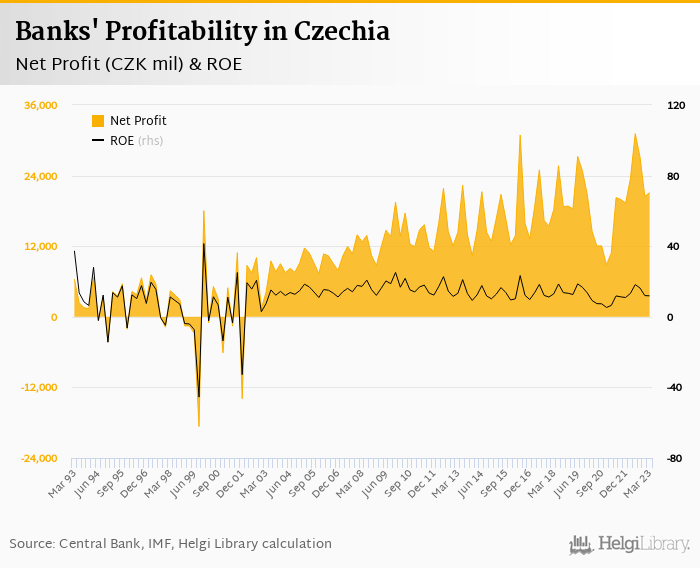

Czech banks decreased net profit 10.1% yoy to CZK 21,116 mil in the first quarter of 2023 and generated ROE of 11.9%.

Operating income fell 5.78%, cost to income increased to 36.7% and banks' share of bad loans fell to 1.90%.

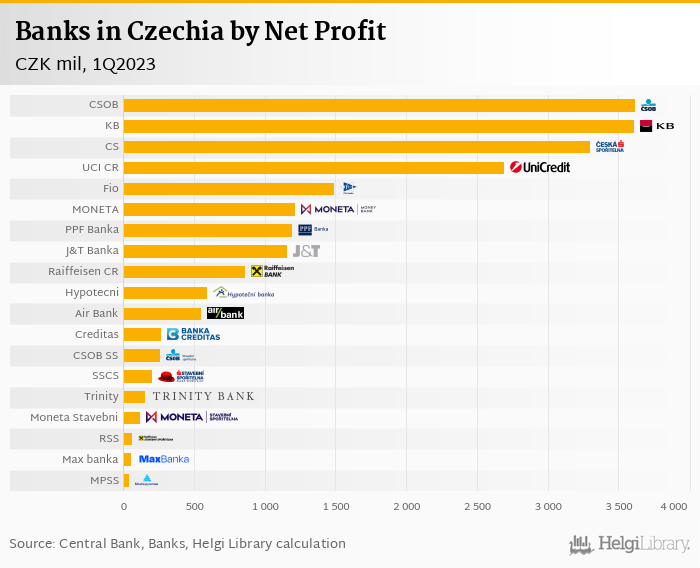

CSOB generated the biggest profit while Modra Pyramida Stavebni Sporitelna produced the smallest one.

Czech banks reported a net profit of CZK 21,116 mil in the first quarter of 2023, down 10.1% when compared to previous year. This implies ROE of 11.9% in 1Q2023. In the last twelve months, profits rose 20.3% yoy to CZK 99,877 mil and ROE reached 14.5%.

CSOB generated the largest net profit in the last quarter (CZK 3,617 mil) followed by Komercni Banka and Ceska Sporitelna. At the other end of the scale was Modra Pyramida Stavebni Sporitelna with a reported profit of CZK 41.9 mil:

Revenues decreased 5.78% yoy to CZK 55,788 mil in the first quarter of 2023:

| 1Q2022 | 1Q2023 | Change | 1-3/2022 | 1-3/2023 | Change | |

| Revenues | 59,211 | 55,788 | -5.78% | 59,211 | 55,788 | -5.78% |

| Net Interest Income | 41,832 | 40,258 | -3.76% | 41,832 | 40,258 | -3.76% |

| Net Fee Income | 9,876 | 9,730 | -1.48% | 9,876 | 9,730 | -1.48% |

| Other Income | 49,335 | 46,058 | -6.64% | 49,335 | 46,058 | -6.64% |

| Costs | 19,374 | 20,492 | 5.77% | 19,374 | 20,492 | 5.77% |

| Staff Cost | 11,239 | 12,200 | 8.55% | 11,239 | 12,200 | 8.55% |

| Operating Profit | 36,363 | 31,763 | -12.6% | 36,363 | 31,763 | -12.6% |

| Cost of Risk | 0.164% | 0.039% | -0.125 pp | 1,592% | 398% | -1,195 pp |

| Pre-Tax Profit | 28,470 | 26,008 | -8.65% | 28,470 | 26,008 | -8.65% |

| Net Profit Bank | 23,477 | 21,116 | -10.1% | 23,477 | 21,116 | -10.1% |

| ROE | 13.3% | 11.9% | -1.41 pp | 13.2% | 11.8% | -1.42 pp |

| NIM | 1.86% | 1.73% | -0.133 pp | 1.77% | 1.65% | -0.115 pp |

| Cost To Income | 32.7% | 36.7% | 4.01 pp | 32.7% | 36.7% | 4.01 pp |

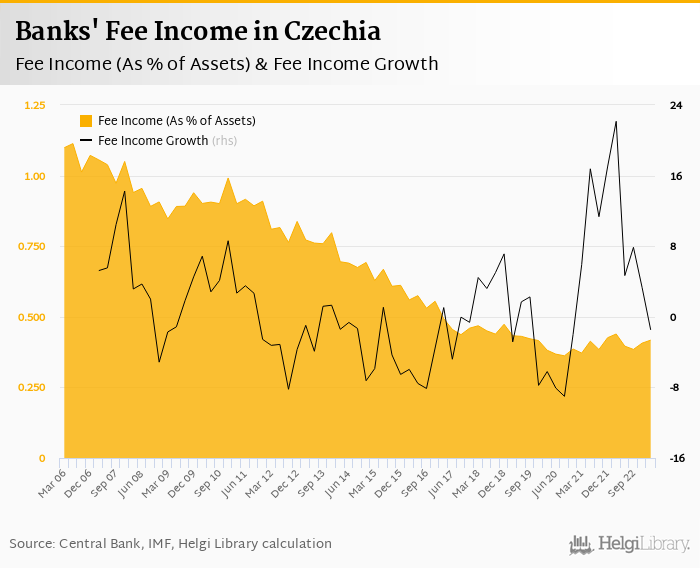

Net interest margin decreasing 0.133 pp to 1.73% as asset yield grew by 1.87 bp to 5.59% and cost of funding increased by 2.16 bp to 4.18%. Fees added 17.4% to total revenues and decreased by 1.48% when compared to last year:

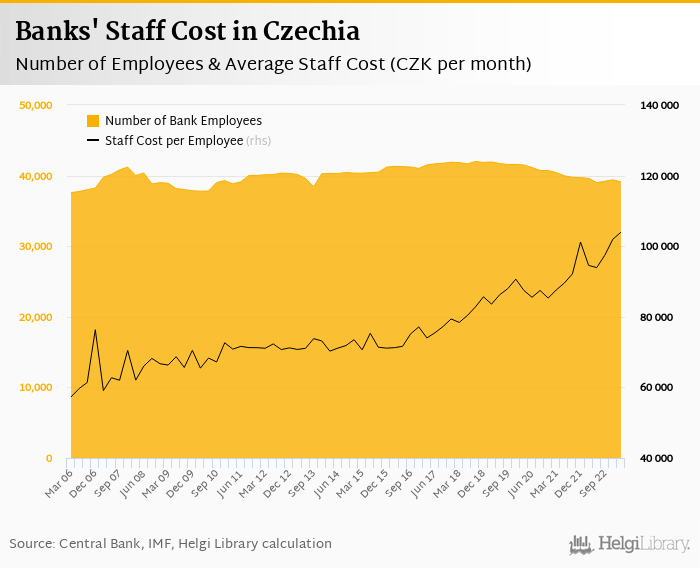

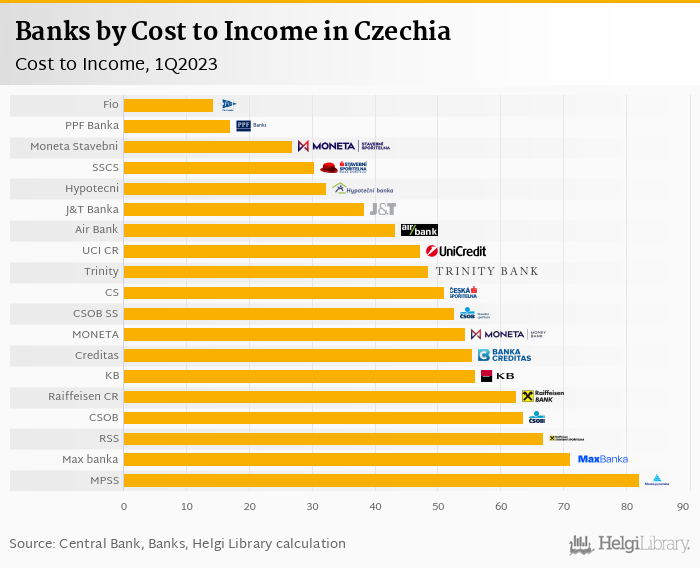

Banks operated with average cost to income of 36.7% in the last quarter as operating costs rose 5.77% yoy. Staff accounted for 59.5% of operating expenditure with a total of 39,115 employees in the sector. Banks paid their staff 9.93% more than last year with the average monthly cost of CZK 103,965 per person:

While Fio banka was the most cost efficient based on the cost to income ratio in the first quarter of 2023 (with 14.4%), Hypotecni Banka operated with the lowest operating costs when compared to a sum of loans and deposits, i.e. when utilization of both assets as well as liabilities is taken into account (0.359%):

Commercial banks generated operating profit before provisioning of CZK 31,763 mil in the first quarter of 2023, down 12.6% when compared to last year. Ceska Sporitelna generated the largest operating profit in the first quarter of 2023 (CZK 5,652 mil), whilst Fio banka was operating with the highest operating margin when compared with risk weighted assets (17.3%):

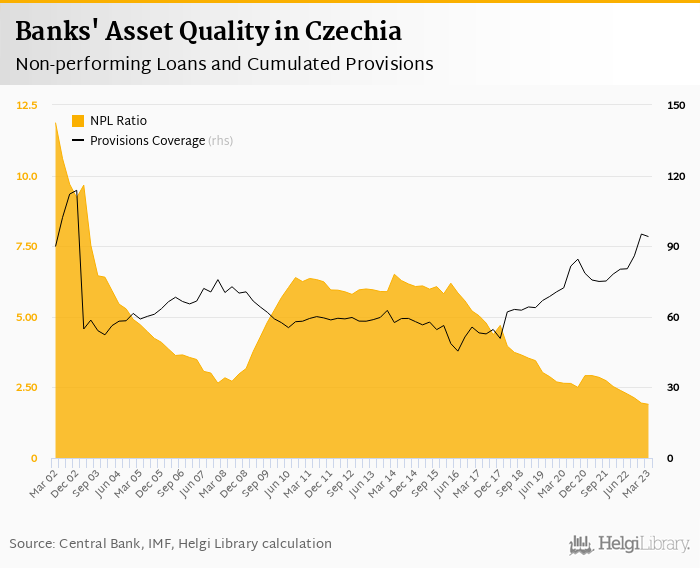

Provisions have "eaten" some 1.25% of operating profit in the first quarter of 2023 as cost of risk reached 0.039% of average loans. The volume of non-performing loans decreased by 11.8% qoq to CZK 78.3 bil and represented 1.90% of total loans at the end of March. Provisions covered 94.1% of NPLs, up from 80.2% a year ago:

Within the sector, PPF Banka had to create the most provisions in the first quarter of 2023 relative to its loans (1.07%) and J&T Banka the least (-1.18%). In terms of overall asset quality, we estimate that Fio banka was operating with the highest share of non-performing loans, some 9.25% of customer loans at the end of March:

The three largest banks created 49.9% of sector's total profit in the first quarter of 2023, down when compared to 55.3% seen three years ago. In terms of revenue and operating profit, the trio generated 54.8% and 41.8% of the total:

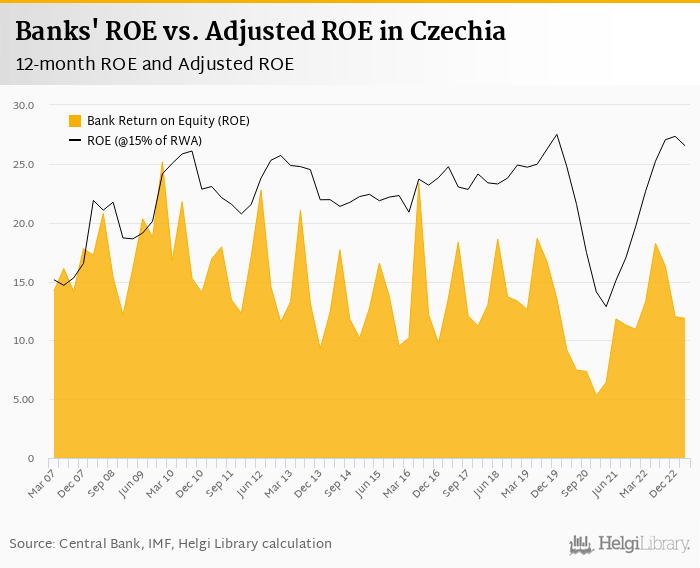

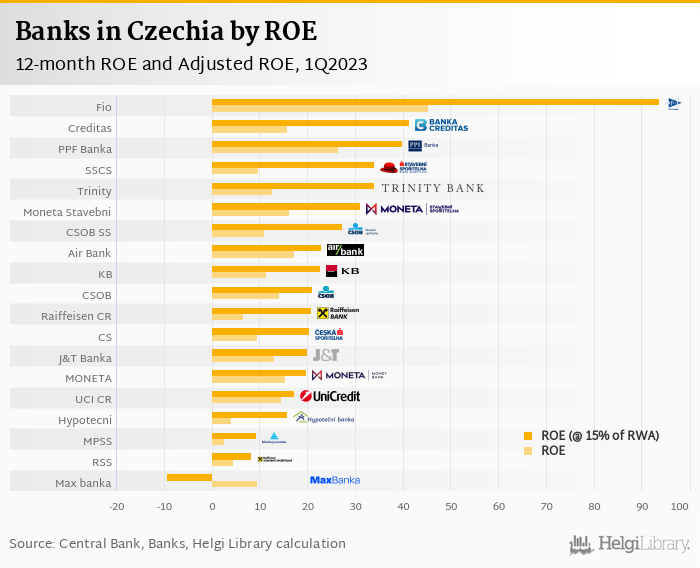

Overall, Czech banks generated its shareholders an annualized return on equity of 11.9% in the first quarter of 2023 and 14.5% return in the last four quarters. When equity "adjusted" to 15% of risk-weighted assets, the return on equity would have reached 22.4% in 1Q2023 and 26.7% in the last twelve months.

Fio banka generated its shareholders the highest return in the last quarter (ROE of 45.4%) followed by PPF Banka (26.5%) and Air Bank (17.3%). When adjusted for the same level of equity (i.e. 15% of RWA), Fio banka, Banka Creditas and PPF Banka would have made it to the top of the list:

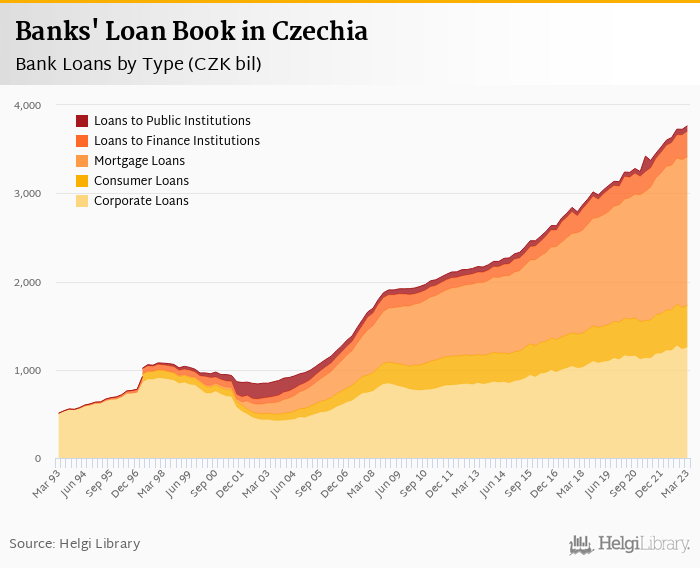

Loans increased by 1.11% qoq to CZK 4,117 bil during the first quarter of 2023. This implies an annual growth rate of 4.88% in the last 12 months:

Mortgage loans grew 3.45% yoy in the last 12 months and were up 0.669% qoq in the last quarter. At the end of March, mortgages formed 40.9% of total loans. Consumer loans increased 0.815% qoq (up 4.10% yoy) and represented 11.5% of total bank loans while corporate loans grew 1.63% qoq and were up 2.85% yoy to CZK 1,257 bil (or 30.5% of loans).

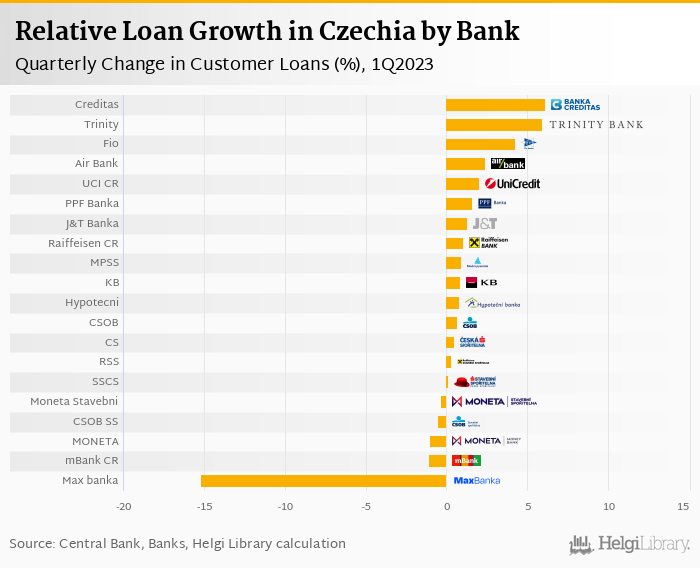

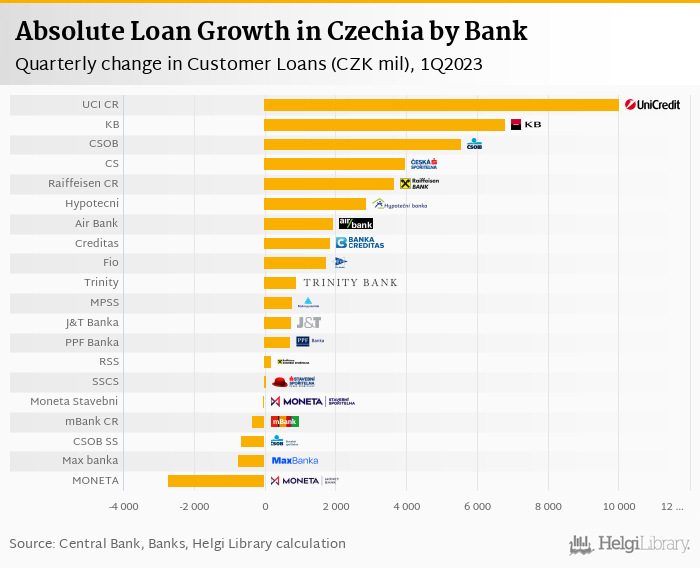

Banka Creditas has grown the fastest in relative terms within the last quarter (6.10%% qoq), followed by Trinity Bank and Fio banka. In absolute terms, however, UniCredit Bank Czecho-Slovakia the largest piece of the pie when compared to the previous quarter (CZK 10,020 mil or 22.1% of the market net increase) followed by Komercni Banka and CSOB:

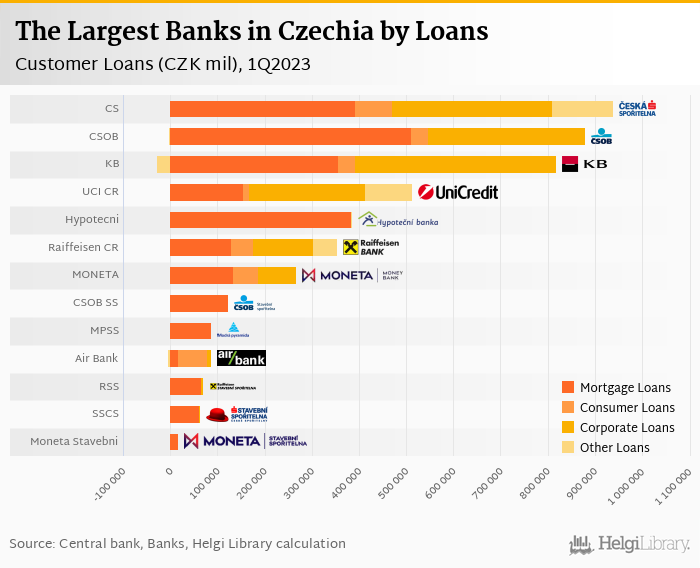

Overall, Ceska Sporitelna remains the largest lender with 22.0% of the market followed by CSOB with a 21.0% market share and Komercni Banka (19.1%). At the end of March 2023, most of Ceska Sporitelna's loans came from residential mortgages (43.4% of total). Corporate loans formed 37.6% and consumer loans represented a further 8.57% of the total loan book:

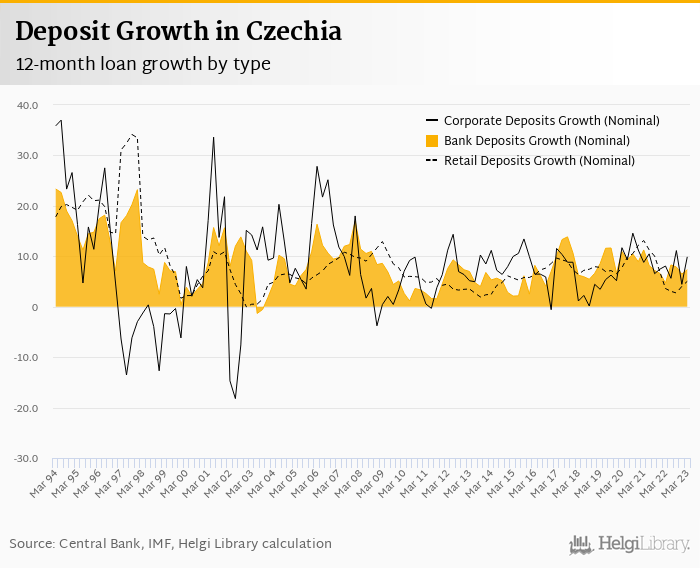

Customer deposits increased 13.1% qoq to CZK 6,625 bil during the first quarter of 2023. This means an annual growth rate of 7.34%, which is below the average growth of 7.44% we have seen in deposits in the last decade:

As partly seen above, households deposits grew 1.48% qoq and 5.03% yoy in the last 12 months and represented 52.0% of total customer deposits at the end of March 2023. Corporate deposits increased by 7.26% qoq (or 9.89% yoy) and made up 22.1% of total.

Max banka appears to have grown the fastest in deposits in relative terms last quarter compared to the next bunch of Czech banks (452% qoq), followed by Banka Creditas and PPF Banka. In absolute terms, when compared to the previous quarter, however, most new deposits went to UniCredit Bank Czecho-Slovakia (CZK 255,611 mil) followed by Ceska Sporitelna and Komercni Banka:

Overall, Ceska Sporitelna is the largest deposit collector with a 20.6% market share followed by CSOB (20.2%) and Komercni Banka (16.3%):

At the end of March 2023, customer deposits in Czechia reached 88.0% of GDP, up from 84.5% seen a decade ago. Loan to deposit ratio accounted for 62.1% in Czechia at the end of first quarter of 2023, down from 63.6% a year ago and 74.5% in 2013. When comparing only household loans and deposits, the ratio was 62.6% at the end of March 2023:

Czech banks operated with capital adequacy ratio of 22.5% at the end of the first quarter of 2023, up 0.158 bp when compared to the same period of last year. Sector's Tier 1 ratio reached 21.8% and equity accounted for 17.5% of loans. This is up 3.66 bp and down 0.404 bp when compared to five years ago.

Hypotecni Banka reported the highest capital adequacy ratio (51.7%) followed by Fio banka (34.5%) and Max banka. Moneta Stavebni Sporitelna and Raiffeisen Stavebni Sporitelna managed to operate with relatively low capital ratios of 15.1% and 16.0%, respectively:

Fio banka achieved the highest ROE in the last three years (35.2%) followed by Moneta Stavebni Sporitelna (22.3%) and Air Bank (16.9%). When adjusted to the same level of capital (15% of risk-weighted assets), Fio banka would be the most profitable with a ROE of 93.6% in the last twelve months:

To see more details, please, download the pdf report for free.

If you are interested in data used in this report, you can find and download all the specific indicators in excel format in the statistical dossier: Data on Banking Sector in Czechia.

All corporate data for the banks mentioned in the report could be found and downloaded here: Comparison of 20 Companies within Czech Banks.