Stavebni Sporitelna Ceske Sporitelny doubled its net profit to CZK 260 mil with ROE of 13.7%.

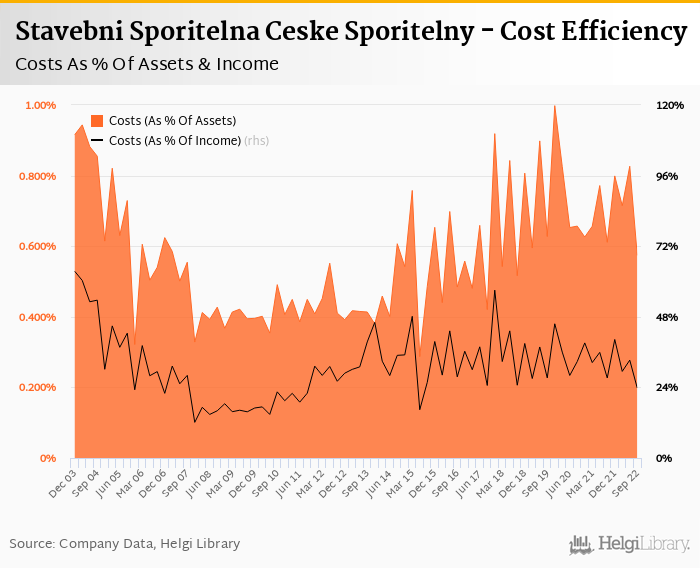

Revenues increased 17.9% yoy and cost rose 3.07%, so cost to income decreased to 23.8%

Cost of risk amounted 0.059% and loan to deposit ratio increased to 99.5%

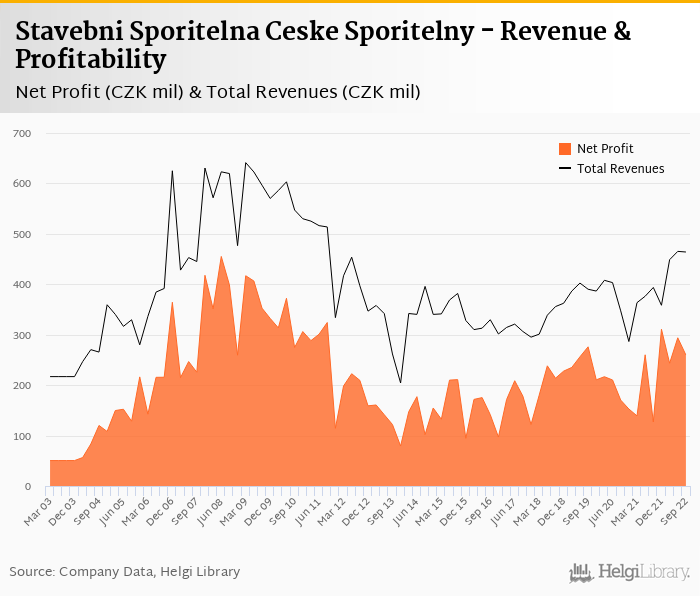

Revenues increased 17.9% yoy to CZK 464 mil in the third quarter due mainly to net interest income increase (up 17.3% yoy). Net interest margin increased only by 0.128 pp to 2.00% of total assets, so 15% volume loan growth helped a lot to to top line. When compared to three years ago, revenues were up 18.9%:

Average asset yield was 3.70% in the third quarter of 2022 (up from 2.91% a year ago) while cost of funding amounted to 1.89% in 3Q2022 (up from 1.15%).

Costs increased by only 3.07% yoy and the bank operated with impressive cost to income of 23.8% in the last quarter. Staff cost rose 4.06% as the bank employed 193 persons (up 5.32% yoy) and paid CZK 96,763 per person per month including social and health care insurance cost:

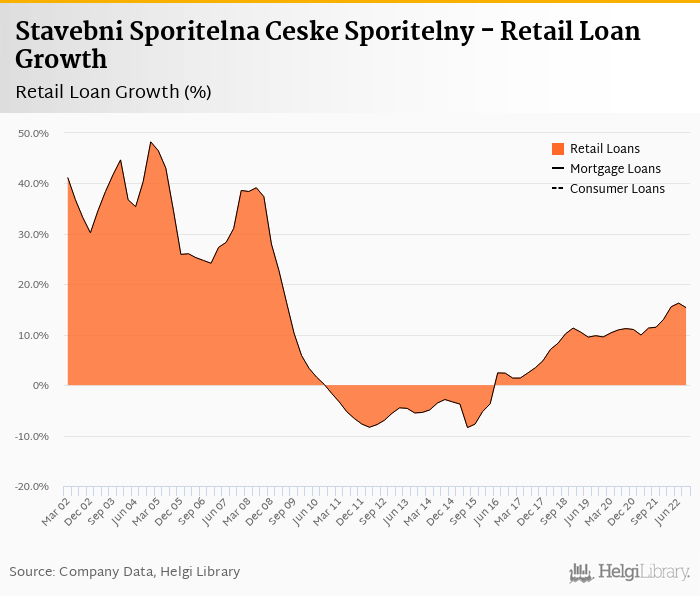

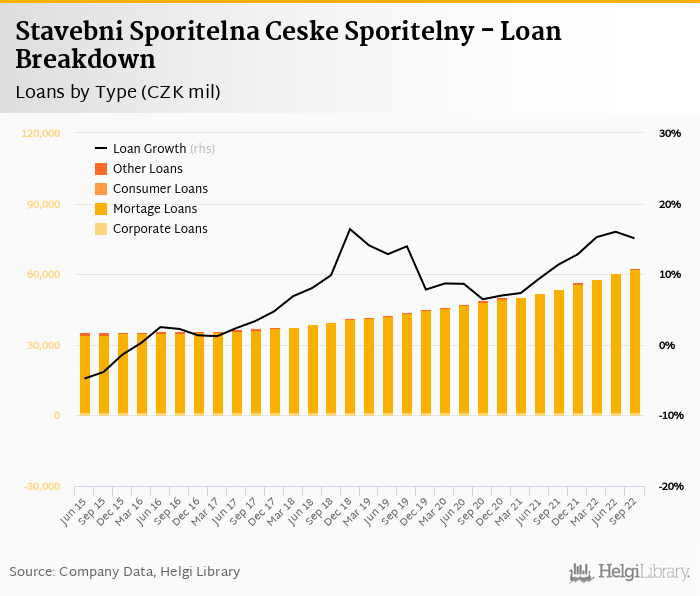

Stavebni Sporitelna Ceske Sporitelny's customer loans grew 2.53% qoq and 15.1% yoy in the third quarter of 2022 beating the market but customer deposit fell 1.86% qoq and 0.786% yoy. That’s compared to average of 10.5% and 0.681% average annual growth seen in the last three years.

At the end of third quarter of 2022, Stavebni Sporitelna Ceske Sporitelny's loans accounted for 99.5% of total deposits and 80.0% of total assets.

Retail loans grew 2.56% qoq and were 15.4% up yoy. They accounted for 97.5% of the loan book at the end of the third quarter of 2022 while corporate loans increased 1.56% qoq and 5.66% yoy, respectively. Mortgages represented 97.5% of the Stavebni Sporitelna Ceske Sporitelny's loan book, consumer loans added a further 0% and corporate loans formed 2.55% of total loans:

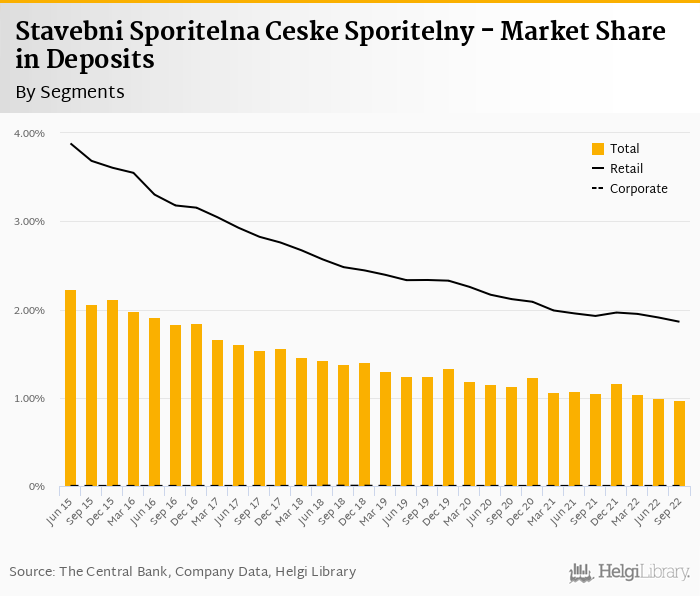

We estimate that Stavebni Sporitelna Ceske Sporitelny has gained 0.099 pp market share in the last twelve months in terms of loans (holding 1.53% of the market at the end of 3Q2022). On the funding side, the bank seems to have lost 0.085 pp and held 0.971% of the deposit market:

Cost of risk reached 0.059% of average loans in the third quarter and lower cost of risk was the second most important driver of profit growth when compared to last year. We estimate Stavebni Sporitelna Ceske Sporitelny's non-performing loans amounted to around 1.0% of total loans and provisions to stay high at 90-100% of bad loans:

Without details, we estimate Stavebni Sporitelna Ceske Sporitelny's capital adequacy ratio reached approximately 29% in the third quarter of 2022, up from 27.7% for the previous year. Bank equity accounted for 12.4% of loans:

Overall, Stavebni Sporitelna Ceske Sporitelny made a net profit of CZK 260 mil in the third quarter of 2022, up 104% yoy. This was driven heavily by higher interest rates and loan growth and mainly by lower cost of risk when compared to last year. This means an annualized return on equity of 13.7%, or 31.3% when equity "adjusted" to 15% of risk-weighted assets:

Solid set of results driven by higher interest rates, loan growth, very good cost control and mainly lower cost of risk when compared to last year.