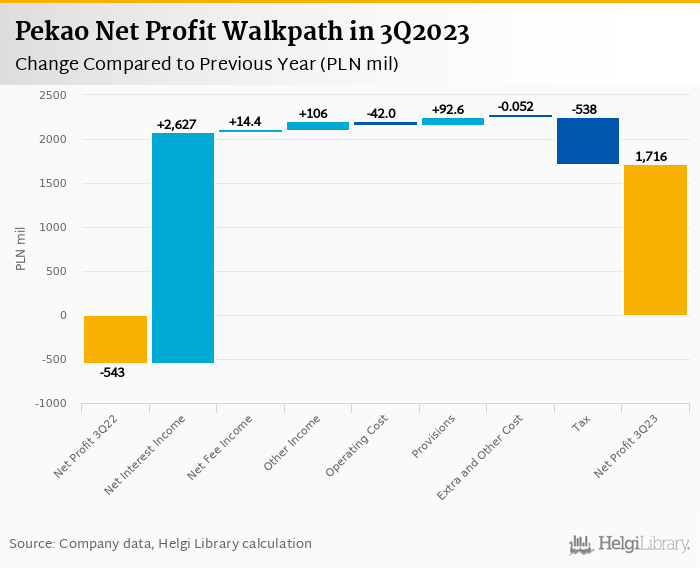

Pekao rose its net profit 4-fold to a record high of PLN 1.72 bil in 3Q2023 and generated ROE of 25.3%. When adjusted for one-offs, the profit was 10.8% higher.

Revenues increased 9.2% yoy when adjusted for credit moratoria and cost rose 16.2% when adjusted for contribution to the Bank Garantee Fund. Cost to income decreased to 37.0%

Asset quality remained good with NPLs at 5.88% and fully covered by provisions incl. its PLN 2.3 bil FX mortgages exposure

Strong results in 2Q2023 already expected by the market driven by strong and peaking interest margin and lower cost of risk. Trading at PE less than 8.0x and PBV of 1.1x with potential 10% dividend yield, Pekao stock looks attractive.

Pekao made a record net profit of PLN 1.72 bil in the third quarter of 2023, up 20% yoy when adjusted for credit moratoria last year. When adjusted further for lower contribution to the Bank Guarantee Fund, the pre-tax profit would have growth "only" some 11% yoy. Despite the impressive headline numbers, two thirds of the profit improvement came from the lower provisions (vs. last year) with the rest coming from better operating profitability (up 5.5% yoy) thanks mainly to higher interest margin and trading income. And, good numbers were widely expected:

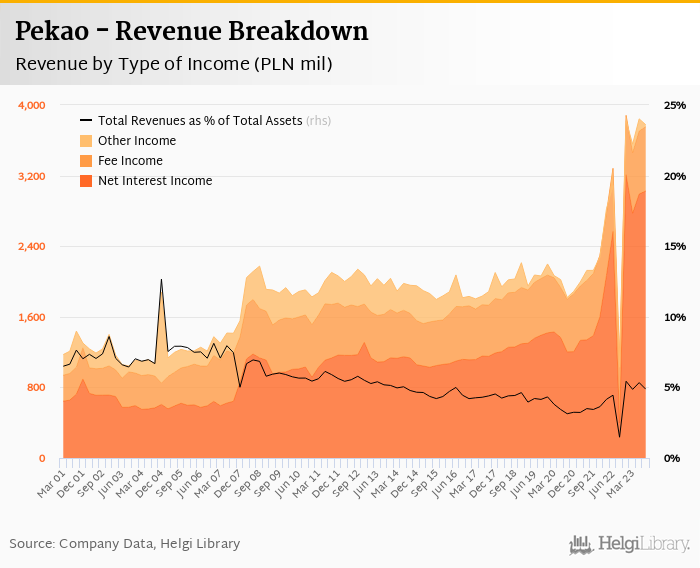

Revenues increased adjusted 9.2% yoy to PLN 3.78 bil in the third quarter of 2023 with net interest income generating more than 60% of the increase. Fee income grew 2.0% yoy with some signs of recovery and other/trading income added PLN 106 mil thanks mainly to absence of last year's losses. When compared to three years ago, revenues have more than doubled:

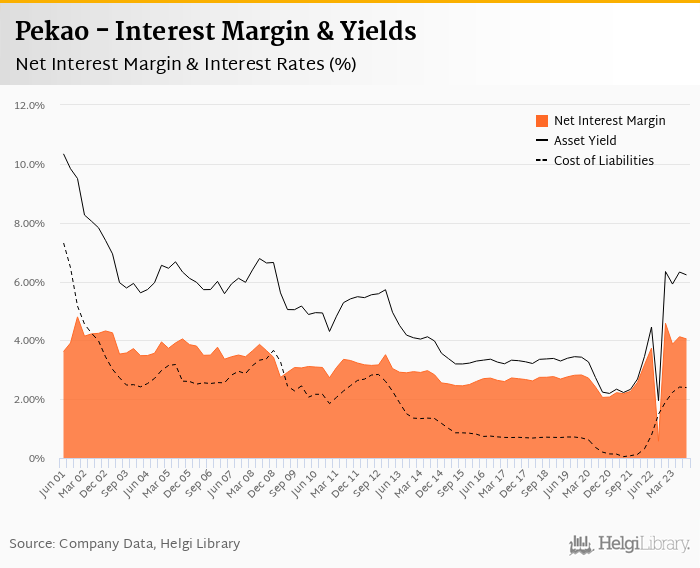

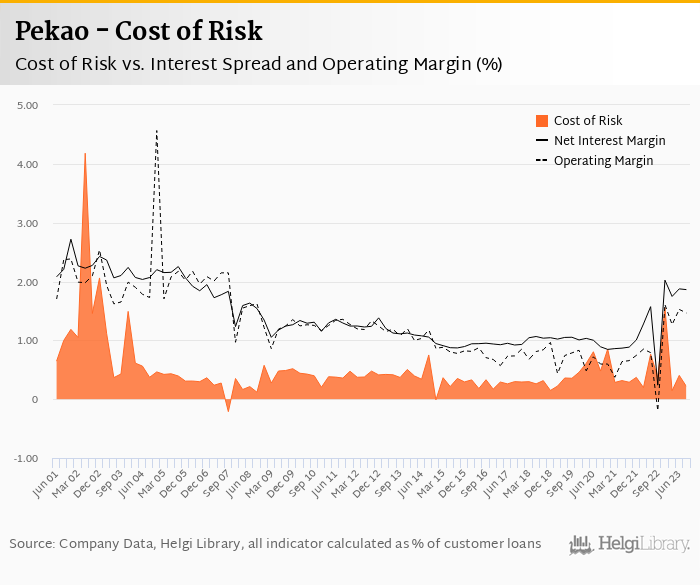

Net interest margin seems be peaking at over 4.0% and slight reduction of 7 bp in margins and spreads has been seen last quarter (NIM at 4.05%). Average asset yield was 6.22% in the third quarter of 2023 (with loan yield slightly down to 7.91%) while cost of funding remained stable at 2.39% in 3Q2023.

With current account still accounting 74% of total deposits (and average cost of deposits at only 2.15%), Pekao's customers do not seem to be chasing better priced term deposits aggressively, it seems:

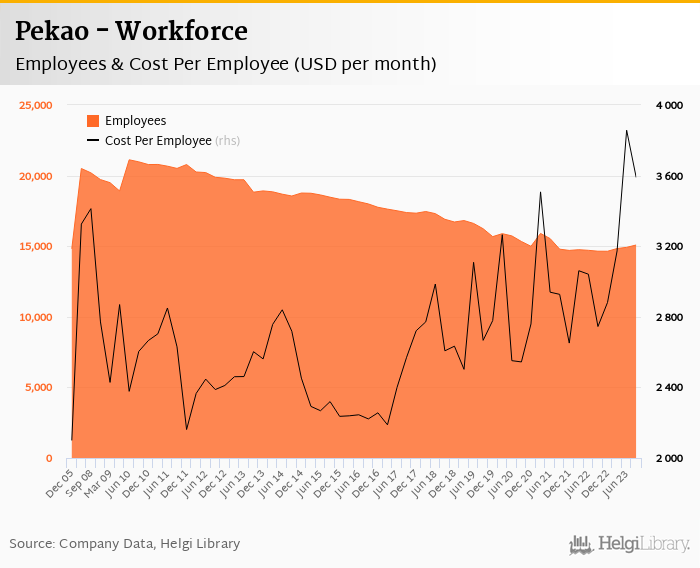

Costs increased by 3.1% yoy and the bank operated with average cost to income of 37.0% in the last quarter. When adjusted for lower to the contribution to the Bank Guarantee Fund last quarter, costs have increased by hefty 16.2% yoy.

This is clearly a result of wage adjustments (staff cost rose 21.0% yoy) and further increase in Bank's workforce (up 3.0% to 15,086 persons). On the other hand, the quarterly costs have stabilized at around PLN 1.4 bil in the last three quarters, so the pressure might naturally ease in the coming quarters:

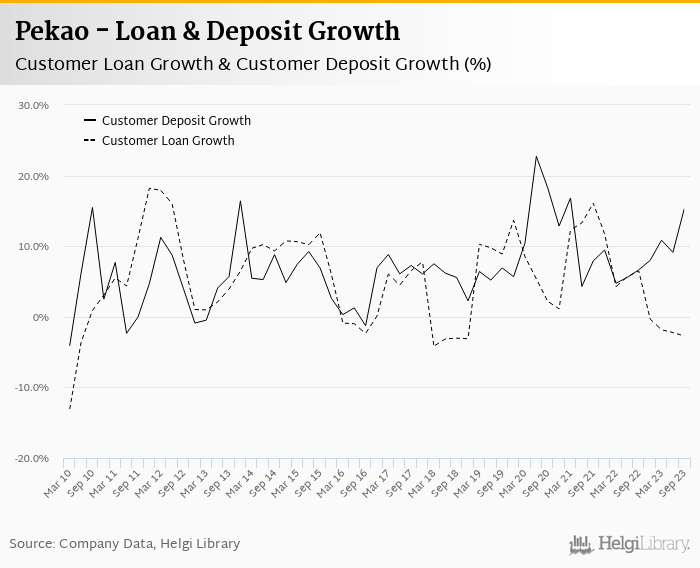

Demand for lending remains subdued in spite of a pick up in sales of new mortgages and cash loans. On the other hand, deposits increased strongly last quarter.

Customer loans grew 1.77% qoq and decreased 2.72% yoy in the third quarter of 2023 while customer deposit growth amounted to 8.81% qoq and 15.3% yoy.

At the end of third quarter of 2023, Pekao's loans accounted for 67.3% of total deposits and 52.4% of total assets.

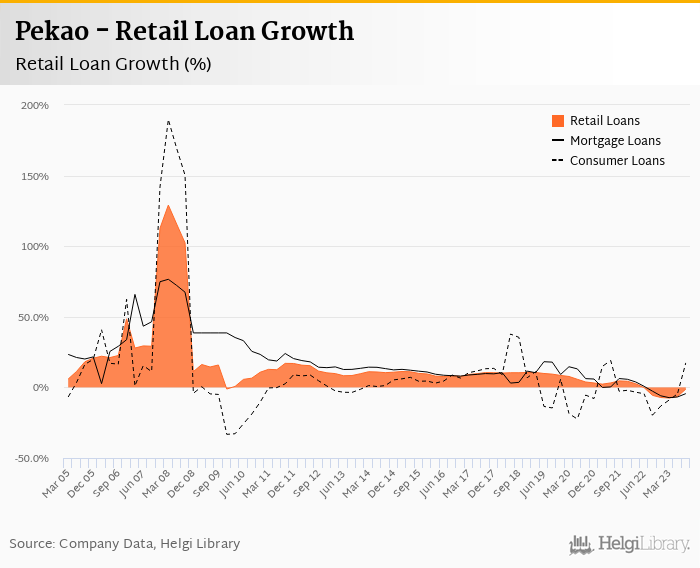

Retail loans grew 1.6% qoq (down 1.20% yoy) while corporate loans increased 2.0% qoq (down 4.2% yoy), respectively. Mortgages represented 39.0% of the Pekao's loan book, consumer loans added a further 8.28% and corporate loans formed 53.0% of total loans:

Asset quality remained stable with NPL ratio at 5.88% of total loans and provisions covering 102% of NPLs at the end of the third quarter of 2023. Also, Bank's relatively small PLN 2.3 bil exposure to FX mortgages remains fully covered with PLN 2.5 bil of specific provisions.

Pekao's capital adequacy ratio reached 17.3% in the third quarter of 2023, up from 16.8% for the previous year. The Tier 1 ratio amounted to 15.6% at the end of the third quarter of 2023 while bank equity accounted for 17.4% of loans:

Overall, Pekao made a net profit of PLN 1.72 bil in the third quarter of 2023, up 416% yoy or 11% when adjusted for credit moratoria and lower contribution to the Bank Guarantee Fund. This means an annualized return on equity of 25.3% in the last quarter or when the last four quarters are taken into account:

Although expected, another record quarterly profitability seen in the 3Q2023 driven heavily by strong interest margin, absence of last year's trading losses and relatively lower provisions. Good numbers on sale of new loans might suggest better times ahead, though development in net interest margin is something to watch closely.

Trading at PE of less than 8.0x and PBV of 1.1x expected in 2024 with potentially 10% dividend yield from 2023 profits, Pekao stock is attractively valued, especially, as fully covered FX mortgage portfolio suggests limited downside risks.