Raiffeisen Bank Int. decreased its net profit 19.3% to EUR 879 mil in 3Q2023 and generated ROE of 19.3%. Better than expected top as well as bottom line numbers lead to a further upgrade in profit guidance for 2023.

For the first nine months of 2023, profit would have grown 26% to EUR 1.036 mil, ROE would have reached 10.9% and CET1 would have amounted to 14.4% when adjusted for Russian business and a sale of Bulgarian unit.

In 3Q23, revenues decreased 16.8% yoy and cost fell 5.0%, so cost to income increased to 39.1% (or 45.2% adjusted). Bad loans fell to 2.80% and 59% of them were covered by provisions.

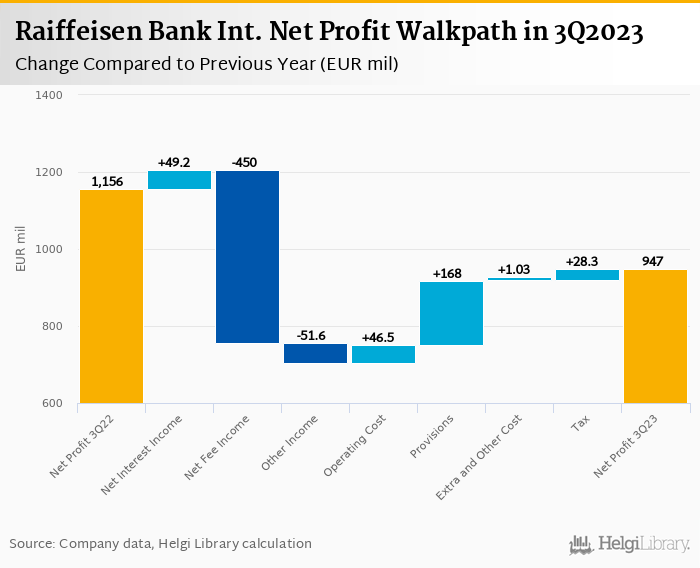

Raiffeisen Bank Int. made a net profit of EUR 879 mil in the third quarter of 2023, down 19.3% yoy, or decrease of EUR 210 mil in absolute terms. While core business continues to be solid (net interest income up 28%), headline numbers are being increasingly affected by reduction in business activity in Russia/Belorus and weakear RUB - headline interest income up only 3.5%, fees down 40% and other income 27% lower when compared to last year. Good cost control and low cost of risk represent clear positives this quarter:

Revenues decreased 16.8% yoy to EUR 2.25 bil in the third quarter of 2023 and was up 9% qoq and 21% yoy when adjusted for Russia/Belorus. Core net interest income rose further 22 bp to 2.54%, core fees fell 16% yoy and other income fell further 2% yoy. When compared to three years ago, headline revenues were up 52.4%:

Average headline asset yield was 5.35% in the third quarter of 2023 (up from 3.59% a year ago) while cost of funding amounted to 2.81% in 3Q2023 (up from 1.13%).

Headline costs decreased by 5.0% yoy and the bank operated with average cost to income of 39.1% in the last quarter. The adjusted growth would have been approximately 8% and corresponding cost to income ratio would have reached 45.2% when Russia/Belorus is excluded:

Customer loans grew 0.1% qoq and decreased 6.5% yoy in the third quarter of 2023 while customer deposit growth amounted to 0.56% qoq and fell 6.6% yoy.

At the end of third quarter of 2023, Raiffeisen Bank Int.'s loans accounted for 84.1% of total deposits and 49.9% of total assets.

Retail loans fell 1.58% qoq and were 4.28% down yoy accounting for 48% of the loan book at the end of the third quarter of 2023 while corporate loans decreased 3.89% qoq and were 13.8% yoy lower, respectively:

Asset quality remained good with non-performing loans at 2.80% of total loans and provisions covering 59% of NPLs at the end of the third quarter of 2023.

Cost of risk was close to zero, though operating environment and outlook are increasingly challending. The management mentioned first signs of deterioration in 3Q2023.

Also, further EUR 166 mil of provisions have been created for Poland's CHF-mortgage portfolio. Provisions have therefore increased to EUR 1.34 bil against EUR 1.87 bil loan portfolio.

Raiffeisen Bank Int.'s capital adequacy ratio reached 19.7% in the third quarter of 2023, up from 18.1% for the previous year. The Tier 1 ratio amounted to 17.1% at the end of the third quarter of 2023 while bank equity accounted for 19.5% of loans.

CET1 ratio reached 16.5% (target for 2023) and 14.4% assuming PBV zero deconsolidation of Russian business. The management plans a EUR 0.65 dividend paid from 2023 profits (accrued already in 3Q23 CET1 ratio) and the decision will be based on the capital position of the Group excl. Russia.

Overall, Raiffeisen Bank Int. made a net profit of EUR 879 mil in the third quarter of 2023, down 19.3% yoy. This means an annualized return on equity of 19.3% in the last quarter or 17.4% when Russia/Belorus is excluded:

Following the solid 9M2023 results, the management further improved its profit guidance for 2023. The main targets are:

- net interest income of EUR 5.6-5.7 bil (EUR 4.2-4.3 bil excl. Russia/Belorus)

- fee income of EUR 2.9-3.0 bil (or EUR 1.8 bil)

- decline in lending of approximately 1.0% (vs. 2.0% growth when Russia/Belorus excluded)

- cost to income ratio of 43-45% (or 50%) and cost of risk at 40 bp (30 bp)

- ROE of around 16% (or 10% excl. Russia/Belorus) and CET1 at around 16.5% (above 13.5%)

Better than expected results and upgrade in profit guidance might add some optimism, especially, as Raiffeisen stock remains "dirt-cheap" trading at PBV of 0.5x and PE of 6-7.0x expected in 2024. That's already when adjusted for sale of Russian business for nil, which might need further support if/when announced.