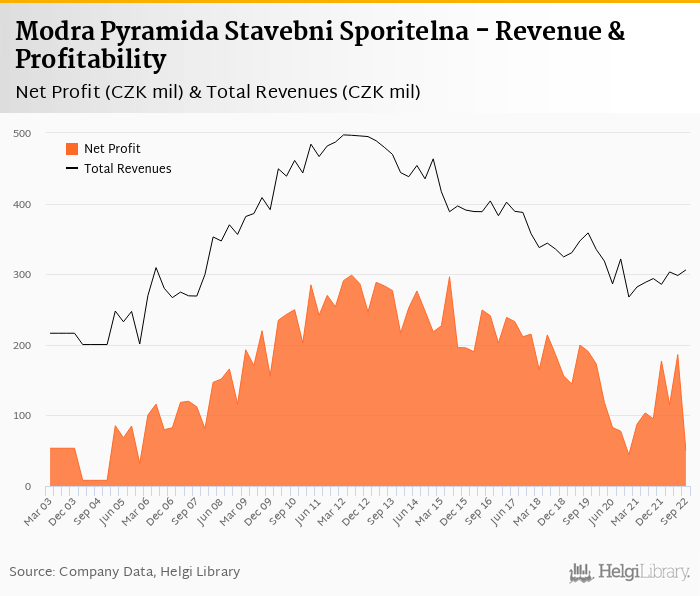

Modra Pyramida decreased its net profit 48% to CZK 49.5 mil in 3Q22 and generated ROE of 3.0%.

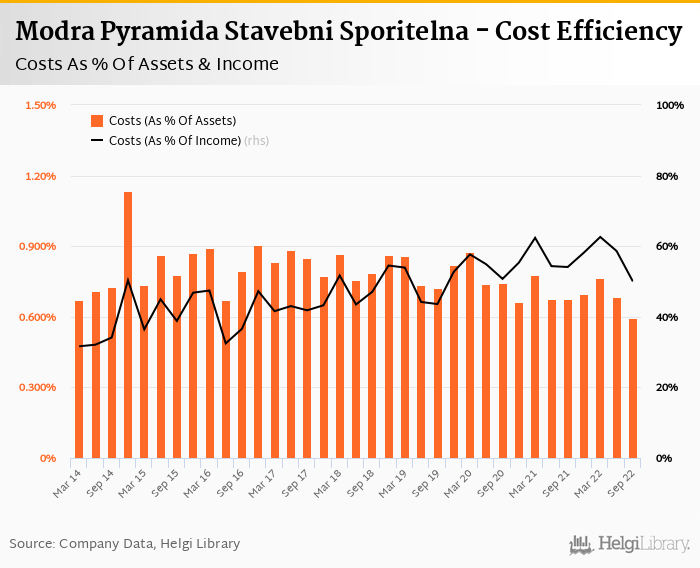

Revenues increased 4.18% yoy and cost fell 3.67%, so cost to income decreased to 50.0%

Cost of risk amounted 0.46% and loan to deposit ratio increased to 150%

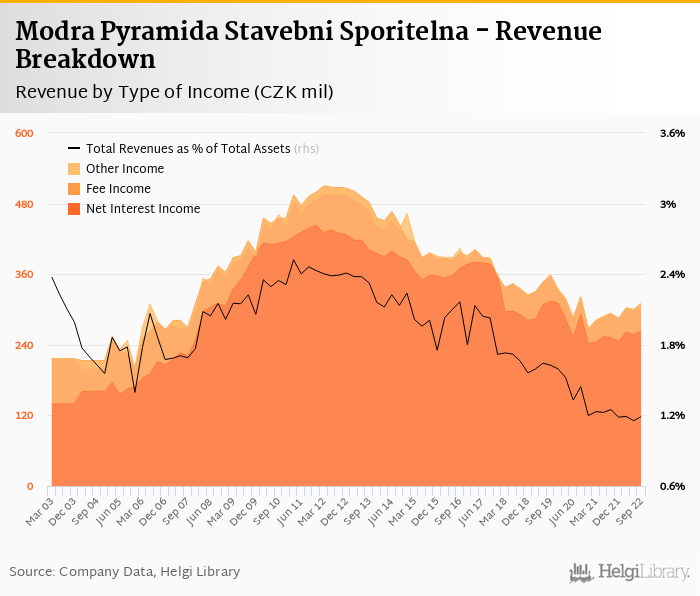

Revenues increased 4.2% yoy to CZK 306 mil in the third quarter of 2022. Net interest income rose 4.3% yoy in spite of net interest margin decreasing 0.051 pp to 1.02% of total assets. Fee income grew 14.5% yoy and added a further 15.3% to total revenue. When compared to three years ago, revenues were down 14.6%:

Average asset yield was 4.03% in the third quarter of 2022 (up from 2.57% a year ago) while cost of funding amounted to 3.21% in 3Q2022 (up from 1.60%).

Costs decreased by 3.67% yoy and the bank operated with cost to income of 50.0% in the last quarter. Staff cost rose 4.68% as the bank employed 356 persons (up 9.54% yoy) and the Bank paid CZK 82,169 per person per month in staff cost:

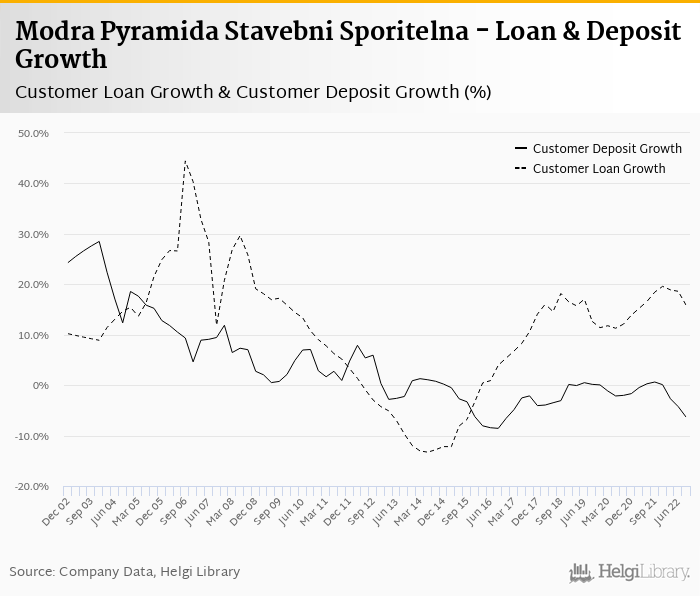

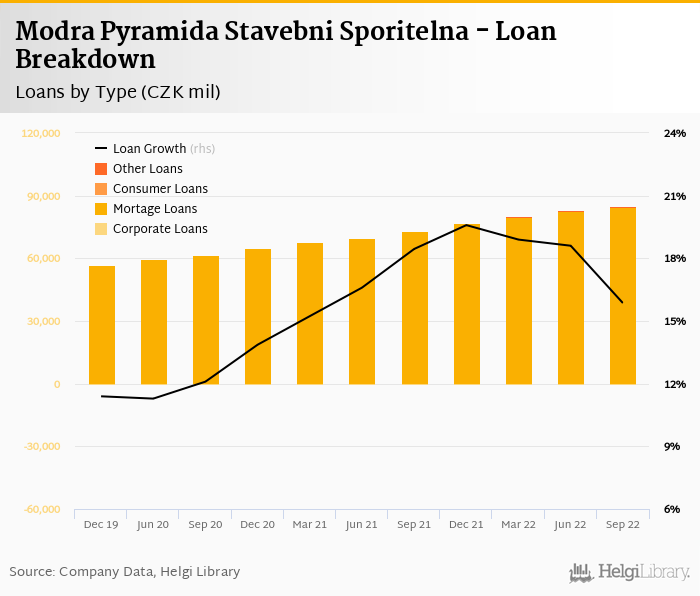

Customer loans grew relatively strong 2.59% qoq and 15.9% yoy in the third quarter of 2022 while customer deposit fell 2.36% qoq and 6.33% yoy. That’s compared to average of 15.3% and -1.65% average annual growth seen in the last three years.

At the end of third quarter of 2022, Modra Pyramida Stavebni Sporitelna's loans accounted for 150% of total deposits and 82.4% of total assets.

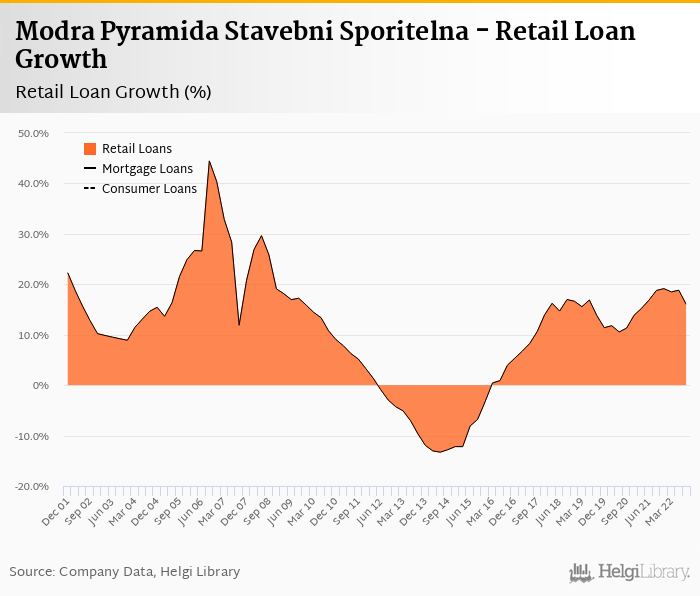

Retail loans grew 2.62% qoq and were 16.0% up yoy. They accounted for 99.7% of the loan book at the end of the third quarter of 2022 while corporate loans decreased 5.62% qoq and -18.5% yoy, respectively. Mortgages represented 99.7% of the Modra Pyramida Stavebni Sporitelna's loan book, consumer loans added a further 0% and corporate loans formed 0.293% of total loans:

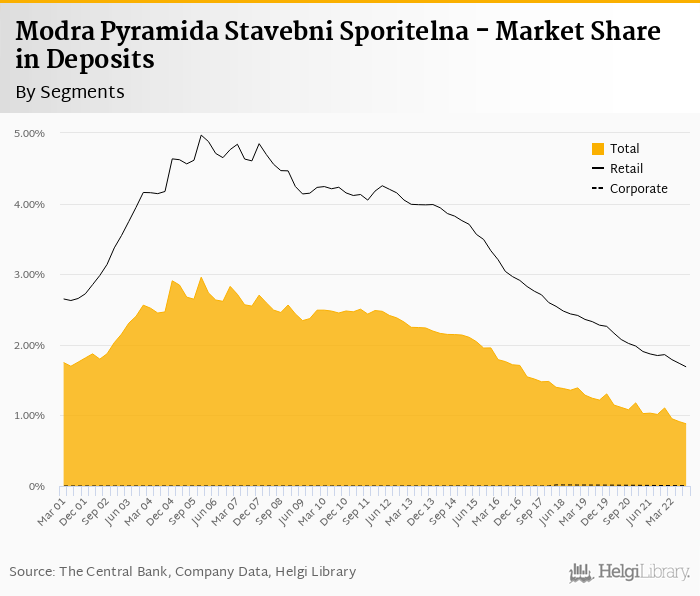

We estimate that Modra Pyramida Stavebni Sporitelna has gained 0.149 pp market share in the last twelve months in terms of loans (holding 2.09% of the market at the end of 3Q2022). On the funding side, the bank seems to have lost 0.133 pp and held 0.880% of the deposit market:

Cost of risk reached 0.462% of average loans as the Bank set aside CZK 96.6 mil in provisons. Provisions have "eaten" some 63.2% of operating profit in the third quarter of 2022, which is a high number. Full-year numbers might show more details if loan portfolio deterioration or debt securities revaluation are to blame.

We estimate that bank's NPL ratio of amounted to around 1.5% and some 40% of that was covered by provisions at the end of September:

We estimate that Modra Pyramida Stavebni Sporitelna's capital adequacy ratio reached approximately 20.0% in the third quarter of 2022 while bank equity accounted for 7.73% of loans:

Modra Pyramida Stavebni Sporitelna's net profit fell 48% yoy to CZK 49.5 mil in the third quarter of 2022, though operating profit grew solid 13.4% yoy. This means an annualized return on equity of 3.03%, or 12.9% when equity "adjusted" to 15% of risk-weighted assets:

Solid operating performance vs. significant increase in cost of risk, something to look at in the Bank's full-year results. Given the relatively high loan to deposit ratio and increased cost of funding, development in net interest margin will be interesting to watch in the near future.