Raiffeisenbank Czech Republic decreased its net profit 35.2% to CZK 1.59 bil in 3Q2023 and generated ROE of 11.7%.

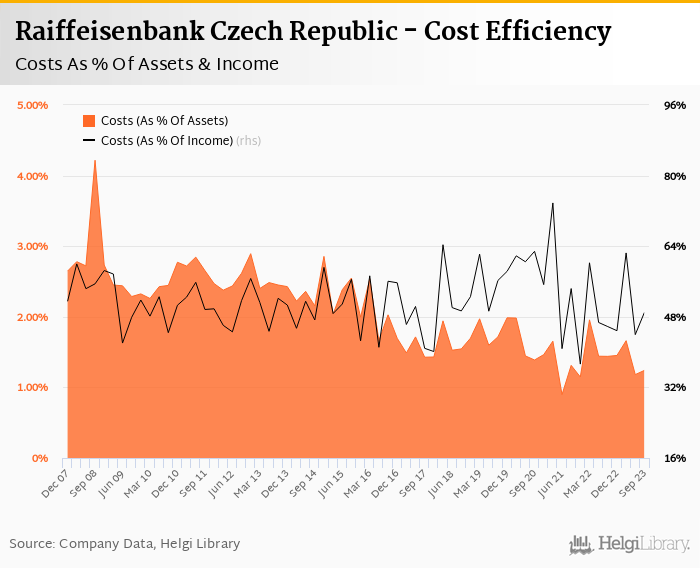

Operating profit fell 2.9% as revenues decreased 9.3% yoy and cost fell 2.9%. Cost to income increased to 49.0%

Cost of risk fell back to annualized 0.29%, a third of the level seen in the previous quarter.

The third quarter suggests a further stabilisation of interest margin, ongoing good cost control and stable asset quality. Good, but not good enough to fight off weak external environment.

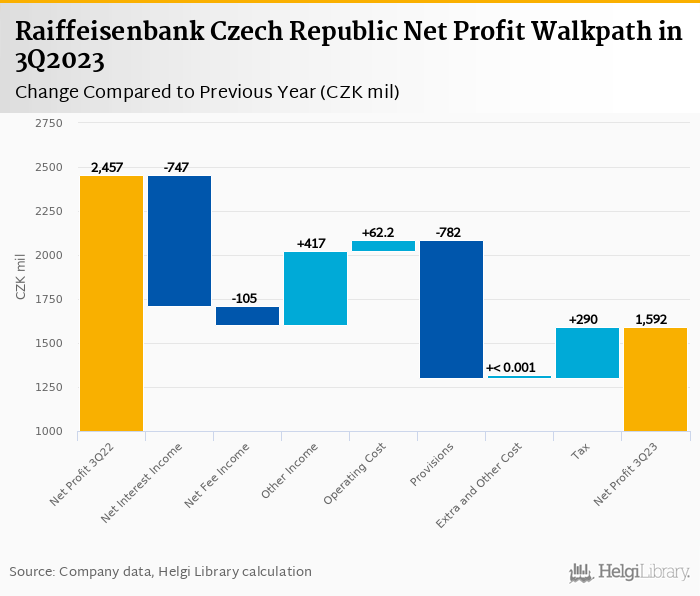

Raiffeisenbank Czech Republic made a net profit of CZK 1.59 bil in the third quarter of 2023, down 35.2% yoy, or decrease of CZK 864 mil in absolute terms. In spite of a solid general profitability (the 3Q2023 results are still some 30-50% higher on average when compared to 2019-2021), the pressure is clearly there. When looking at the difference to 2022 results, the main positives come from lower loss on trading income, good cost control and lower effective tax rate:

Revenues decreased 9.3% yoy to CZK 4.25 bil in the third quarter of 2023 with interest and fee income falling 18.2% and 10.2% yoy, respectively. On the positive side, interest margin seems to be stabilising, gross fees continue rising and absence of trading losses improved the other non-interest income by CZK 417 mil yoy:

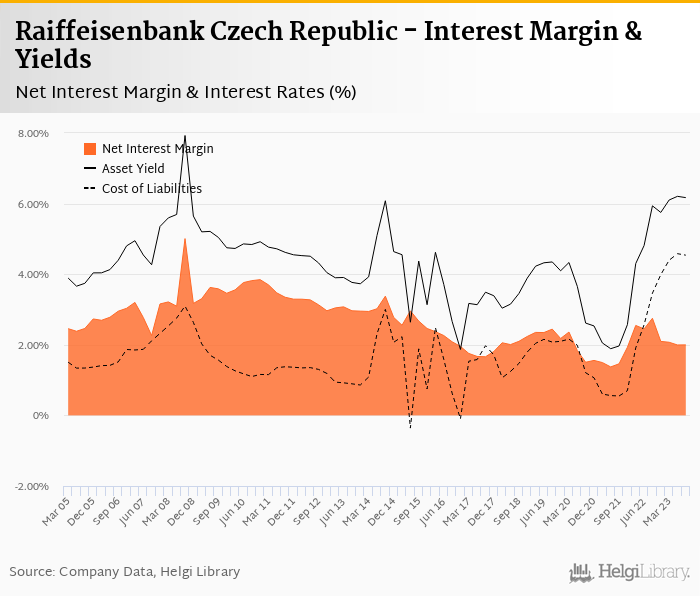

Net interest margin remained stable at around 2.00% when compared to last quarter as both, asset yield (6.17% in the third quarter of 2023) as well as cost of funding (at 4.54% in 3Q2023) fell some 4 bp when compared to previous quarter:

Ongoing good cost control is a second major piece of good news this quarter. Operating costs decreased by 2.90% yoy and the bank operated with average cost to income of 49.0% in the last quarter.

Staff cost rose only 1.54% (with personnel down 4-5% yoy on our estimates) while depreciation and other costs were down 10.8% and 3.4% yoy, respectively. These are impressive numbers fuelled by synergies from bank's recent acquisitions, we assume:

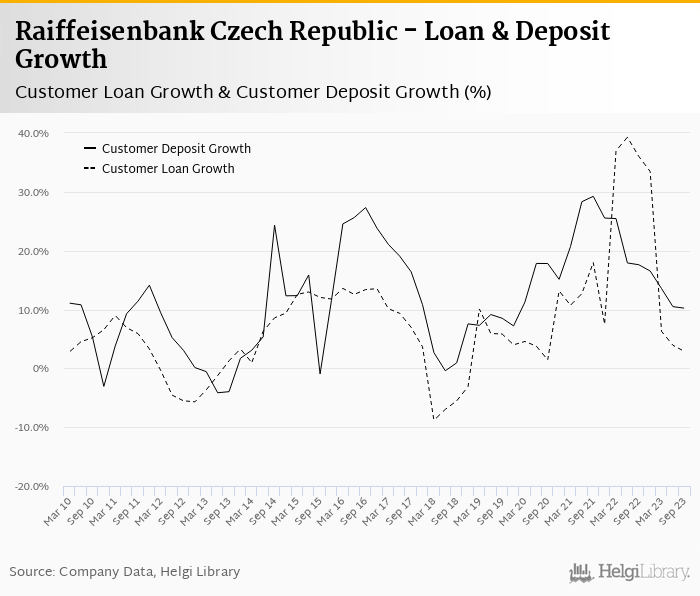

Similar to the overall trends, demand for lending remains weak. Raiffeisenbank Czech Republic's customer loans grew 1.54% qoq and 2.89% yoy in the third quarter of 2023 while customer deposit growth amounted to 1.46% qoq and 10.2% yoy.

At the end of third quarter of 2023, Raiffeisenbank Czech Republic's loans accounted for only 66.5% of total deposits and 53.2% of total assets.

Retail loans grew 0.41% qoq and were 2.91% up yoy while corporate loans increased 2.20% qoq and 3.58% yoy, respectively. We estimate that mortgages represented more than a third of the Raiffeisenbank Czech Republic's loan book, consumer loans added a further 14% and corporate loans formed around 36% of total loans:

We estimate that Raiffeisenbank Czech Republic has lost 0.22 pp market share in the last twelve months in terms of loans (holding 8.42% of the market at the end of 3Q2023). On the funding side, the bank seems to have gained 0.16 pp and held 7.83% of the deposit market:

With little official data for the third quarter, we assume Raiffeisenbank Czech Republic's non-performing loans reached approximately 1.5% of total loans, down from 1.80% when compared to the previous year with provisions accounting for around 77% of NPLs.

Following relatively high provisions created last quarter, cost of risk fell back to 0.29% of loans in the third quarter. Still, provisions have "eaten" some 12.1% of operating profit in the third quarter:

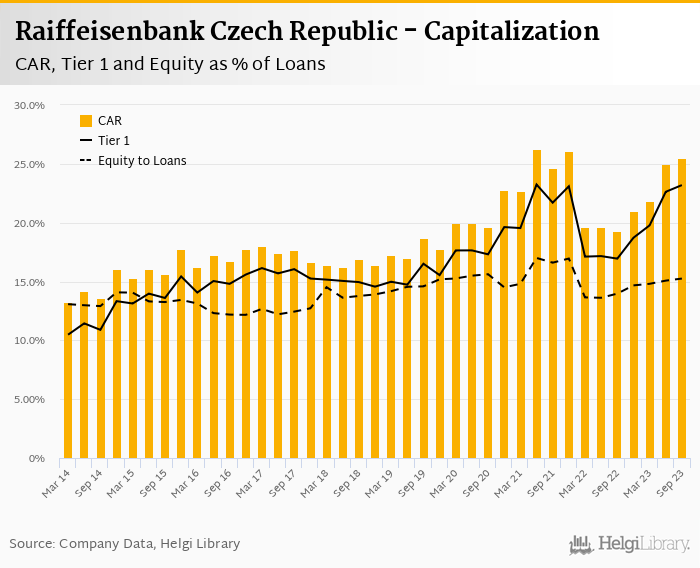

We estimate Raiffeisenbank Czech Republic's capital adequacy ratio might have increased above 25% in the third quarter of 2023, up from 19.3% for the previous year while bank equity accounted for 15.2% of loans:

Overall, Raiffeisenbank Czech Republic made a net profit of CZK 1.59 bil in the third quarter of 2023, down 35.2% yoy. This means an annualized return on equity of 11.7% in the last quarter or when the last four quarters are taken into account:

Similar to the previous quarter, Raiffeisenbank Czech Republic announced a mixed set of results with revenue side under pressure offset partly by good cost control and lower effective tax rate. A decline in cost of risk is a good piece of news signalling last quarter was a one-off.

With enough liquidity, capital and enlarged client base, the Bank is well positioned to be a challenge to the bigger players.