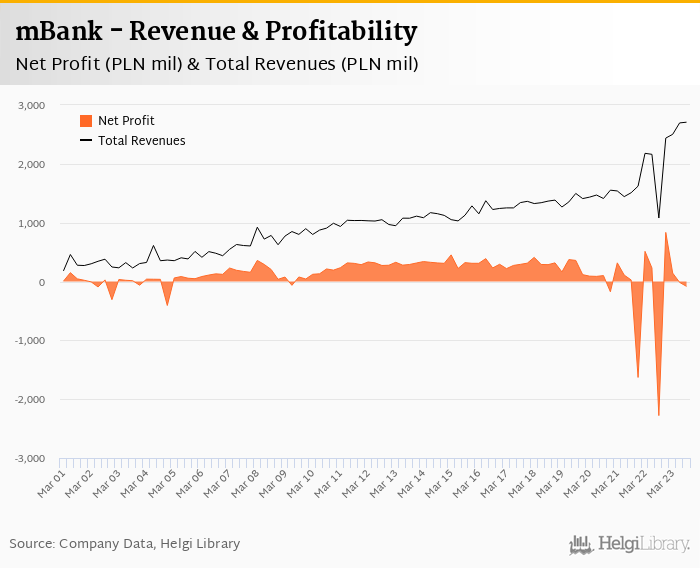

mBank reported a net loss of PLN 83.0 mil in 3Q2023 due mainly to further PLN 1.1 bil of provisions for FX mortgages

Operating profitability was a record high at almost PLN 2.o bil due mainly to still improving interest margin

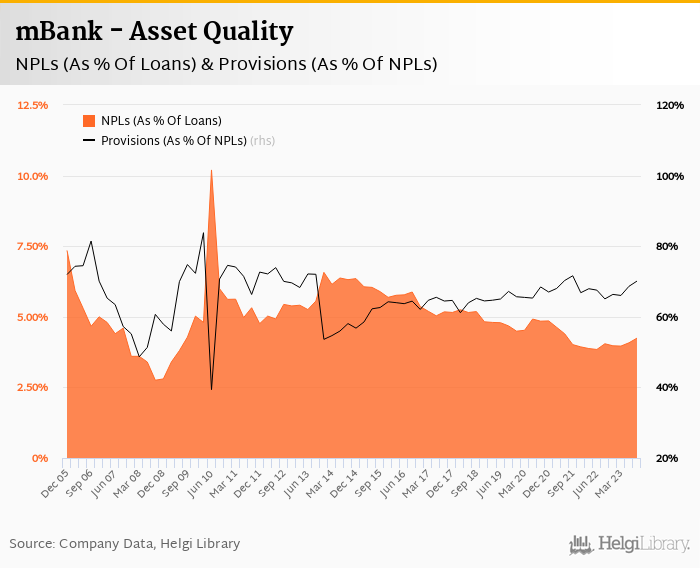

Bad loans rose to 4.24% of total loans and provision coverage increased to 70%. Almost 86% of FX mortgages are covered by provisions now.

The results were roughly in line with market expectations and valuation of PE of 9.0x and PBV of 1.3 expected in 2024 suggest market expects the worst in FX saga to be over

mBank made a net los of PLN 83.0 mil in the third quarter of 2023, roughly in line with management's warning and market expectations. Although not a great result, this is a massive improvement when compared to a scary loss of PLN 2.28 bil seen last year. On the operating level, the Bank made a record profit of almost PLN 2.0 bil as higher interest margins boosted the revenue side:

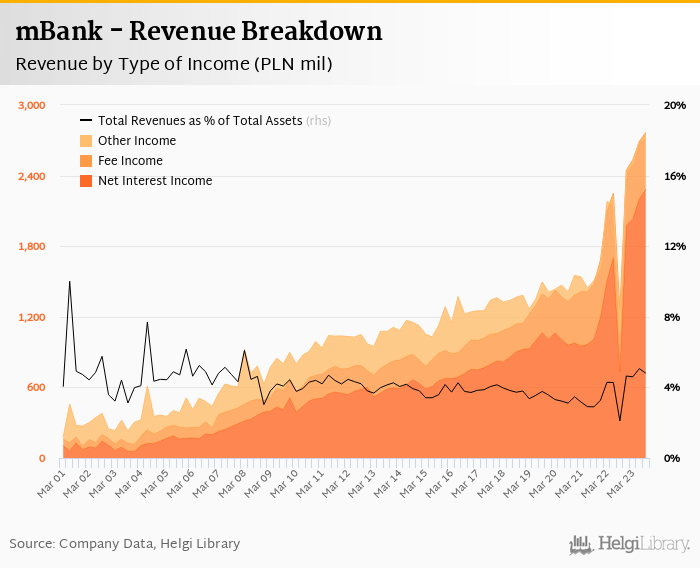

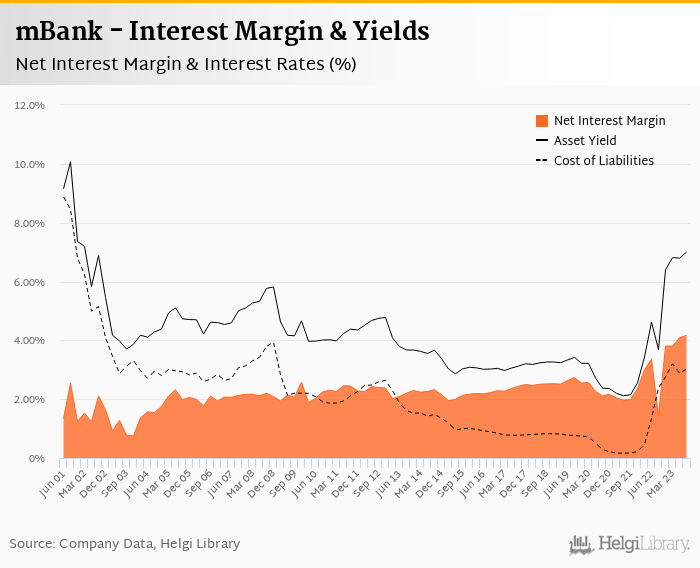

Revenues increased 24% yoy to PLN 2.71 mil in the third quarter of 2023 when adjusted for last year's credit holidays and net interest income generated 85% of the increase. With loans continue to decline, the revenue growth is driven purely by an improvement in interest margin. NIM rose 2.73 pp to 4.17% of total assets in 3Q2023 and added further 8 bp qoq. Fee income fell 6.1% yoy. When compared to three years ago, revenues have almost doubled:

Average asset yield was 7.00% in the third quarter of 2023 (up from 3.68% a year ago and 6.80% last quarter) while cost of funding amounted to 3.02% in 3Q2023 (up from 2.39% last year and 2.89% in 2Q23).

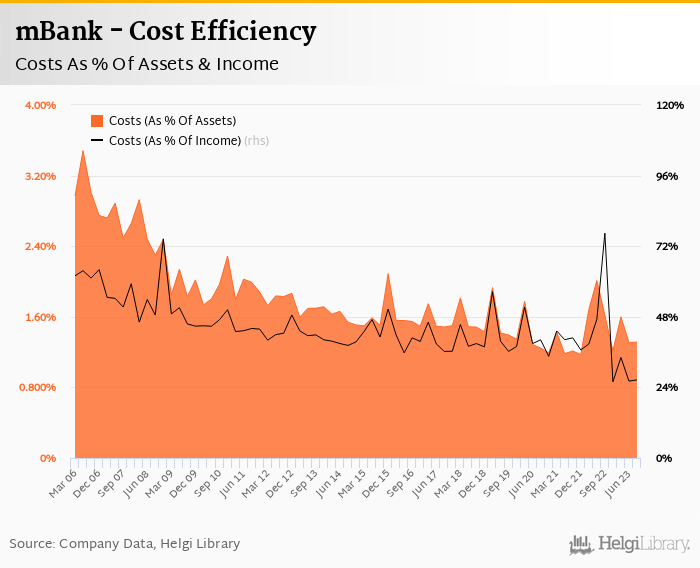

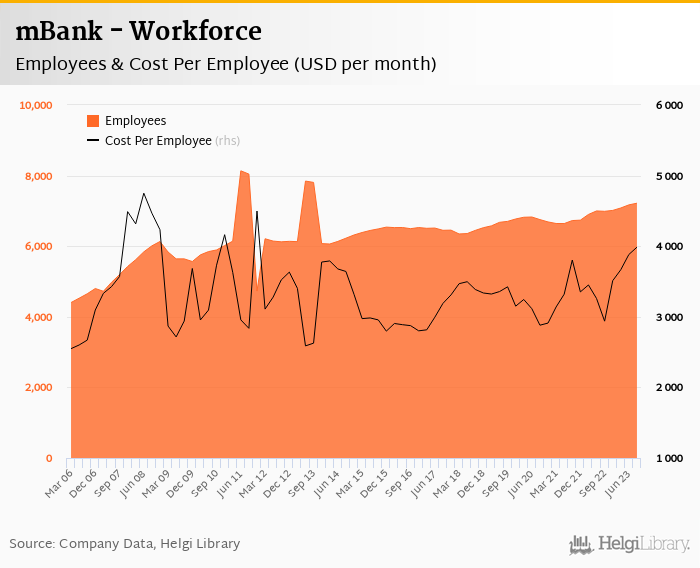

Costs decreased by 12.8% yoy and the bank operated with impressive cost to income of 26.6% in the last quarter. When adjusted for the contribution to the Guarantee Fund last year, however, operating costs have increased by 19.2% yoy and 2.0% qoq. mBank added 230 persons to its list and staff cost rose 25.9% when compared to last year:

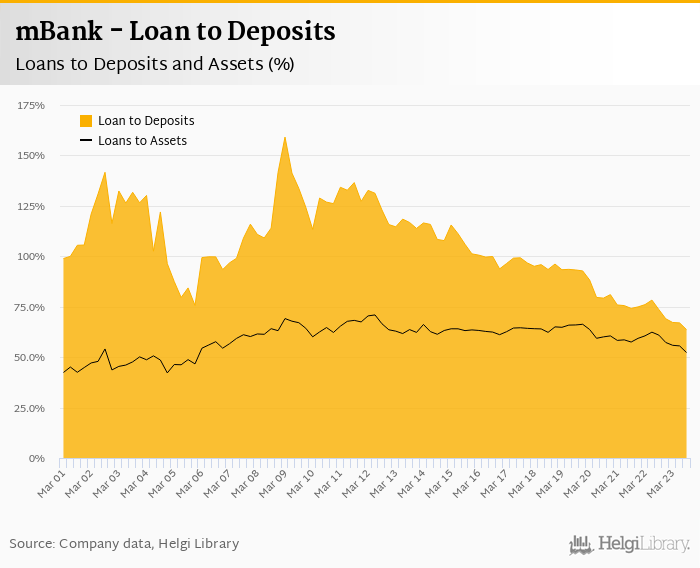

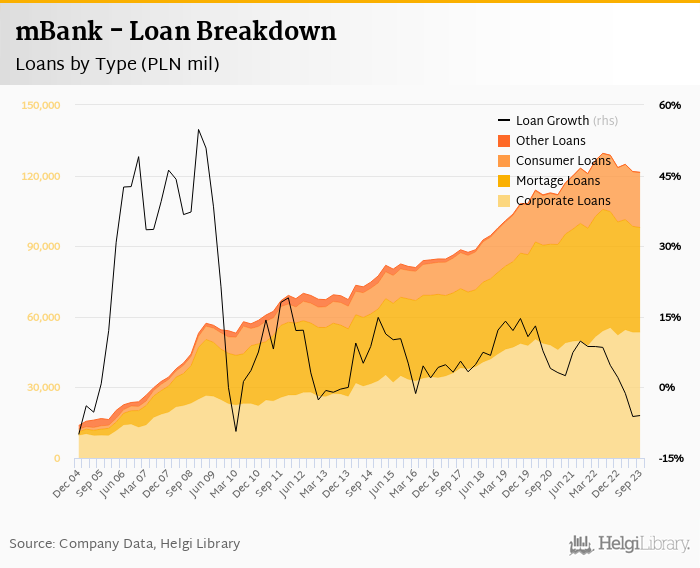

Loan book continues to shrink as FX mortgage cleanup and high interest rates discourage potential customers to get on. mBank's customer loans decreased further 0.43% qoq and 6.0% yoy in the third quarter of 2023. On the other hand, depositors are increasingly attracted and added further 4.78% qoq and 8.7% yoy to the Bank's deposit base.

Despite the reduction from 94% two years ago, current account deposits still form almost 77% of mBank's deposits.

At the end of third quarter of 2023, mBank's loans accounted for 63.6% of total deposits and 52.3% of total assets. This is the lowest figure since 1996, on our data:

Retail loans fell 0.48% qoq and were 7.30% down yoy while corporate loans increased 0.045% qoq and were down 3.47% yoy, respectively. Mortgages represented 37.8% of the mBank's loan book, consumer loans added a further 19.8% and corporate loans formed 45.4% of total loans:

mBank's non-performing loans increased PLN 188 mil when compared to last quarter and reached 4.24% of total loans, up from 4.05% when compared to the previous year. Provisions covered some 70.1% of NPLs at the end of the third quarter of 2023, up from 65.1% for the previous year.

Some PLN 1.1 bil of furher provisions for FX mortgage loans have been created in the last quarter, in line with the management's guidance. As such, total of PLN 8.1 bil (or PLN 10.7 bil when closed cases included) of provisions for legal risk have been created covering almost 86% of FX mortgage loans at the end of September 2023.

mBank's capital adequacy ratio reached solid 16.9% in the third quarter of 2023, up from 14.7% for the previous year. The Tier 1 ratio amounted to 14.6% at the end of the third quarter of 2023 while bank equity accounted for 11.6% of loans:

Overall, mBank made a net loss of PLN 83.0 mil in the third quarter of 2023 and reduced its loss by PLN 2.0 bil when compared to last year's worst-ever quarter. The loss translates into an annualized return on equity of -2.45% in the last quarter or 6.62% when the last four quarters are taken into account:

Following strong 9M2023 results and higher interest rate environment, the Management has udjusted its profit guidance for 2023-2025, originally set in 2021. The main assumptions are:

- cost to income ratio to be below 40% (from around 40%)

- cost of risk at around 0.80% (unchanged)

- loan growth of around 3.0% in 2022-2025 (vs. 8.0% expected for 2021-2025)

- deposit growth of around 6.0% in 2022-2025 (vs. 8-9.0% in 2021-2025)

- revenue growth of 4.5% in 2022-2025 (vs. 9-10% in 2021-2025)

- net interest margin at above 3.0% compared to around 2.5% earlier

- ROE of 14% compared to above 10% earlier

mBank announced solid set of 3Q2023 results in line amid already guided market expectations. Hefty provisioning for FX mortgages was offset by very strong operating profitability on the back of high interest margins. Details on these two, i.e. need for additional provisions and speed of net interest margin normalization will likely drive Bank's profitability in the coming quarters.

Trading at relatively high PE of 9.0x and PBV of 1.3x expected in 2024, the market might be shifting its focus on Bank's strong operating profitability and business model.