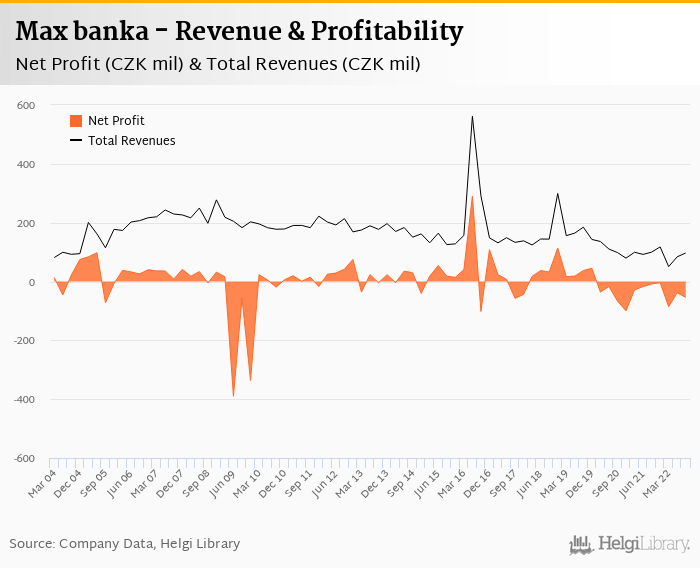

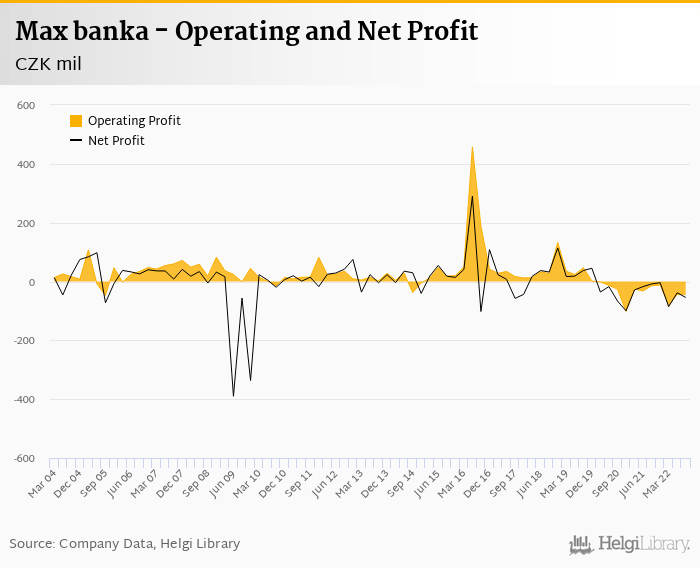

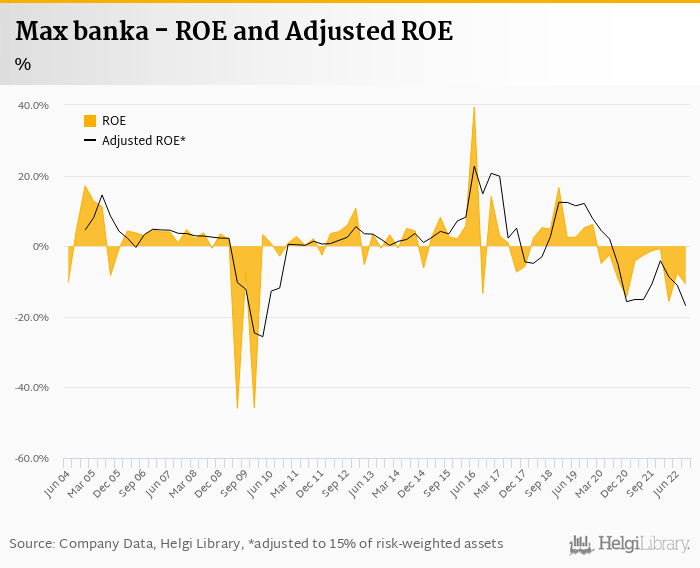

Max banka increased its net loss to CZK 54.2 mil in 3Q2022 and generated a negative ROE of 10.8%.

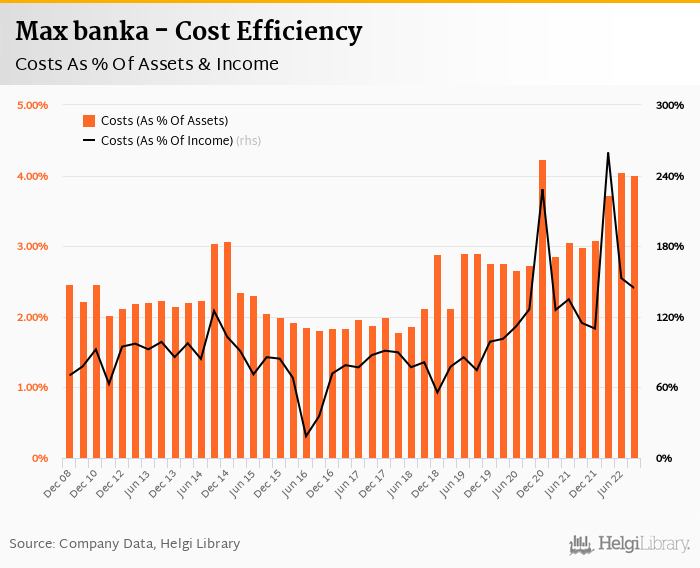

Revenues decreased 2.9% yoy and cost rose 22.1%, so cost to income increased to 144%

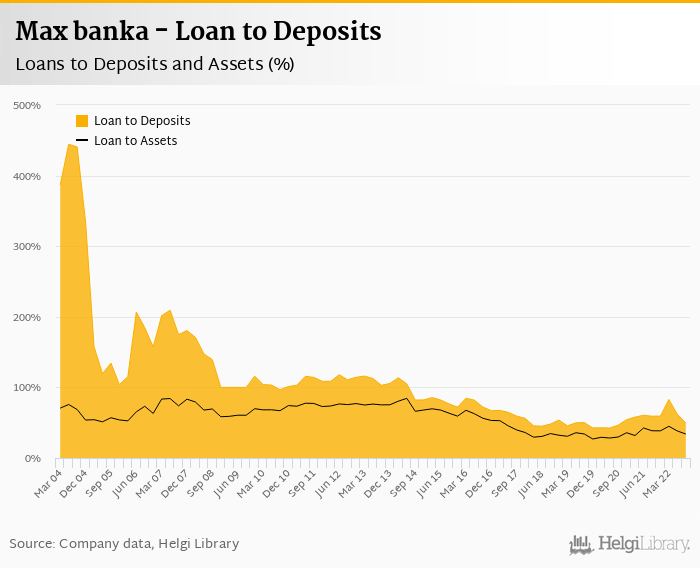

Cost of risk increased to 0.983% and loan to deposit ratio decreased to 49.4%

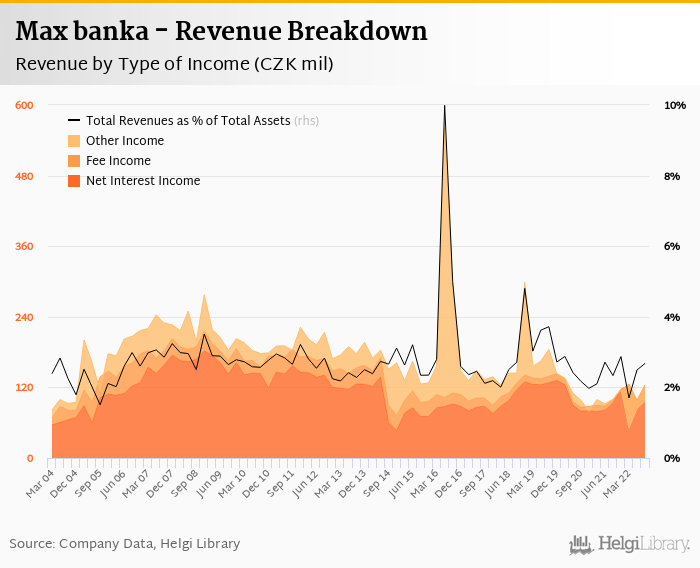

Revenues decreased 2.93% yoy to CZK 96.9 mil in the third quarter of 2022. Although net interest income rose 30.8% yoy supported by rising net interest margin (up 1.06 pp to 3.51% of total assets), net trading loss of CZK 27.4 mil offset all the positives from rising interest rates. When compared to three years ago, revenues were down 47.5%:

Average asset yield was 6.10% in the third quarter of 2022 (up from 2.85% a year ago) while cost of funding amounted to 3.02% in 3Q2022 (up from 0.494%).

Costs increased by 22.1% yoy driven by personnel cost and the bank operated with average cost to income of 144% in the last quarter. Staff cost rose 27.3% as the bank employed 187 persons (down 2.95% yoy) and paid relatively high cost of CZK 153,101 per person per month when social and health care insurance cost is included:

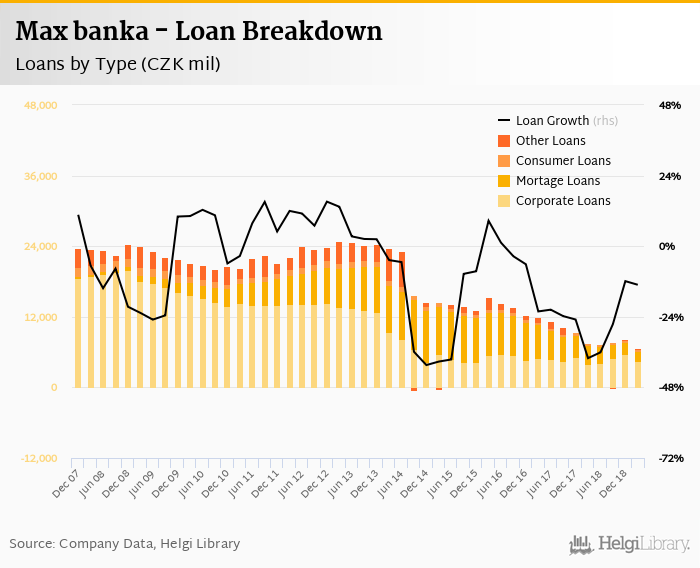

Max banka's customer loans continued to shrink and decreased 4.73% qoq and 25.4% yoy in the third quarter of 2022. On the other hand, customer deposit jumped 19.6% during the quarter, but were still 10.7% down when compared to last year. That’s compared to average of -6.34% and -13.8% average annual growth seen in the last three years.

At the end of third quarter of 2022, Max banka's loans accounted for 49.4% of total deposits and 34.0% of total assets.

Retail loans fell 5.60% qoq and were 21.2% down yoy. They accounted for 18.4% of the loan book at the end of the third quarter of 2022 while corporate loans decreased 5.19% qoq and -21.4% yoy, respectively:

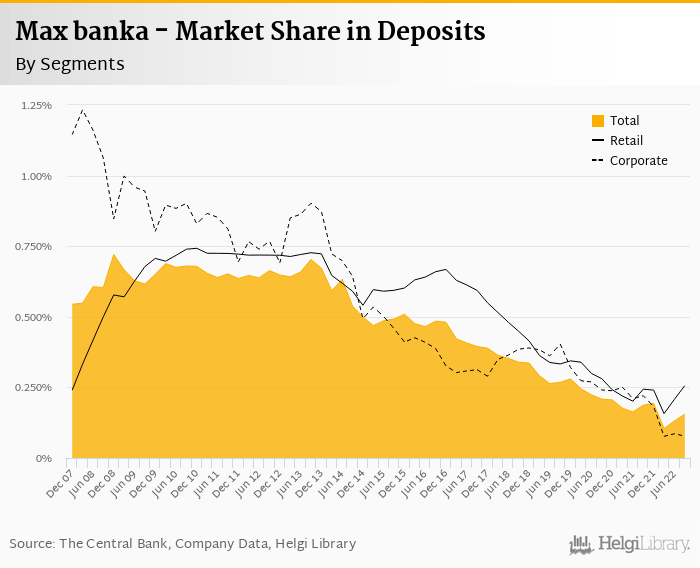

We estimate that Max banka has lost 0.053 pp market share in the last twelve months in terms of loans (holding 0.121% of the market at the end of 3Q2022). On the funding side, the bank seems to have lost 0.032 pp and held 0.155% of the deposit market:

Cost of risk reached 0.983% of average loans provisions have "eaten" some 12.8% of operating revenues in the third quarter of 2022 as cost of risk reached 0.983% of average loans:

We estimate Max banka's non-performing loans reached 7.0-8.0% of total loans, up from 5.68% when compared to the previous year. Provisions might be covering some 40% of NPLs on our estimates, down from 48.2% for the previous year:

Without providing much details, we estimate Max banka's capital adequacy ratio reached approximately 29% in the third quarter of 2022, up from 24.8% for the previous year. The Tier 1 ratio should be the same as CAR while bank equity accounted for 40.9% of loans:

Overall, Max banka made a net loss of CZK 54.2 mil in the third quarter of 2022 and the Bank was loss-making on the operating level as well. This means an annualized return on equity of -10.8%, or -16.9% when equity "adjusted" to 15% of risk-weighted assets:

Year 2022 is a year of a clean up following the takeover of the Bank by Creditas Group. While loan portfolio continues to shrink and additional trading losses are booked, increased personel cost suggests operational restructuring has also started. Watch for details of asset quality, potential restructuring reserve and capital structure when full year results are released.