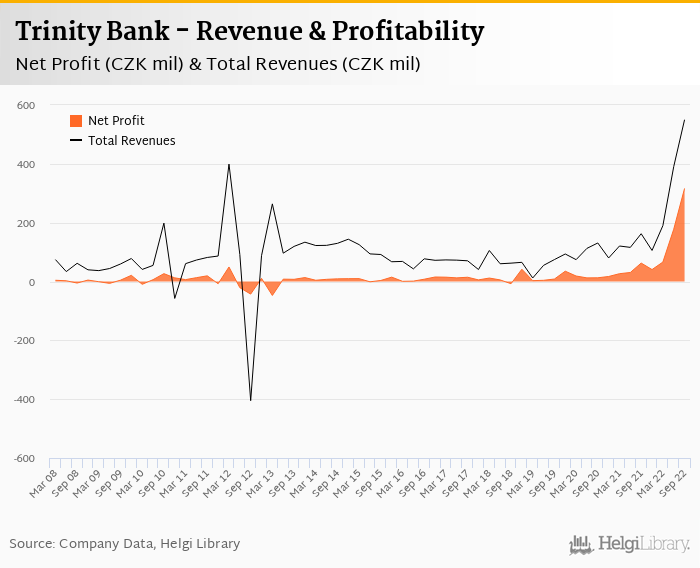

Trinity Bank increased its net profit 5-fold to CZK 316 mil in 3Q2022 and generated ROE of 38.8%.

Revenues increased 239% yoy and cost rose 65.2%, so cost to income decreased to 26.3%

Cost of risk amounted 0.339% of loans and loan to deposit ratio decreased to 19.8%

Revenues increased impressive 239% yoy to CZK 550 mil in the third quarter of 2022. Net interest income rose 241% yoy driven by margin expansion and strong loan and deposit volume growth while fees grew 41% yoy. It's however the other non-interest income supporting bank's extraoprdinary profitability in the last two quarters with CZK 97 mil in 2Q22 and CZK 140 mil income in 3Q22. When compared to three years ago, revenues were up 638%:

Average asset yield was 6.18% in the third quarter of 2022 (up from 2.81% a year ago) while cost of funding amounted to 4.14% in 3Q2022 (up from 0.408%).

Costs increased by 65.2% yoy and the bank operated with average cost to income of 26.3% in the last quarter. Staff cost rose 78.5% as the bank employed 163 persons, up 44% compared to last year. They cost the Bank CZK 154,077 per person per month on average including social and health care insurance cost:

We estimate Trinity Bank's customer loans grew approximately 39% yoy in the third quarter of 2022 and customer deposit growth to reach 309% yoy when compared to last year. That’s compared to average of 24.3% and 114% average annual growth seen in the last three years.

In spite of the fast loan growth, Trinity Bank's balance sheet remains very "underlent" with loans accounting for only 19.8% of total deposits and 18.5% of total assets.

With no detailed breakdown provided for 3Q22, we assume retail loans grew some 38% yoy and accounted for less than 1.o% of the loan book at the end of the third quarter of 2022. Corporate loans might have increased by approximately 36% yoy as balance sheet data for the quarter suggest:

We estimate that Trinity Bank has gained 0.070 pp market share in the last twelve months in terms of loans (holding 0.308% of the market at the end of 3Q2022). On the funding side, the bank seems to have gained 0.726 pp and held 0.987% of the deposit market. The Bank remains particular strong in household deposit collection, where it had increased its market share from 0.4% to 1.8% just within the last twelve months. On the asset side, the money is being increasingly used to fund corporates, where Bank's market share rose from 0.7% in September 2021 to 0.9% now:

With no official details from the Bank, we guesstimate Trinity Bank's non-performing loans reached 6.0-6.2% of total loans at the end of September, down from 12.4% when compared to the previous year. With more than CZK 10 bil in real estate collateral, bank's provisions coverage remains one of the lowest on the market somewhere in the range of 15-20% of NPLs at the end of the third quarter of 2022, compared to 16.0% for the previous year.

In the third quarter, cost of risk reached 0.339% of average loans and loan loss provisions have "eaten" only 2.55% of operating profit, so no signs of asset quality pressure from the numbers we can see:

We estimate Trinity Bank's capital adequacy ratio has reached 19.9% in the third quarter of 2022 based on the profitability and loan growth the Bank reported, down from 21.5% for the previous year. The Tier 1 ratio might have amounted to 17.3% at the end of the third quarter of 2022 while bank equity accounted for 29.0% of loans:

Overall, Trinity Bank made a record net profit of CZK 316 mil in the third quarter of 2022, up 405% yoy. This is a very impressive result fuelled by margin expansion, strong volume growth and non-interest income gains. This means an annualized return on equity of 38.8%, or 26.7% when equity "adjusted" to 15% of risk-weighted assets:

Very impressive set of results for second consecutive quarter putting the Bank among the most profitable ones in terms of return on equity. Strong revenue growth driven by rising interest rates and high non-interest income and no major pressure from asset quality deterioration seen so far. Apart from the sustainability of the non-interest income side, the main questions should be focused on the Bank's large exposure to the real estate segment and relatively highly-priced household deposits, something to watch for in the coming months.